:quality(80)/business-review.eu/wp-content/uploads/2023/08/CTPark-Bucharest-West_BUW24-7-scaled.jpg)

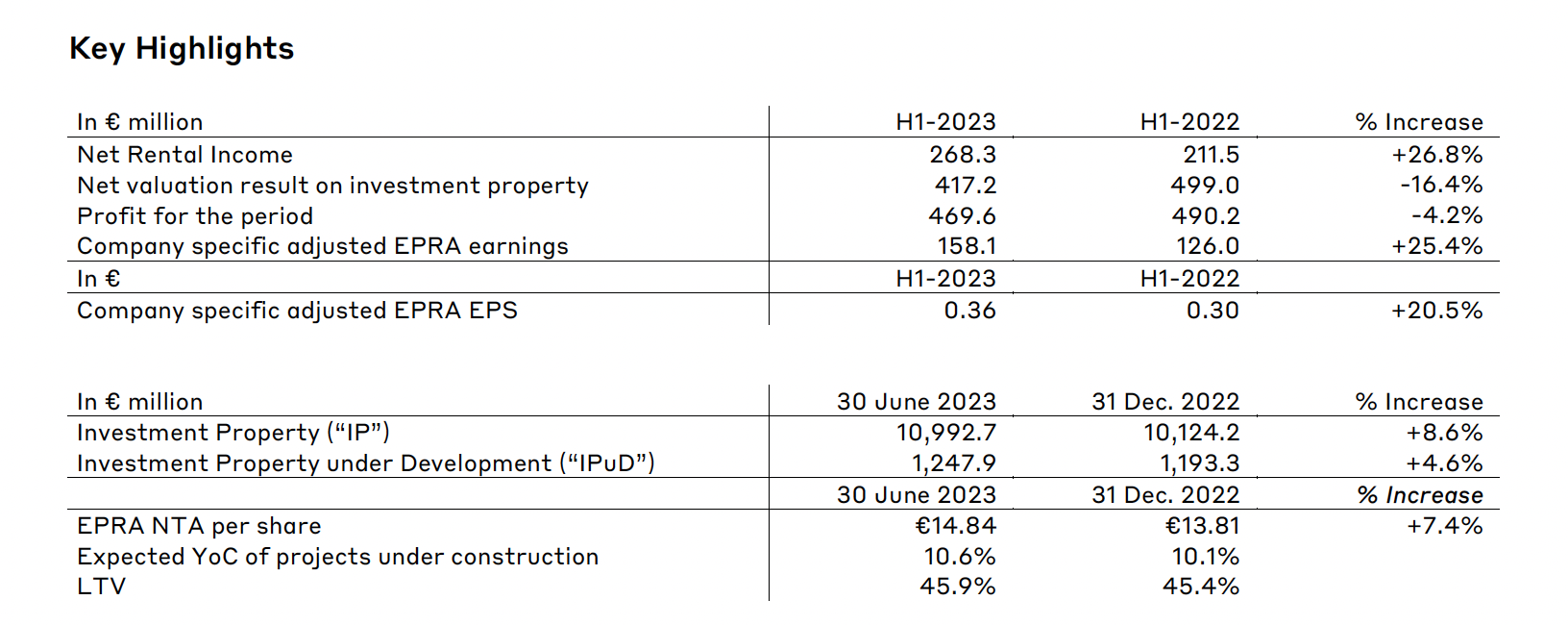

CTP N.V. recorded in H1-2023 Net Rental Income of €268.3 million, up 26.8% y-o-y, and like-for-like rental growth of 7.5%, mainly driven by indexation and reversion on renegotiations and expiring leases. The contracted revenues for the next 12 months stood at €654 million as of 30 June 2023.

CTP’s expected Yield-on-Cost (“YoC”) for the 1.8 million sqm of projects under construction increased to an industry-leading 10.6% from 10.1% at year-end 2022. The Group’s standing portfolio grew to 11.0 million sqm of GLA owned as of 30 June 2023, while the Gross Asset Value (“GAV”) increased by 8.2% to €12.4 billion. EPRA NTA per share increased by 7.4% to €14.84.

Company-specific adjusted EPRA earnings increased by 25.4% to €158.1 million. CTP’s Company specific adjusted EPRA EPS amounted to €0.36, on track to reach CTP’s guidance of €0.72 for 2023.

