:quality(80)/business-review.eu/wp-content/uploads/2015/12/Romanian-real-estate-market.jpg)

From the economic perspective, Romania crosses one of the best times in recent history: Gross Domestic Product (GDP) has entered its eighth consecutive year of growth, employment and wages rise from month to month, so nowadays the biggest threat to new investment projects seems to be the labor shortage. Yet, the mortgage loans are much lower in Romania compared to Poland or Hungary.

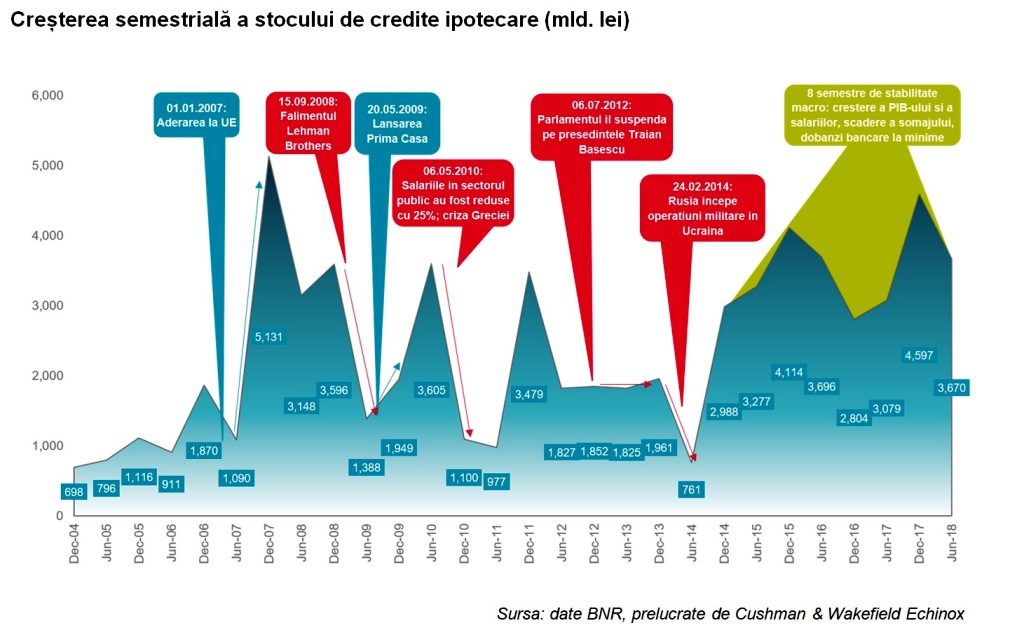

Combined with bank interest, which are also at historic lows in recent years, the macro indicators brought back optimism in the residential market, fueling demand for loans for the purchase of a house: in each of the last eight semesters (between S2 2014 and S1 2018), the balance of loans mortgage increased by at least RON 2.8 billion (the equivalent of EUR 600 million), reaching mid-year close to the threshold of RON 70 billion (EUR 15 billion).

At the end of 2008, the balance of the mortgage was about RON 21 billion (EUR 5.7 billion), almost three times lower, according to the National Bank of Romania (BNR), acquisition finance real estate in the last decade fueled during this period especially the First Home Program. Through this program, approximately 245,000 mortgages have been granted over the past nine years, so the balance is roughly equally divided between standard mortgages and state guaranteed loans.

Bucharest and Ilfov County account for 41.4 percent of this stock, but growth also comes from other regions, considering that the share of the capital is slightly down from a maximum of 43.8 percent reached in mid-2014.

National Institute of Statistics data also show that house prices have increased by about 25 percent over the last four years, both at Bucharest and at national level, above the inflation rate, but below the level with which the salaries were increased, which have advanced more than 50 percent within the same timeframe, so housing accessibility has improved.

Nevertheless, there have recently been more public views in the public space that warn about the risks of overheating the residential market, based, on the one hand, on the upward trend in prices and, on the other hand, on the activity on the construction sites: even though last year the level of new home deliveries was stable both in Bucharest and in the country, the surface of residential buildings for which building permits were issued in the Capital City increased by 60 percent in 2017 compared to the previous year, which is visible in many areas of the city.

Given that the echoes of the last financial crisis, which began ten years ago, are getting worse, we’ve been looking to identify the main factors that have affected markets activity over the past decade analyzing the evolution of the mortgage loan balance.

Between 2005 and 2007, the credit was weak, the balance rising by about RON 1 billion per semester, so that a peak of RON 5 billion was recorded immediately after the accession to the European Union, followed by two other solid semesters, in which banks added RON 3 to 3.5 billion to the credit stock.

Lehman Brothers bankruptcy on September 15, 2008, an event seen as a symbol of the subprime financial crisis, reverberated strongly in the local banking system, causing price collapses, but also a sharp decline in the number of real estate transactions and loans.

Subsequently, on the background of housing price adjustment and especially after the launch of the First Home Program on May 20, 2009, the level of transactions resumed to rise, but the advance was suddenly stopped a year later when Romania had to resort to a loan of EUR 20 billion from the IMF, the EU, the World Bank and the EBRD to stabilize the exchange rate and adjust the budget deficit, while reducing salaries by 25 percent in the budget sector, a tough austerity measure that left deep traces.

The second semester of 2011 was positive, with an advance of RON 3.5 billion, followed by four semesters (2012-2013), in which the credit was sluggish, with advances below the level of RON 2 billion. It should be noted that the political tensions that culminated with the suspension of President Traian Basescu in Parliament followed by a dismissal referendum did not have a significant impact on the mortgage lending activity, as the market reacted more acutely when the political crisis local currency overlapped with Russia’s military intervention in Ukraine: in the first half of 2014, the weakest advance of the mortgage balance in the last decade was only RON 761 million.

Subsequently, presidential elections took place at the end of 2014, Klaus Iohannis obtaining a five-year mandate with the general support of major European powers and institutions, coinciding with the exit from the crisis and a return to a positive trend of the economy, general, and the residential market, in particular, the mortgage loan stock advancing between RON 2.8 and RON 4.6 billion in each of the following eight semesters.

What conclusions can we draw? Considered overall, the residential market still has enormous potential. The average mortgage debt ratio for the adult population was EUR 895 at the end of last year, compared with EUR 2.991 in Poland and EUR 1.683 in Hungary, while the share of mortgage credit in GDP was only 7.6 percent (compared to 20 percent in Poland and 11 percent in Hungary), according to Hypostat 2018, A Review of Europe’s Mortgage and Housing Markets, so banks still have enough space to lend.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/Vlad-Saftoiu-Head-of-Research-Cushman-Wakefield-Echinox.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/11/Dana-Radoveneanu-Head-of-Retail-Cushman-Wakefield-Echinox-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2021/11/Cristina-Lupascu-PR-Research-Director-Cushman-Wakefield-Echinox.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/11/Victor-Cosconel_Colliers--scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)