:quality(80)/business-review.eu/wp-content/uploads/2014/07/329085-alexfas01-1.jpg)

Unpredictable regulation and poor infrastructure are among the key issues faced by French companies in Romania, whose direct investments in the country reach roughly EUR 7 billion. French investments span the sectors and have registered an uneven performance in the aftermath of the financial crisis, but investors are pinning their hopes on the gradual recovery of the local economy.

Ovidiu Posirca

According to the French Chamber of Commerce and Industry in Romania (CCIFER), there were over 3,500 companies with French capital that were active locally last year. The French presence in Romania is prominent in the banking, automotive, telecom, retail and energy sectors.

Manuela Furdui, managing partner of Finexpert, a tax consultancy firm, says that French firms have to deal with a lack of predictability and instability of decisions with a fiscal impact. Finexpert has been working with French companies for over 10 years, providing services in the tax field, ranging from accounting to consultancy on accessing state aid.

She told BR that some of the French clients in the firm’s portfolio said they faced a rigid administrative system and lengthy decision making in important processes that impact businesses. “One such example is the reimbursement of VAT where months or even years are required for a solution, with the process being blocked largely due to issues related to the form and not the background (e.n. of regulation),” Furdui told BR. She added that French companies are still attracted by the flat corporate tax rate of 16 percent, which is a competitive advantage for Romania against other EU member states. At present, 35 percent of Finexpert’s portfolio of clients are French companies that are mainly active in the automotive, IT and agriculture sectors.

[restrict]

Financial sector seeks growth

BRD Groupe Societe Generale, the second biggest lender in Romania by assets, returned to the black in the first quarter of this year, reporting a net profit of RON 37 million, mainly due to lower risk costs. The bank said, however, that demand for new loans in the corporate segment remained subdued.

The lender registered a slight increase of 1.3 percent in gross loans to individuals, while mortgages rose 16.5 percent on the back of the Prima Casa program (the government-backed mortgage scheme for first-time buyers). BRD’s level of non-performing loans (NPLs) amounted to 21.8 percent, which was in line with the banking system average.

Philippe Lhotte, chairman and CEO of BRD Groupe Societe Generale, said the lender was ready to assist all companies investing in Romania, including French ones, no matter what economic sector they belong to. Lhotte said that the economic framework in Romania was improving, mentioning the good macroeconomic indicators, low interest rates and stable currency. “What the economy needs now is sustainable and significant growth, on one hand, and more confidence, on the other. I think the banking system is continuing to recover from the very difficult period it has experienced over the last few years and that it is well prepared to resume financing the economy better,” Lhotte told BR. He added that BRD aimed to grant more loans, noting that the lender was seeing “slightly growing demand” in both the retail and corporate segments. The banker said that SMEs remain a priority for financing.

Meanwhile, Cetelem, the consumer loan provider that is part of BNP Paribas Personal Finance, announced last month that it had granted over 1 million loans in Romania. The company said that its clients used the loans primarily to upgrade their homes, purchase a car or pay for a vacation.

Elsewhere, the insurance market will post slight growth this year, sustained primarily by the increase of motor vehicle liability insurance (MTPL) premiums, according to Anca Roscaneanu, general manager of insurance broker Gras Savoye Romania. “At the same time the mediation insurance market will maintain the growing trend, coming mostly from the retail business,” she told BR.

The company mediated around RON 35.7 million worth of premiums in the first half of last year and this year has reported a 6 percent gain in income. Gras Savoye aims to increase its turnover by 15 percent this year against 2013. The insurance broker is currently working for about 300 large and medium-sized enterprises, with less than half of them having French ownership. Roscaneanu said the company has registered increased demand from the industrial extraction sector, as well as from production and services, software development, transport, trade and postal services.