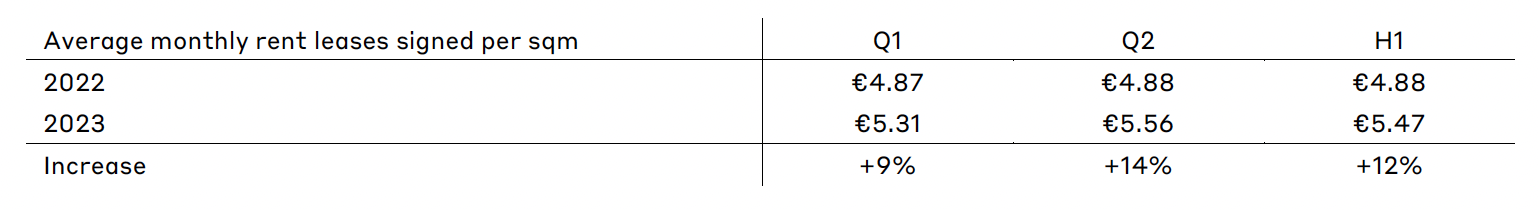

“We saw a strong pick-up in leasing during the second quarter with in total of 850,000 sqm signed during H1-2023. As occupier demand remains robust and the supply of new industrial & logistics space is decreasing, vacancies stay low, allowing us to continue to drive rental growth, with the rental levels of new leases that we signed in H1-2023 up 12% compared to H1-2022.

The business-smart CEE region has seen strong growth in recent years and is expected to continue to outperform in the years ahead. The industrial & logistics sector in CEE benefits from structural demand drivers, such as professionalisation of supply chains, e-commerce, and occupiers seeking to enhance the resilience of their supply chains through nearshoring and friend-shoring, with production in Europe for Europe, as the CEE region offers the best cost location.

We continue to deliver on our promises, the expected YoC of our 1.8 million sqm of development projects, which have a potential rental income of €133 million, increased to 10.6%, and we expect that to improve further during the year, thanks to decreasing construction costs and higher rents. Our industry-leading YoC and profitable pipeline also continues to drive positive revaluations, as we mobilise our landbank, which we have been able to acquire at attractive prices,” comments Remon Vos, CEO CTP N.V.

In H1-2023, CTP signed leases for 850,000 sqm, with contracted annual rental income of €56 million, and an average monthly rent per sqm of €5.47 (H1-2022: €4.88).

Nearly two-thirds of those leases were with existing tenants, in line with CTP’s business model of growing with existing tenants in existing parks.

Some of the main leasing deals included a 54,000 sqm prolongation with TD Synnex a leading distributor and solutions aggregator for IT ecosystems, 52,000 sqm with Taiwan headquartered Inventec, which produces computers, notebooks, servers and other IoT devices and 28,000 sqm with a German automotive firm which develops electrified drive technologies, all in the Czech Republic. 27,000 sqm with Titan X, a global supplier of cooling systems for commercial vehicle manufacturers, 25,000 sqm with a German renewable energy developer and service provider and 25,000 sqm with TRUMPF Huettinger, a global manufacturer of power supplies for plasma coating, induction heating, and laser excitation processes, all in Poland. In Romania, CTP signed a lease agreement of 18,500 sqm with a retail company distributing sport apparel.

Leveraging these drivers allowed CTP to increase its average market share in the Czech Republic, Romania, Hungary, and Slovakia from 27.8% at year-end 2022, to 28.0% as at H1-2023 and it remains the largest owner of industrial and logistics real estate assets in those markets. The Group is also the market leader in Serbia and Bulgaria.

With over 1,000 clients, CTP has a wide and diversified international tenant base, consisting of blue-chip companies with strong credit ratings. CTP’s tenants represent a broad range of industries, including manufacturing, high-tech/IT, automotive, and e-commerce, retail, wholesale, and third-party logistics. This tenant base is highly diversified, with no single tenant accounting for more than 2.5% of its annual rent roll, which leads to a stable income stream. CTP’s top 50 tenants only account for 33.3% of its rent roll and most are in multiple CTParks.

Strong cash flow generating portfolio

The Company’s occupancy came to 93%, this slight decrease compared to 31 December 2022 (94%) is primarily due to the delivery of CTPark Amsterdam City. The Group’s client retention rate remains strong at 92% (H1-2022: 91%) and demonstrates CTP’s ability to leverage long-standing client relationships. The portfolio WAULT stood at 6.5 years (H1-2022: 6.4 years), in line with the Company’s target of >6 years.

