:quality(80)/business-review.eu/wp-content/uploads/2023/11/Dana-Radoveneanu-Head-of-Retail-Cushman-Wakefield-Echinox-1.jpg)

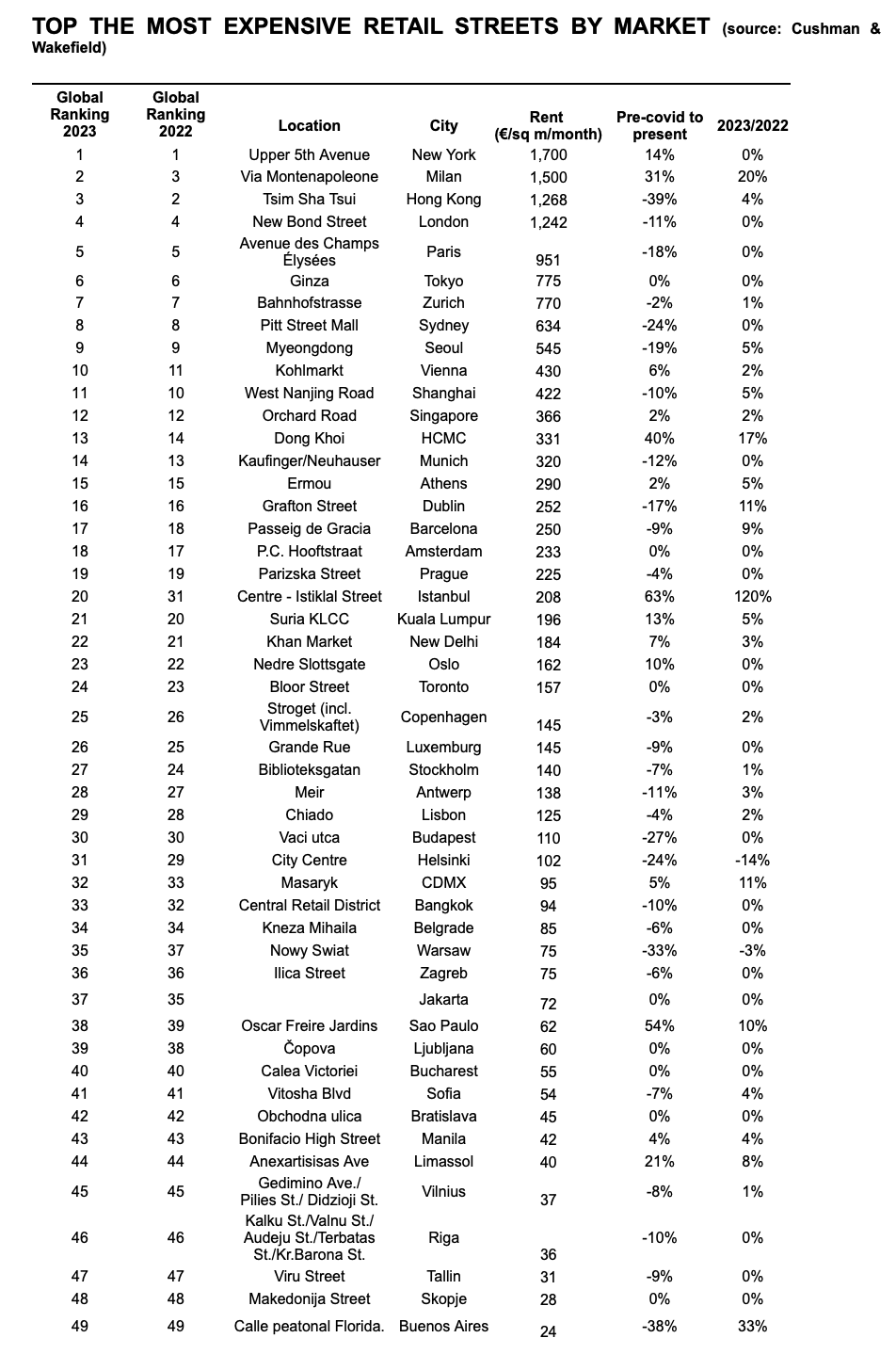

New York’s Fifth Avenue has maintained its position as the world’s most expensive retail street, with Milan’s Via Montenapoleone climbing to second in the global rankings, according to Cushman & Wakefield’s latest ‘Main Streets Across the World’ report.

The 33rd edition of the report reveals retail rents on Via Montenapoleone grew 20% over the past year to $1,766 USD/sq ft/ yr to displace Hong Kong’s Tsim Sha Tsui which dropped to third after more modest 4% rental growth to $1,493 USD/sq ft/ yr. Rents at Fifth Avenue held steady at $2,000 USD/sq ft/ yr.

With a rent level on Calea Victoriei, the main retail street of the city, of €55/sq. m/month, Bucharest ranks 40th in the top 49 cities analyzed worldwide and in position 50 out of 57 in the European ranking, just behind Ljubljana. In Prague, Budapest, Zagreb and Belgrade the rents are above the level in Bucharest, a lower value being recorded in Sofia, Bratislava, Vilnius, Riga or Skopje.

Europe has three of the top five most expensive retail streets globally, with London’s New Bond Streetin fourth and Avenues des Champs-Élysées in Paris fifth respectively, and five of the top 10.

“The report focuses on prime headline rents in best-in-class high street locations across the world which, in many cases, are directly connected to the luxury sector. It includes a ranking of the most expensive rents across the world – featuring the top one per country. Calea Victoriei in Bucharest is the only Romanian location included in the report, representing the most expensive retail street on the local market. The availability of spaces suitable for the opening of luxury stores remains extremely limited in this area of Bucharest, but the proximity to Calea Victoriei has become a magnet for premium hotel brands amid the revival of tourism in this post-pandemic context, a positive factor could influence the need for modern high street retail spaces in the near future,” says Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox.

“Vacancy in super-prime retail locations remains tight, leading to competitive tension when rare sites become available which feeds through to rents. Even as concerns over consumers cutting discretionary spending have been affecting the economy, retailers and have been securing or enhancing flagship stores in key markets. These stores are a critical part of a brand’s retail equation. They are the physical embodiment of the brand, something that is very hard to curate in an online environment. Often this is reinforced with bespoke products only available for purchase in-store as they channel customers into real-world retail experiences,” says Rob Travers, Head of EMEA Retail at Cushman & Wakefield.

As the world continues to emerge from the impacts of the global pandemic, prime retail destinations similarly have continued their rebound, recording mostly positive rental growth over the past year.Rents across global prime retail destinations increased on average by 4.8% in local currency terms over the past year. The strongest growth was recorded in Asia Pacific, which averaged 5.3%, with the Americas at 5.2% and Europe at 4.2%.

:quality(80)/business-review.eu/wp-content/uploads/2023/11/Madalina-Cojocaru-Partner-Office-Agency-Cushman-Wakefieled-Echinox-2-scaled.jpeg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/03/Screenshot-2024-03-25-at-4.24.58 PM.png)

:quality(50)/business-review.eu/wp-content/uploads/2022/10/Cristi-Moga-Head-of-Capital-Markets-Cushman-Wakefield-Echinox_.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2022/02/Andrei-Brinzea-_Partner-Land-Industrial_Cushman-Wakefield-Echinox-sm-960x640.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/FOT_9989-7-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/08/One-Floreasca-City-2-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/ROMTEXTIL-2.jpg)