:quality(80)/business-review.eu/wp-content/uploads/2023/08/Screenshot-2023-08-10-at-6.45.45-PM.png)

Imobiliare.ro launches Imobiliare.ro Finance after a year and a half since the acquisition of DSA Advisor, one of the main mortgage brokers active on the Romanian market.

Thus, 10 years after its establishment and in a complex market context, DSA Advisor has successfully gone through an extensive process of digitalization, development, and rebranding, becoming Imobiliare.ro Finance.

“In the last year and a half, we have been able to integrate a company with over 10 years of experience into our ecosystem and assist thousands of homebuyers in financing their dream home. The market has responded better than we thought it would, and today our efforts are taking us to a new stage: DSA Advisor becomes Imobiliare.ro Finance and provides, together with Imobiliare.ro, the best home buying experience“, says Dan Niculae, Managing Director of Imobiliare.ro Finance.

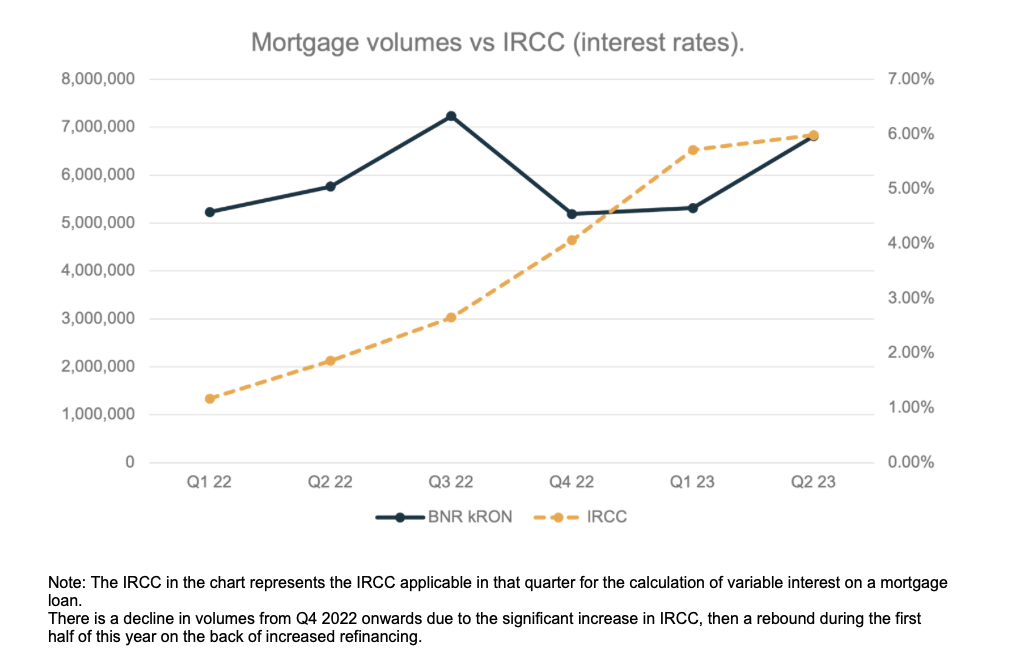

The market context in which this transformation process is taking place is a particular one, with mortgage volumes strongly affected by interest rate developments, but with a positive outlook.

In this context, more and more Romanians are turning to the assistance of a mortgage broker – about 25-30% of buyers – an increase compared to previous years, given that the service is free by law (OUG 52/2016).

At the same time, Imobiliare.ro Finance observes, analyzing the national bank data, a 10% increase in the volume of mortgage loans granted in the first half of the year, compared to the same period last year. However, the figures also include refinancing, the share of which in total loans granted has increased this year.

Imobiliare.ro Finance estimates that the volume of new mortgage loans granted in Romania, excluding refinancing, contracted by about 20% amid rising interest rates. However, the mortgage market is performing above expectations or even outperforming other markets in the region.

There is a decline in volumes from Q4 2022 onwards due to the significant increase in IRCC, then a rebound during the first half of this year on the back of increased refinancing.

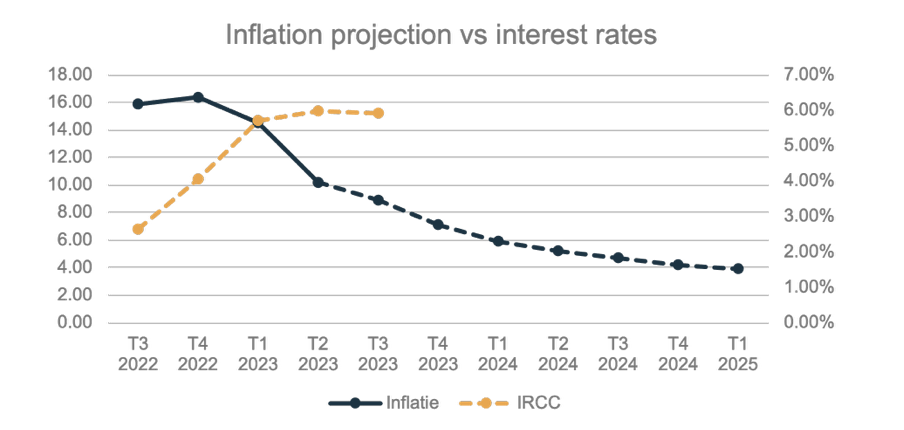

On the other hand, banks have started to show offers with decreasing fixed interest rates, showing optimism about the evolution of interest rates in the medium term. In fact, the national bank projection for inflation over the next two years shows a considerable drop as early as the second half of this year, with annual inflation in 2025 estimated at 4%. This development will ease the pressure on interest rates, allowing us to expect interest rates to fall from next year onwards.

In Europe, more than 50% of clients seek expert assistance to obtain financing, and Romania is developing in the same direction. Reaching the European average will mean doubling the number of customers accessing the right loan with expert help.

“The end consumer is changing with society as a whole and becoming busier, but also more connected to technology and information. He still needs human contact and understanding but is increasingly interested in keeping this interaction to a minimum – a specialist who has all the information and with whom he can communicate intensively until solutions are obtained. From this I dare to conclude that credit intermediation as an activity is entering the golden age”, underlines Doru Iliescu, founder of DSA Advisor and one of the leaders of Imobiliare.ro Finance.

:quality(80)/business-review.eu/wp-content/uploads/2023/10/sorina-faier-2023-wide.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/BeFunky-collage-49-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Legion-Tab-Lifestyle-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Asigurarea-de-locuinta-NN-scaled.jpg)