Rent collection level stood at 99.8% in H1-2023 (FY-2022: 99.7%), with no deterioration in payment profile.

Rental income amounted to €280.4 million, up 21.7% y-o-y on an absolute basis. On a like-for-like basis, rental income grew 7.5%, mainly driven by indexation and reversion on renegotiations and expiring leases.

The Group has put measures in place to limit service charge leakage, especially in Czech Republic and Germany, which resulted in the improvement of the Net Rental Income to Rental Income ratio from 92% in H1-2022 to 96% in H1-2023. Consequently, the Net Rental Income increased 26.8% y-o-y.

An increasing proportion of the rental income generated by CTP’s investment portfolio benefits from inflation protection. Since end-2019, all the Group’s new lease agreements include a double indexation clause, which calculates annual rental increases as the higher of:

- a fixed increase of 1.5%–2.5% a year; or

- the Consumer Price Index.

As at 30 June 2023, 58% of income generated by the Group’s portfolio includes this double indexation clause, and the Group is on track to increase this to around 70% by the end of 2023.

The reversionary potential at H1-2023 stood at 14.1%. New leases have been signed continuously above ERV’s, illustrating continued strong market rental growth and supporting valuations.

The contracted revenues for the next 12 months stood at €654 million as at 30 June 2023, increasing 21.5% y-o-y, showcasing the strong cash flow generation of CTP’s investment portfolio.

Profitable pipeline increasing

CTP continued its disciplined investment in its highly profitable pipeline.

In H1-2023, the Group completed 413,000 sqm of GLA (H1-2022: 157,000 sqm). Excluding CTPark Amsterdam City, which was acquired during the construction, the developments were delivered at a YoC of 10.4%, 85% let and will generate contracted annual rental income of €16.0 million, with another €2.6 million to come when these reach full occupancy.

The main own-built deliveries during H1 were: 51,000 sqm in CTPark Vienna East in Austria (fully leased to amongst others DHL, Frigologo, Quick Service Logistics, Toyota, Schachinger), 47,000 sqm in CTPark Warsaw South in Poland (leased to amongst others Fiege), 41,000 sqm in CTPark Sofia West in Bulgaria (leased to Lidl) and 25,000 in CTPark Brno Líšeň (leased to amongst others Bufab, Stannah Stairlifts, Swiss Automotive Group and Dr. Max).

The Group also delivered the 120,000 sqm inner-city development CTPark Amsterdam City, the first XXL multi-story logistics building in the Netherlands. The park, including the 6MWp roof-top solar, has an ERV of €17 – 18 million, which is above the underwriting, and is currently 25% (pre-)let. The Group expects to be nearly fully let over the course of 2024. The park has obtained a BREEAM excellent rating and a A+++++ energy label, the highest available, supporting clients to realise their ESG targets.

While average construction costs in 2022 were around €550 per sqm, CTP expects those to drop below €500 per sqm in 2023, in part thanks to CTP’s in-house construction and procurement teams. This decline in construction costs, together with continued rental growth driven by strong occupier demand and low vacancies, has allowed CTP to increase its YoC target to 11% for new construction, an industry-leading level, supported by CTP’s unique park model and in-house construction and procurement expertise.

At the end of H1-2023, the Group had 1.8 million sqm of buildings under construction with a potential rental income of €133 million and an expected YoC of 10.6%. CTP has a long track record of delivering sustainable growth through its tenant-led development in its existing parks. 65% of the Group’s projects under construction are in existing parks, while 28% are in new parks which have the potential to be developed to more than 100,000 sqm of GLA. Planned 2023 deliveries are 56% pre-let and CTP expects to reach 80%-90% pre-letting at delivery, in line with historical performance. As CTP acts in most markets as general contractor, it is fully in control of the process and timing of deliveries, allowing the Company to speed-up or slow-down depending on tenant demand, while also offering tenants flexibility in terms of building requirements.

In Poland, the Group signed in total of more than 190,000 sqm of (pre-)lettings and has more than 40,000 sqm under advanced negotiations. The supply of new industrial & logistics space in Poland is estimated to decrease by up to 40% between 2022 and 2024, while the market has seen a record net absorption of 4.2 million sqm in 2022 and rent increases of up to 30%. This continued in H1-2023, with net absorption of almost 2.0 million sqm, and CTP is well positioned to benefit from those trends.

