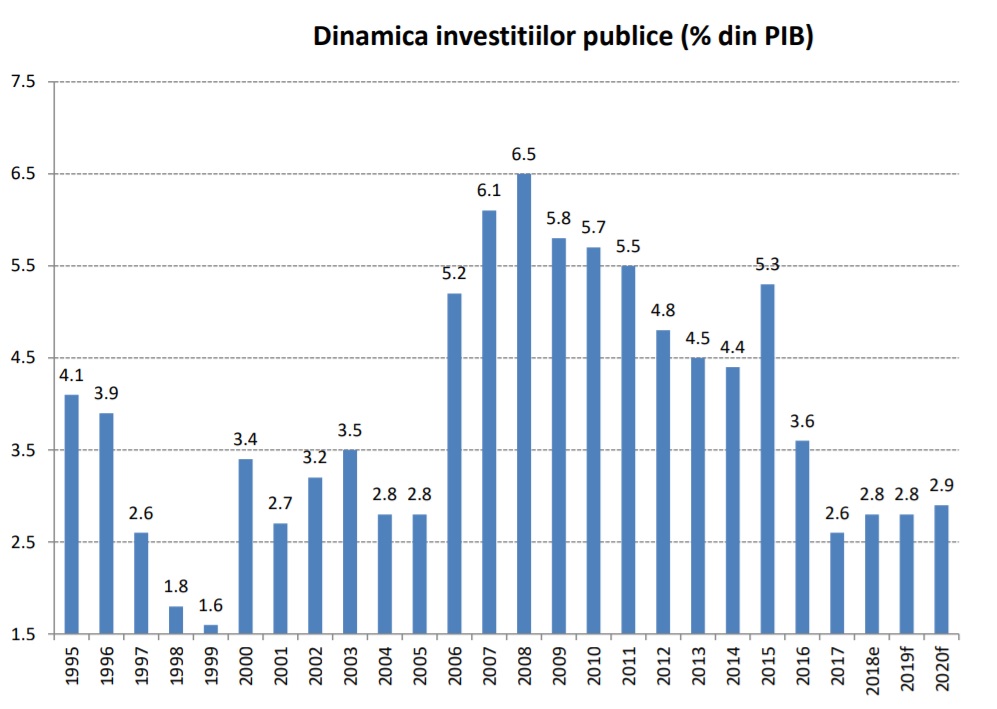

The Romanian government cut public investment to 2-decade low since 2017 as it need money to finance its soaring social spending on wages and pensions, official data reveals.

Last year, public investment in Romania declined to 2.6 percent of gross domestic product (GDP), a record low since 1999, when the country was plunged into its worst economic crisis since the fall of communism.

But this year the government didn’t speed up investment despite the lack of infrastructure in the country.

In the first nine months of this year, capital spending – that includes investment – rose by 46.7 percent year-on-year but only to 1.2 percent of GDP (RON 11.3 billion) but mainly due to spending on buying US weapons.

“Capital spending is up by 46.7 percent YoY influenced by defence spending. Net of all that, we estimate a 27.2 percent YoY rise. Another tranche of defence spending of 0.26 percent of GDP announced for September was most likely delayed as data suggest,” ING Bank analysts said in a research note.

Last year, Romania’s public investment of 2.6 percent of GDP was the ninth lowest among the 28 European Union member states but much lower than in other Eastern European countries which need to reduce the gap in terms of infrastructure with the more advanced economies.

Estonia has spent 5.4 percent of its GDP on investment last year, while Hungary – which has already a much better infrastructure than Romania – has allotted 4.5 percent of GDP for investment, Poland – 3.8 percent of GDP and the Czech Republic – 3.4 percent, according to AMECO.

The lack of public investment could be seen in every day life by anybody in Romania, from the lack of motorways (around 780 km in the whole country) to the very poor state of the rail network.

During the last few years, the Romanian government has adopted a strategy of wage-led growth, stimulating household consumption and GDP growth rates, but this model has generated larger fiscal and current account deficits – as well as higher inflation rates.

As a consequence, in January-September 2018 “the share of rigid state spending (up by 18 percent YoY) out of stable revenue sources (up by 12.8 percent YoY) reached almost 80 percent, limiting budget flexibility and increasing the vulnerability of public finances to potential shocks,” ING analysts warn.

With economic growth slowing down both domestically and abroad, this budget structure suggests that public investment could be reduced even further into the next period if the government remains committed to the 3 percent of GDP deficit target, analysts estimate.

:quality(80)/business-review.eu/wp-content/uploads/2014/04/arad-timisoara-motorway.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/1.AKTOR_A0Sud_L3_ruta_ce_conecteaza_A0_cu_A1_iunie_2024.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/RetuRO-Bacau-2.jpeg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/Ilustratie-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)