:quality(80)/business-review.eu/wp-content/uploads/2022/08/Carrefour-RO.jpg)

French Group Carrefour announces a solid financial performance for third trimester of the year, with sales up 9% compared to the same period last year, and e-commerce up 31%. Local market values in comparable terms place Carrefour Romania in third position in terms of turnover evolution in Europe. Sales of Carrefour-branded products continue to grow rapidly, exceeding 35% food sales, up +3 points compared to Q3 2022. Carrefour full-year 2023 targets are confirmed.

“In a context of continued pressure on the purchasing power of our customers, our Group confirmed the solidity of its commercial momentum and the attractiveness of its model, thanks to the tireless commitment of its teams. In the third quarter, we continued the implementation of the Carrefour 2026 plan, in particular through the deployment of the Maxi method in our European stores, the full operationalization of ‘Eureca,’ our European purchasing platform, and the continuation of our digital transformation, with robust e-commerce growth and increasing use of tech & data solutions. In this context, Carrefour enters the end of the year with confidence and confirms its full-year 2023 objectives,” declared Alexandre Bompard, Chairman and Chief Executive Officer.

CONTINUED SOLID COMMERCIAL MOMENTUM IN Q3 AMID UNCHANGED FUNDAMENTALS

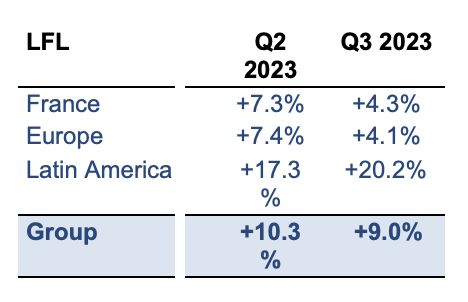

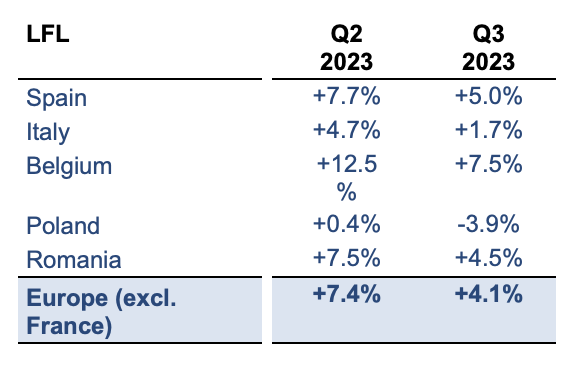

Carrefour posted solid growth in sales in France (+4.3% LFL) and in Europe (+4.1% LFL) in Q3. The quarter was marked by a continuation of the trends observed over the past few months, with activity and customer behavior in line with those of the previous quarter.

In France and Europe, the sales evolution in Q3 (c.+4% LFL) compared to Q2 (c.+7% LFL) reflected the general slowdown in food inflation of around three points, cycling on strong acceleration of inflation last year. Consumer prices have been globally stable month over month since the start of summer in Europe. Against a backdrop of continued pressure on purchasing power (cumulative inflation over 2 years of around +20% in Western Europe and +30% in Eastern Europe), consumer behavior remained unchanged, with continued trading down and food and non-food volumes still contracting in Q3, at a pace close to that of the previous quarter.

Carrefour-branded products continue to attract an ever-increasing customer base; they represent more than 35% of food sales over the quarter, up +3 points year-on-year. This rapid increase supports the Group’s ambition of reaching 40% of food sales from private labels by 2026.

In this environment, the Group continues to execute its strategic plan at good pace:

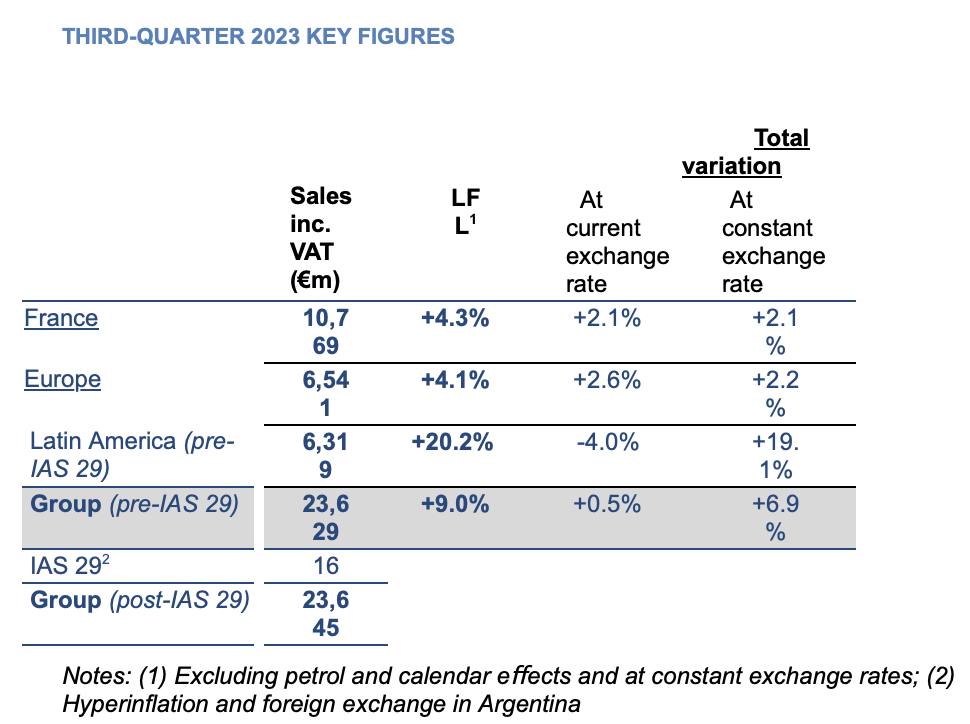

THIRD-QUARTER 2023 SALES INC. VAT

Third-quarter sales inc. VAT increased by +9.0% on a like-for-like basis (LFL).They reached €23,629m pre-IAS 29, an increase of +6.9% at constant exchange rates. This increase includes a negative petrol effect of -1.5%. After taking into account a negative exchange rate effect of -6.4%, mainly linked to the depreciation of the Argentinian Peso, total sales growth at current exchange rates amounted to +0.5%. The impact of the application of IAS 29 was +€16m.

In Romania (+4.5% LFL), Carrefour posted solid momentum, with growth in store traffic.

In Q3 2023, Carrefour Romania maintained a stable trajectory, relying on the strength of its commercial model to increase customer satisfaction. Therefore, the company accelerated its initiatives to support customers’ purchasing power, notably through campaigns such as the Weekend Voucher, Neighbourhood Voucher and Top 100 HIT Products, as well as repeated waves of targeted price reductions.

“The results for the third quarter reflect Carrefour Romania’s ability to adapt its business model and operate in a challenging European context. We remain committed locally to preserving the purchasing power of Romanians through personalized promotions and campaigns. The increased foot traffic in our over 410 multi-format stores across the country gives us confidence that we are well-positioned in the region for accelerated growth. The portfolio of private labels also plays a key role, as demonstrated in the Group’s Q3 results, reaching 35% of food sales, making it another priority investment area. We continue our mission to secure the top spot for what truly matters to our customers: uncompromising quality, local and fresh products, and an optimal shopping experience,” said Régis Moratin, CFO Carrefour Romania.

Carrefour Romania continues its expansion plans, ending Q3 with 412 stores, along with an expanded digital footprint through its e-commerce partners, Bringo and Glovo.

CARREFOUR, A COMMITTED COMPANY

In Q3 2023, the Group continued to implement the major CSR pillars of the Carrefour2026 strategic plan. On climate, Carrefour launched in September 2023 an international coalition that aims to accelerate sales of plant-based alternatives with seven industrial partners (Danone, Unilever, Bel, Andros, Bonduelle, Nutrition &Santé, Savencia). This coalition will accelerate and unite around the objective of €500m in sales of plant-based protein products in Europe by 2026 at Carrefour, with an overall objective of €3bn for the eight partners.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/12/Carrefour_JulienMunch_3-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/11/Razvan-Testa-Horia-Ispas-Raluca-Vasilache-Vera-Aman-Stefania-Serban-Tuca-Zbarcea-Asociatii.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-32-scaled.jpg)