In 2023 the Group is targeting the delivery of least 1 million sqm – and more if demand remains robust. The 196,000 sqm of leases that are currently signed for future projects, which haven’t started yet, are a clear illustration of continued occupier demand.

CTP’s landbank amounted to 20.7 million sqm as at 30 June 2023 (31 December 2022: 20.3 million sqm), which allows the Company to reach its target of 20 million sqm GLA by the end of the decade. The landbank was roughly stable compared to 31 December 2022, with the Group focusing on mobilising the existing landbank to maximise returns, while maintaining disciplined capital allocation in landbank replenishment. 62% of the landbank is located within CTP’s existing parks, while 27% is in or is adjacent to new parks which have the potential to grow to more than 100,000 sqm. 19% of the landbank was comprised of options, while the remaining 81% was owned and accordingly reflected in the balance sheet.

Roll-out of solar energy investments on track

CTP is on track with its expansion plan for the roll-out of photovoltaic systems over the course of 2023. With an average cost of ~€750,000 per MWp, the Group targets a YoC of 15% for these investments.

CTP’s sustainability ambition goes hand in hand with more and more tenants requesting photovoltaic systems, as they provide them with i) improved energy security, ii) a lower cost of occupancy, iii) compliance with increased regulation and / or their clients requirements and iv) the ability to fulfil their own ESG ambitions.

Pipeline drives valuation results

Investment Property (“IP”) valuation increased from €10.1 billion as at 31 December 2022 to €11.0 billion as at 30 June 2023, driven by, among other factors, the €406 million transfer of completed projects from Investment Property under Development (“IPuD”) to IP, a €252 million net revaluation result, €103 million of standing assets acquisitions, and €50 million of landbank acquisitions.

IPuD increased by 4.6% to €1.2 billion as at 30 June 2023, mainly driven by progress on developments, while the projects under construction increased from 1.7 million sqm of GLA at year-end 2022 to 1.8 million sqm of GLA at the end of H1-2023. The cost to complete the current pipeline amounts to €676 million.

GAV increased to €12.4 billion as at 30 June 2023, up 8.2% compared to 31 December 2022.

On a like-for-like basis CTP saw a positive revaluation of 0.4% in the first half of 2023, consisting of a yield impact of -4.8%, fully offset by the impact of increased ERVs and others of +5.2%. The like-for-like ERV growth amounted to 6.3%.

CTP expects further positive ERV growth on the back of continued tenant demand, which is positively impacted by the secular growth drivers in the CEE region. Especially since CEE rental levels remain affordable, as despite the strong growth seen, they have started from significantly lower absolute levels than in Western European countries.

The revisionary yield increased 30bps in the first half of the year, bringing it to from 6.8% as at 31 December 2022 to 7.1% as at 30 June 2023. The yield widening was mainly driven by the Czech Republic, Slovakia, and Hungary, while countries like Romania, Serbia and Bulgaria saw less yield widening, as the yields in those countries were already higher.

The gross portfolio yield stood at 6.6% on 30 June 2023. With the larger yield movements in Western European markets, the yield differential between CEE and Western European logistics is back to the long-term average. CTP expects the yield differential to decrease further, driven by the higher growth expectations for the CEE region.

The H1-2023 revaluation of €417.2 million was mainly driven by a revaluation of IPuD (€165.6 million), standing assets including the stabilization of 2023 deliveries (€191.2 million), and landbank (€62.3 million).

EPRA NTA per share increased from €13.81 as at 31 December 2022 to €14.84 as at 30 June 2023, representing an increase of 7.4%. The increase is mainly driven by the revaluation (+€0.94) and Company specific adjusted EPRA EPS (+€0.36), but was partly offset by the dividend (-€0.24) and others (-€0.03).

Robust balance sheet and strong liquidity position

In line with its proactive and prudent approach, the Group benefits from a solid liquidity position to fund its growth ambitions, with a fixed cost of debt and conservative repayment profile.

During the second quarter of 2023, the Group demonstrated its continued good access to – and the depth of – the bank lending market, signing in May the first €280 million tranche of a five-year and seven-year unsecured facility with a consortium of international financial institutions at a fixed all-in cost of 4.7%.

