:quality(80)/business-review.eu/wp-content/uploads/2021/05/doosan2.jpg)

In 2020, the real estate market registered a 32% increase in investments, the largest transactions accumulated over 2020 mil. Eur, the office segment excepts more than 230.000 new sqm this year, the industrial sector achieved an increase of 60% of new leases compared to the previous year, and the residential section noted an increase of up to 20% in prices for luxury housing, according to the annual report of Crosspoint Real Estate.

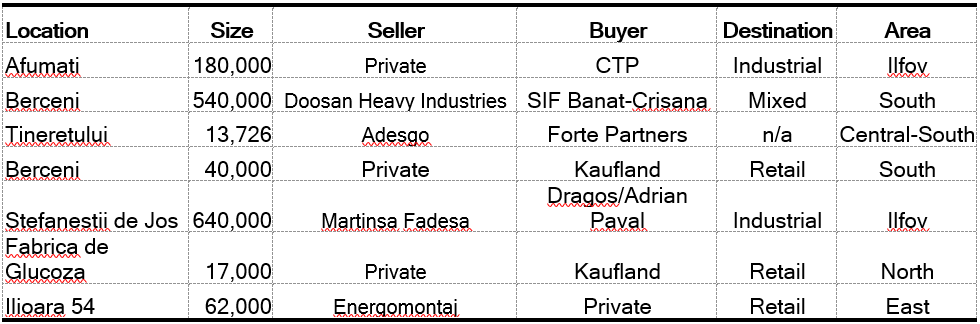

Photo: The Doosan IMGB platform in South Bucharest. The land plot with an area of 540,000 square meters, acquired by SIF Banat – Crișana, is the largest land plot ever traded in Bucharest.

The COVID-19 pandemic had a strong negative impact on the global economy throughout 2020, with a 6.4% yoy drop in GDP in the EU-27 area. Relatively, Romania’s GDP decreased by 3.9%. The lockdown period, as well as the restrictive measures instated by the Government, have led to the negative contribution to GDP growth of important economic sectors such as agriculture, industry and hospitality. With a 6.6% share of GDP, the construction sector seemed not only to survive the unprecedented conditions but to also thrive in 2020, being one of the few sectors with a positive contribution (0.8%) to the GDP growth.

“However, last year the local real estate market continued its evolution, the industrial and residential sectors exceeding even the most optimistic expectations. Although the future of the office market is uncertain, the volume of projects announced for delivery in 2021 indicates a confidence of developers in the ability to adapt to new conditions.”, says Ilinca Timofte, Crosspoint Real Estate Research Analyst.

Surprising growth in investments

The Romanian investment market went through a positive evolution in 2020, with a total investment volume which exceeded the expectations – volume reached a little over 805 M€ in 2020, a 32% increase yoy. Despite the uncertainty surrounding the future, the office sector remained in 2020 the investors’ preferred type of asset, with an 85.3% share in the total investment volume, followed by the industrial market with only 10.3% share in the total.

Bucharest attracted the majority of investments in 2020 (83%), although in the previous couple of years regional markets have emerged as a promising alternative to the capital city. However, in the current circumstances, investor approach has been cautious and betting on a more stable, established market such as Bucharest.

The market sentiment for 2021 remains positive, with over 140M EUR investments recorded in the first 4 months of the year and high hopes for a fast return to the previous years’ normal.

Office: 45% renewals and renegotiations

With the delay of several projects due for delivery this year, the current stock stands at around 3.3 M sqm. Over 150,000 sqm of new office space have been delivered in 2020. While most of the projects expected to be delivered during the year have been completed on time, in some cases there have been partial deliveries or even postponements. Still, 2021 is expected to witness the addition of some 230,000 sqm of new office space to the current stock. While most developers remained unfazed and went on with the delivery of their projects, mainly because they were already under construction, the new turn the market has taken in 2020 has determined others to reconsider their plans. Indefinite postponements in deliveries and even reconversions of planned office buildings have been announced or at least taken into consideration by several developers.

