:quality(80)/business-review.eu/wp-content/uploads/2018/05/dreamstime_xs_55984397-1.jpg)

The Romanian currency end August almost unchanged against the European currency, even if it was one the most volatile months of the year. Due to the internal economic situation, but also to the one in Turkey and USA, it is likely that the RON will remain close to current levels or depreciate mildly in the longer term, as it shows the analysis made Ebury fintech.

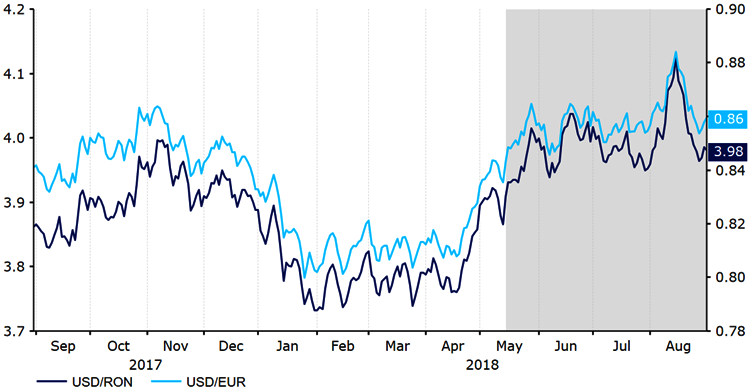

The US Dollar rose to its highest level in more than a year against the RON in mid-August. Since then it has returned back to the narrow range the pair established in May (Figure 1).

The situation in Turkey took a turn for the worse in August. Economic vulnerabilities including a large current account deficit, reliance on foreign credit, double-digit inflation and an unwillingness of the central bank to raise interest rates, combined with a conflict with the US over Turkey’s arrest of the American pastor, Andrew Brunson, led to a large-scale currency depreciation.

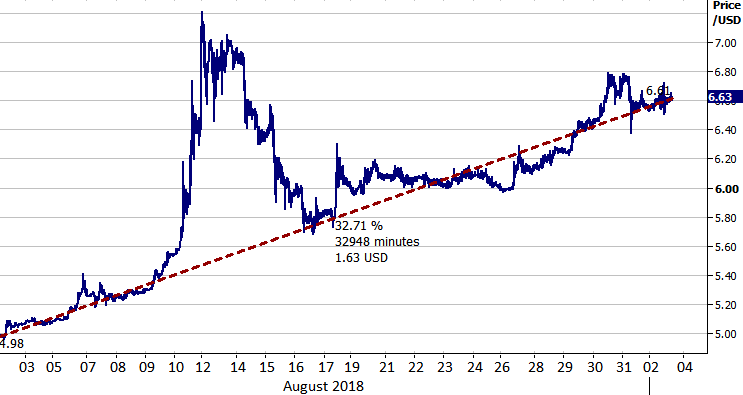

Since the beginning of the year, the Turkish Lira has lost close to 40% against the Dollar, losing around a significant portion of its value in just one month (Figure 2).

The sell-off of the Lira has led to questions about the standing of financial institutions in the country and raised concerns within the European Central Bank over European banks’ engagement in Turkey.

After all, with Lira tumbling, the costs of servicing the debt in foreign currency has skyrocketed and some Turkish banks could bail on their loans from European financial institutions. This could be an even greater problem given many Turkish banks are owned, in some cases in large part, by European institutions.

The currency crisis in Turkey was one of the main reasons for the recent decline in EUR/USD that took the pair to the 1.13 level, its lowest level in a year.

With USD/RON heavily inversely correlated with EUR/USD, the pair rose to 4.10. Since then, fears regarding European institutions’ engagement in Turkey has eased after it became clear that even if Turkey’s banks defaulted they would cause visible, but manageable issues for the European banks and would not have a domino-style effect on financial institutions in Europe.

Despite its significant influence, the situation in Turkey wasn’t the only factor contributing to the changes in USD/RON. New data confirmed that the Euro-area economy has begun to slow, with investors concerned that the threat of a global trade war could worsen the outlook. This has already taken a toll on sentiment, economic expectations and business activity, especially in the manufacturing sector.

