:quality(80)/business-review.eu/wp-content/uploads/2022/02/Andrei-Brinzea-_Partner-Land-Industrial_Cushman-Wakefield-Echinox-sm-960x640.jpg)

The expansion of logistics companies sustained the demand for warehouse spaces in Romania, a demand which totaled more than 330,000 sq. m in Q1 2023, a 10% increase compared with the same period of last year, according to the Cushman & Wakefield Echinox real estate consultancy company. Romania and Hungary are the only countries in the Central and Eastern Europe where the take-up had a positive evolution in Q1, with decreases ranging between 20% and 50% being recorded in Poland, the Czech Republic and Slovakia.

Logistics operators accounted for approximately 50% of the Q1 2023 demand in Romania, with a significant activity also coming from manufacturing and FMCG companies.

Net take-up (excluding renewals) amounted to around 200,000 sq. m, with more than 50% of it being related to projects which are due to be delivered in 2024.

Andrei Brînzea, Partner Land & Industrial Agency Cushman & Wakefield Echinox:

“The demand for industrial and logistics spaces remained relatively strong at the beginning of the year, even in a context characterized by high inflation and interest rates, decelerating consumer demand and overall economic uncertainly. Moreover, Romania continues to be a relevant market in the region, attracting companies which aim to strengthen or expand their presence in the CEE, offering some of the most competitive conditions when it comes to costs (including occupancy costs) and to the quality of the spaces built by developers”.

The demand was mainly concentrated around the major logistics hubs in the country, namely Bucharest (32% of the total volume) and Timisoara (25%), while tenants also showed interest towards Pitesti or Slatina.

In terms of supply, a slowdown of investments was observed in Q1, given that developers have taken a more cautious approach due to the economic uncertainties and also to the fact that fewer speculative projects are currently developed. Therefore, nearly 100,000 sq. m of new spaces were completed in Q1, below the Q1 average of the last two years, an average of 180,000 sq. m respectively. The industrial and logistics stock reached 6.66 million sq. m, with vacancy rates of 5.1% in Bucharest and 6.6% at regional level.

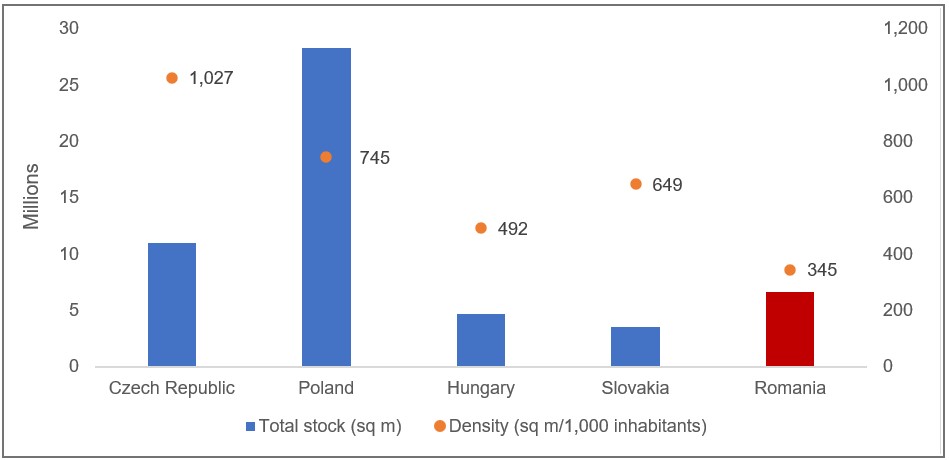

The warehouse market in Romania still lags significantly behind the Czech Republic (11 million sq. m), with Poland being the indisputable leader in the region, with a stock of nearly 29 million sq. m.

Logistics and industrial stock in the Eastern and Central Europe Region

Source: Cushman & Wakefield Echinox Research

WDP, VGP and Globalworth – Global Vision were the most active developers at the beginning of this year, as they expanded their portfolios with new projects in Bucharest, Brasov, and Targu Mures.

Developers plan to complete new projects with a total leasable area of 400,000 sq. m across the country by the end of 2023, as Bucharest remains the preferred destination, with around 50% of the projects to be delivered being located near the capital city, while Brasov, Timisoara, Slatina, Arad and Sibiu will also benefit from new spaces in the coming period.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/Vlad-Saftoiu-Head-of-Research-Cushman-Wakefield-Echinox.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/11/Dana-Radoveneanu-Head-of-Retail-Cushman-Wakefield-Echinox-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2021/11/Cristina-Lupascu-PR-Research-Director-Cushman-Wakefield-Echinox.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/05/Lavinia-Rasmussen.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)