A little over 200,000 sqm of office space were leased in Bucharest in 2020, a 46% fall in demand yoy. Furthermore, most of the take-up (45%) consists in renewals and renegotiations. This might be a sign that, while headline rents have remained stable, contracts are being heavily negotiated and the incentives offered by owners are larger than before the COVID-19 crisis (longer rent-free periods, larger owner contributions to fit-out costs). Companies are also still figuring out their strategies for the future and are currently choosing the safer, more cost-efficient option of remaining in their current locations, at least for a short to medium term.

Many companies, especially those operating in the IT&C sector, have adopted work from home until the end of the year, with some tenants planning a comeback later in 2021 or even 2022. They were still, however, the main driver of demand for office space in Bucharest, with a 31% share in total take-up in 2020.

A small number of sub-leases were recorded and various large occupiers are planning on downsizing and subletting the extra space. As a consequence of the health crisis, the healthcare sector has reached the 3rd rank in the take-up top, with a 10% share in demand for 2020. However, as time progresses, the ideal workplace seems to become more of a mix between work from home and work from the office, so the impending sense of dramatical change surrounding the industry in 2020 might not be so right after all.

People’s need to connect in person, the desire to feel part of a team, the lack of proper technologies in employees’ homes, the mundane distractions of working from home as well as the fact that workers can no longer balance their work-life relation working exclusively remotely are few of the problems presented in an exclusive WFH scenario. Most likely the future of work will have a larger amount of flexibility compared to the pre-pandemic levels but office buildings will remain a strong tool for employees.

The market shows signs of recovery in the new year, the volume of office space rentals has already increased by 23% in the first quarter of 2021, compared to Q1 2020. In total, over 68,000 square meters of office space were rented in Bucharest in the first three months of the year, out of which 44% were pre-leases.

Industrial, the most thriving

Romania’s industrial stock currently reached 5.1 million sqm at the end of 2020 out of which around 2.4 million sqm are located around the capital city. 528,000 sqm of new industrial space have been delivered in 2020, mainly in Bucharest. The western and northwestern areas of the country host the second largest industrial stock, close to 35% in total. Positively affected by the COVID-19 crisis, as a consequence of growth in the e-commerce sector and the retailers’ need for national coverage, the industrial sector was the obvious star of the commercial real estate sectors in 2020.

The industrial leasing activity in 2020 amounted to over 735,000 sqm, a 60% increase in demand yoy. Most of the activity concentrated in and around Bucharest, where 516,000 sqm were leased. The boost of e-commerce, the growth of strategic industries such as the production of medical equipment as well as the need for urban logistics have created a rise in demand. There is also a growing interest for smaller units from local companies. 2020 was the first year when some sizeable short-term leases were registered, an aspect which might indicate that the sector’s success was somewhat dependent on the uncommon context.

Boosted by e-commerce and the retailers’ need for national coverage, the industrial and logistics sector has had an outstandingly good year. 2021 is expected to follow the same trend, although the dynamics might be slower as the overall context improves. Even in the uncertain event of a full recovery, consumer habits might have already changed profoundly enough to no longer allow a comeback to the traditional market. Opportunities arising from the current situation, such as the shortening of the Asia-Europe supply chains by moving some of the production facilities into CEE and the increase in local workforce could be advantageous for Romania. This however depends highly on a fast and efficient development of local and national infrastructure and the 10% rise in the budget for transportation and infrastructure for 2021 brings an optimistic perspective on this matter.

It is expected that 2021 will continue in the same trend, the first quarter of this year already registering a significant increase in demand for industrial spaces, of over 220,000 sqm, compared to Q1 2020 – when the volume of rentals was 67,000 sqm.

