:quality(80)/business-review.eu/wp-content/uploads/BCR-6066.jpg)

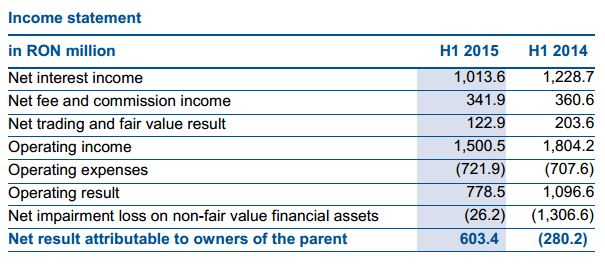

BCR announced its financial results for the first half of 2015, showing a profit of RON 603.4 million (EUR 135.7 million) and a NPL coverage ratio improved to 76.9 percent.

During this period the NPL ratio decreased to 23.1 percent, while in H1 2014 the ratio stood at 29.3 percent.

Banca Comerciala Romana (BCR) achieved in H1 2015 an operating result of RON 778.5 million (EUR 175.0 million), 28.9 percent lower than the previous year at RON 1,096.6 (EUR 246.4), driven by lower operating income, impacted by reduced unwinding contribution and slightly higher costs.

In bank retail business, strong performance in volume generation by the franchise resulted in sales of secured loans increasing by 34 percent annually, with Prima Casa new production 66 percent y-o-y. The retail performing loans balance grew at around RON 16.9 billion, on the back of new lending outgrowing volumes of loans reimbursed or maturing. At RON 9.9 billion, the total performing housing loans portfolio continued to grow versus RON 9.45 billion at end of year 2014.

In bank corporate business, new volumes added on the balance sheet totalled RON 1 billion, while the overall corporate performing loan portfolio grew at around RON 11.9 billion, versus RON 11.5 billion at end of year 2014. According to the report, new approved loans are substantially picking up, supported by a solid pipeline of better quality new business, particularly in overdraft, working capital and supply chain financing.

Net interest income was down by 17.5 percent, to RON 1,013.6 million (EUR 224.9 million), from RON 1.2 billion (EUR 276.1 million) in H1 2014, on the back of accelerated NPL portfolio resolution and efforts to price competitively in the market.

Net fee income was down by 5.2 percent, to RON 341.9 million (EUR 76.9 million), from RON 360.6 million (EUR 86.0 million) in H1 2014, due to lower fees from loan management and current accounts.

Net trading result decreased by 39.6 percent, to RON 122.9 million (EUR 27.7 million), from RON 203.6 million (EUR 45.7 million) in H1 2014.

The operating income decreased by 16.8 percent to RON 1.5 billion (EUR 337.4 million) from RON 1.8 billion (EUR 405.4 million) in H1 2014, mainly driven by reduced net interest income along with lower trading result.

General administrative expenses in H1 2015 reached RON 721.9 million (EUR 162.4 million), up by 2.0 percent in comparison to RON 707.6 million (EUR 158.9 million) in H1 2014. As such, cost-income ratio advanced to 48.1 percent in H1 2015, versus 39.2 percent in H1 2014.

Net charge of impairments on financial assets not measured at fair value through profit and loss recorded a value of RON -26.2 million (EUR -5.9 million) in H1 2015, versus a negative charge of RON -1,306.6 million (EUR -293.6 million) in H1 2014, resulting from NPL legacy improvement.

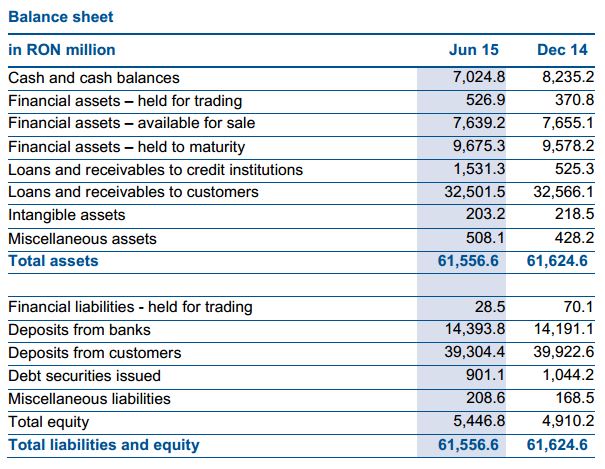

Solvency ratio under local standards (BCR standalone) as of May 2015 stood at 19.6 percent, above the regulatory requirements of the National Bank of Romania (minimum 10 percent).

Deposits from customers were slightly down by 1.5 percent to RON 39,304.4 million (EUR 8,788.0 million) in June 2015, versus RON 39,922.6 million (EUR 8,905.7 million) in December 2014. Customer deposits remain BCR’s main funding source, while the bank benefits from diversified funding sources, including parent company.

BCR offers financial products and services through a network of 509 retail units located in most towns in Romania, as well as 21 business centres and 23 mobile offices dedicated to companies. BCR commands the largest Self-serving banking Equipment network in the country – about 2.600 equipment (ATMs, multifunctional machines, automated payment terminals, FX exchange machines) as well as 12.000 POS terminals for payments by card at merchants.

Natalia Martian

:quality(80)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/09/Studiu-regiunea-N-V_.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/Iulia-Surugiu-scaled.jpg)