:quality(80)/business-review.eu/wp-content/uploads/2020/04/Picture1.jpg)

Episode 3 of the Business Optimism Review series, labeled Taxometer in Miriam Constantin’s original magazine, brings an overview of the new tax rules published in March 2020.

Tax deferrals and an extended tax amnesty – By Miriam Constantin

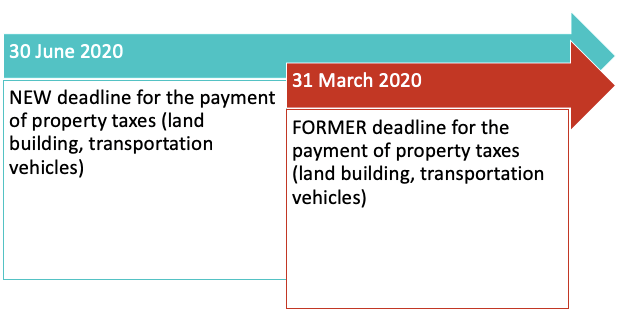

The new tax rules published on the 21st of March 2020 can be explained in the below figures.

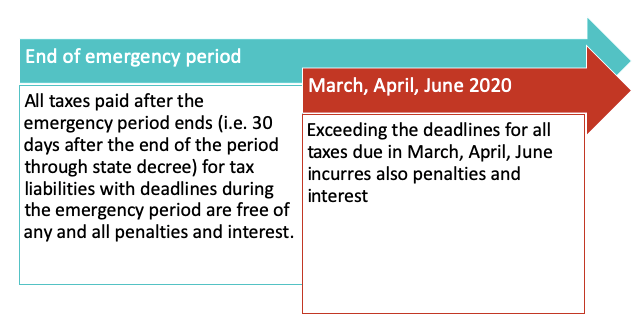

The postponement of property taxes is explicit. Delays in payment of all taxes due during this period are possible without penalties, which, actually, means an indirect deferral of the payment deadlines since no sanctions for late payment will be applied.

Why is this good? Paying taxes later amounts to an indirect financing scheme, enabling companies to use cash otherwise attributed to tax payments to finance part of their activities until the state of emergency stops. Actually, it is an even longer time – taxes can be paid with no penalties in 30 days subsequent to the end of the emergency period.

Are there exemptions? The answer is yes. The restructuring of tax debt is now extended, from an initial deadline in March, to October.

This means that there is even more time for benefitting from the fiscal amnesty measures, and, possibly, even being exempted from paying penalties and interest to large amounts of tax debt (in some cases being as much as the actual taxes).

Can accounts be seized? All seizure proceedings are suspended during the emergency period, and for another 30 days after it ends.

Any impact on VAT? Yes. The Romanian Ministry of Finance has announced a set of tax measures adding up to the support granted to companies during the state of emergency. As such, the VAT reimbursement process was accelerated, and compensation along with VAT refund are said to be resolved with utmost celerity.

The Romanian Government has asked the European Commission to approve the deployment of additional tax incentives – custom duties and VAT exemptions for imports dedicated to preventing and fighting the pandemic.

Though heartily put together by a lawyer and an EMBA student, it does not amount to a specific, legal, financial or tax advice.

It is meant only to present facts, legal provisions, opinions, and data from the optimistic point of view, the kind of details the author and her team wish you to be aware of during this time too.

Should you feel the need to know more or apply some of the ideas presented herein, you should head to your most trusted advisor for a deeper view and a safe travel towards opportunity.

Thank you!

:quality(80)/business-review.eu/wp-content/uploads/2024/04/FOT_9989-7-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/08/One-Floreasca-City-2-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/ROMTEXTIL-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/WhatsApp-Image-2024-04-25-at-3.30.13-PM.jpeg)