In residential, the demand increased continuously

According to data published by the National Statistics Institute, 67,816 homes were delivered in Romania in 2020, a slight increase compared to 2019. Bucharest and Ilfov registered the delivery of 20,800 new units. 4,372 building permits were issued in 2020 in Bucharest and Ilfov county, a slight 3% decrease compared to 2019. The same minor decline has been noted on a national level, with 41,395 building permits issued in total throughout 2020. For 2021, around 180 residential projects are planned to be delivered in Bucharest and Ilfov.

Sales have gone up significantly in the fourth quarter, taking the yearly change to an 8% increase compared to 2019. The positive trend was registered on a national level as well, with regional markets like Cluj an Timis registering rises in demand of 30% and 25% respectively on a year-to-year basis.

The main change in client preferences, influenced strongly by the COVID-19 crisis and its repercussions on our lifestyle, has been the rise in demand for single-family homes. If this shift towards single homes continues in the following years, the residential market in the capital city might adjust accordingly, with a horizontal expansion towards Ilfov county, where large-scale development of such projects is possible. So far however, inner-city dwellings were preferred by buyers in 2020, with Ilfov registering a 6% yoy drop in demand.

The average prices for residential units has registered an increase in 2020, both for new and old dwellings. However, the increase was higher for old units, of around 7%, while prices for new units have only gone up by 2%. In case 2021 will follow the same trend, this aspect could encourage developers and drive potential buyers to the new market, given that the gap in prices between new and old units has already noticeably narrowed. The average price for new units in 2020 reached 1,435€/sqm, while old units averaged 1,351 €/sqm.

As regards the average price by area, southern Bucharest remains the cheapest, with average prices of around 1,000 €/sqm, while prices in the center-north average around 3,000/sqm. While minimum prices have somewhat maintained levels from previous years, the high-end segment has seen a substantial rise in prices in 2020 supported by strong demand, estimated around 20%.

The impact of the COVID-19 pandemic has been more obvious on rent values. Decreases of up to 15% in rents have been registered since March 2020 and the supply has gone up significantly. The increase in house sales, tenants leaving Bucharest and returning to their hometowns or choosing to work remotely from other locations have been the main causes that led to high vacancy levels on the rental market. This was also escalated by the students not returning to university centers, which is also an important driver for demand in campus cities. The entry on the long-term rental market of high-quality short-term rental properties, as a consequence of the reduced global and internal mobility, is a factor that caused a further decrease in rent levels.

The beginning of 2021 was a spectacular one, in terms of demand on the residential market with the highest sales volume recorded in the last five years on the Bucharest market, an increase of 39% compared to the first quarter of last year, given that prices have remained relatively constant since the end of 2020.

Land, 95% increase in transactions

The largest land transactions in Bucharest totaled over 220 m € in 2020, with seven individual transactions of over 10M € each. Developers and investors have quickly caught up on the new turn the market has taken and shifted their focus on the residential market, while office development plans have been put on hold. The land market has been extremely dynamic in 2020, with over 118,000 transactions recorded in Bucharest and Ilfov county (72,175 transactions in Bucharest alone), a 95% yoy increase.

Land prices in Bucharest and adjacent areas have registered an increase during 2020. While the highest rises were recorded in central and northern inner-city areas, prices have also gone up on the outskirts of the city, especially in established residential areas.

Despite the rising prices, investor interest has been constant throughout 2020 and is expected to continue in 2021. This increase in prices will likely be counter-balanced by a smaller number of transactions in the following year. 2021 will also give a clearer view on one of the most talked about subjects in 2020, the deurbanization trend on the residential market. So far, equal rises in land demand have been noted both in Bucharest and Ilfov but the projects in the capital still outnumber those located around the city. Furthermore, residential clients preferred Bucharest to Ilfov in 2020. Still, a larger and more diverse supply in the following years may lead to a redistribution of demand in the future.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/Vulcan-Residence.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/02/Ilinca-TIMOFTE-Head-of-Research_Crosspoint-Real-Estate-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/01/Screenshot-2024-01-31-at-1.18.04-PM.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/01/Codrin-Matei-Principal-Partner-Crosspoint-Real-Estate.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)