While economic prospects are worsening, inflation in the Euro-area seems to be slowly increasing. The disappointing, stubbornly-low core inflation, however, has prevented the European Central Bank from raising the interest rates, which makes the bloc relatively less attractive, hence capital flows are not supporting the common currency.

The situation in the United States is very different. Growth in the second quarter accelerated sharply to 4.2 percent yoy – its fastest pace in four years. Given the rapid increase in inflation, and overall strength of the economy, the Federal Reserve is likely to raise interest rates twice more this year. Increasing interest rates, as well as rising market rates, should continue to support the Dollar.

Our base scenario is for the Dollar to move close to the 1.15 mark against the EUR and to appreciate against the RON to 4.00 at year-end and 4.15 at the end of 2019. If global trade tensions and worries about the situation in the Euro Area continue to intensify it would, however, not be unlikely for USD/RON to strengthen more, especially in the short-term.

RON ends August little changed

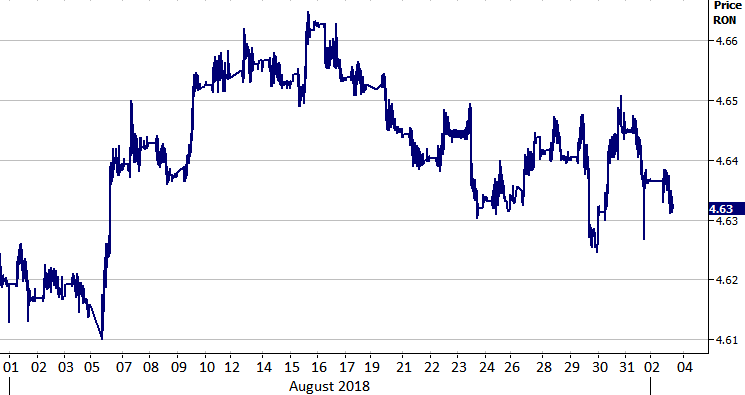

The Romanian Leu had an interesting ride last month. The currency depreciated sharply, pushing EUR/RON close to the higher bound of the channel it remained in since the turn of the year. RON did, however, quickly regained most of its losses, ending the month almost unchanged (Figure 3).

Yet again, the Romanian currency proved resilient to outside news and the risk-off mode in financial markets that resulted in a sell-off in other CEE currencies and emerging markets assets in general. The fact that RON is not as liquid and is more closely managed by the central bank than its regional peers resulted in idiosyncratic movements influenced in large part by the country’s economic and monetary policy landscape, a landscape that’s changing fast.

During its last meeting, the National Bank of Romania (BNR) surprised the markets by not raising its policy rate which stands at 2.5 percent. What’s more,

Mugur Isărescu, the BNR governor said that preliminary data shows that inflation in July should fall, which a few days later turned out to be true.

Inflation showed a sharp decrease from 5.4 percent in June to 4.6 percent in July from a year earlier, while economists polled by Reuters had expected July’s reading to stand at 4.85 percent.

By keeping rates unchanged, voicing that there is a chance that rates will not rise by much more, and lowering its longer-term inflation forecasts, the bank influenced the expectations of the market. This resulted in a fall in Romania’s yields and took a toll on the RON that lost around 1 percent in the week the events took place.

After a period of weekly stagnation that followed a sell-off, the Romanian currency got a boost from an increased interest in auctions of Romania’s Treasury debt.

The demand for the notes maturing in April 2024 and March 2020 was higher-than-expected and pushed the average yield on those notes down, compared to July’s auction of the same issues. Another week of stagnation followed and left the currency only slightly cheaper than where it started the month.

The RON is not the most volatile currency in the region and it’s unlikely to change in the near future. In our view, it is likely that the RON will remain close to current levels or depreciate mildly in the longer term, with the second scenario more realistic given the RON seems to be losing one of its supporting factors – rising interest rates.

:quality(80)/business-review.eu/wp-content/uploads/2023/08/One-Floreasca-City-2-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/ROMTEXTIL-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/WhatsApp-Image-2024-04-25-at-3.30.13-PM.jpeg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Irina-Peptine_Schneider-Electric-scaled.jpg)