In August CTP also signed:

- A €200 million ten-year unsecured loan facility with an international financial institution; and

- A €103 million seven-year secured loan facility with an Austrian bank at a fixed all-in cost of 4.7%4.

Year-to-date the Group has raised €811 million, of which €480 million is unsecured and €331 million secured.

The bank lending market – both secured and unsecured – remains more attractive than the bond market, with pricing reflecting CTP’s long-term reliable and growing cash flows.

The Group’s liquidity position pro-forma for the facilities signed in August stood at €1.5 billion, comprised of €991 million of cash and cash equivalents, and an undrawn RCF of €500 million.

Furthermore, a material amount of additional loan facilities have been agreed to prefund 2024 developments as well as H1-2025 maturities.

CTP’s average cost of debt stood at 1.8% (31 December 2022: 1.5%), with 99.4% of the debt fixed or hedged until maturity. The average debt maturity came to 5.3 years (31 December 2022: 5.7 years).

The Group’s first material upcoming maturity is a €400 million bond in Q4-2023, which will be repaid from available cash reserves (€991 million pro-forma). Following this, the next material debt maturity is not until mid-2025.

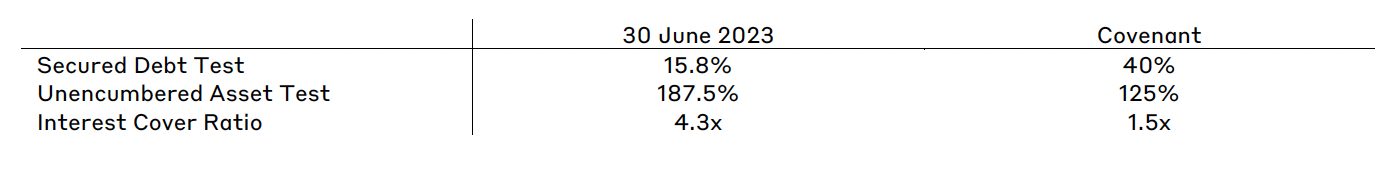

CTP’s LTV came to 45.9% (31 December 2022: 45.4%), just above the Company’s target of an LTV between 40%-45%. CTP expects the LTV at year-end 2023 to be around 45%, when the revaluations of the developments under construction are booked. The Group deems this to be an appropriate level, given its higher gross portfolio yield, which stood at 6.6% as at 30 June 2023. The higher yielding assets lead to a healthy level of cash flow leverage that is also reflected in the forward-looking Interest Coverage Ratio of 5.0x (31 December 2022: 5.6x) and normalised Net Debt to EBITDA of 9.5x (31 December 2022: 9.6x)

The Group had 67% unsecured debt and 33% secured debt as at 30 June 2023, with ample headroom under its covenants to increase the amount of secured debt, which is offered at more attractive rates than the bond market in the current environment.

On 3 August 2023, Moody’s confirmed CTP’s Baa3 rating with a stable outlook.

Outlook and Guidance

Leasing dynamics remain strong, with robust occupier demand, low vacancy across CTP’s markets, and decreasing new supply leading to continued rental growth.

CTP is well positioned to benefit from these trends. The Group’s pipeline is highly profitable and tenant led. The YoC for CTP’s pipeline increased to 10.6%, while the target for new projects is 11%, thanks to decreasing construction costs and rental growth. The next stage of growth is built in and financed, with 1.8 million sqm under construction as at 30 June 2023 and the target to deliver at least 1 million sqm in 2023 – and more if demand remains robust.

CTP’s robust capital structure, disciplined financial policy, strong credit market access, industry-leading landbank, in-house construction expertise and deep tenant relations allow CTP to deliver on its targets, with the Group being on track to reach 20 million sqm of GLA and €1 billion rental income before the end of the decade.

The Group confirms its €0.72 Company specific adjusted EPRA EPS guidance for 2023.

Dividend

CTP announces an interim dividend of €0.25 per ordinary share, an increase of 14% compared to H1-2022, and which represents a pay-out of 70% of the Company specific adjusted EPRA EPS, in line with the Group’s 70% – 80% dividend policy pay-out ratio. The default is a scrip dividend, but shareholders can opt for payment of the dividend in cash.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/CTP-Clubhaus.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/CTP-Craiova.jpeg)

:quality(50)/business-review.eu/wp-content/uploads/2024/06/HelpShip_CTPark-Oradea-Cargo-Terminal.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/05/Lavinia-Rasmussen.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)