French insurer Groupama reported a reduction of 11 percent in gross written premiums last year to RON 718 million against 2012. The company said the drop was triggered by the voluntary decrease of its exposure in the segment of mandatory car insurance, RCA. Francois Coste, general manager of Groupama Romania, said in a statement that the insurer was looking to return to the black this year, pointing out that it reported a profit in the first quarter.

In the past year, the market for valoric vouchers has remained flat, but it should expand at an annual rate of 2.5 percent in the years to come, close to Romania’s GDP growth, said Jean Istasse, CEO of Sodexo Benefits & Rewards, a provider of this type of services. “Meal vouchers are one of most popular fringe benefits with employers due to the direct impact on employees’ motivation and performance. This benefit is used in all sectors of activity by all categories of employers: from small ones to the biggest ones,” Istasse told BR.

He added that gift vouchers are offered by companies that have over 250 employees and are active in the chemicals and metallurgy sectors, alongside services and home & consumer goods industry. Istasse said that nursery vouchers are given to employees working in the insurance distribution, electronics and construction sectors, but the use of this benefit is still small in Romania. “This is due to the small number of places in nurseries compared with demand. This situation would change if the usage of nursery vouchers were extended to other categories of childcare services (like child minding) needed by employees for their work-life balance,” said the CEO. He added that the company grew by 2.5 percent last year, in line with the market, but did not mention to what level.

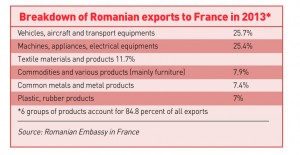

Automotive drives Romanian exports

Carmaker Dacia, controlled by France’s Renault, last year remained the biggest exporter in Romania. The company reported a 19.3 percent increase in sales to 429,540, out of which 24,890 were registered locally. Renault took over the beleaguered Dacia plant in Mioveni back in 1999 and has turned the local company into a global car brand. Dacias are currently exported to 42 countries on four continents. “Renault is continuing its investment projects in Romania both on the side of vehicles and mechanics. In 15 years we have invested over EUR 2.2 billion. At present, our main challenge is to improve (e.n. our) competitiveness and to do our best to satisfy our customers from the point of view of quality and delivery terms,” Nicolas Maure, president and general manager of Dacia and general manager of Renault Romania, told BR.

Maure said that Romania has a “big potential for investors”, adding that the issues of infrastructure and red tape need to be improved in order to convince investors to come into the country. He said that Romanian authorities are open and have supported the company’s investments in Romania, both at a national and local level.

Renault has developed in Romania a complete production system. It includes a design center in Bucharest, the engineering hub Renault Technologie Roumanie that operates in the capital, Titu and Mioveni and two production plants (vehicles and mechanical) on the Mioveni industrial platform, as well as a trading network.

Renault Romania has 17,000 staff and reported a turnover of EUR 4.48 billion last year, accounting for 2.9 percent of Romania’s GDP. The company has generated more than 130,000 jobs in the car industry, as it works with over 1,500 suppliers locally.

Maure said that Dacia has gained 5 percent market share in Romania last year, and expressed his hopes that this year the results will be better. “The economic context should improve and create conditions for the growth of the overall market,” said Maure.

Energy outlook disrupted by changes to regulation

The government’s decision to change the incentives mechanism for renewable producers last summer has unnerved foreign investors, which have put over EUR 6 billion into this sector. With the issue of some green certificates – the main revenue source for producers – put on hold through to 2017, investors fear they will not be able to recover their investments, according to experts.

French utility group GDF Suez has an exposure in the local renewable sector, with a portfolio of 98MW in wind capacities. Last year, the company completed a 48MW wind farm in southeastern Romania followed by a 50MW wind farm in the same area. Experts say that wind producers are currently in the red as their revenues from the sale of one certificate and electricity are insufficient to cover their investments.

GDF Suez Energy Romania, whose main business is the supply and distribution of natural gas, last year reported a 24 percent increase in its net profit to RON 447.1 million, while turnover remained fairly flat. The company invested RON 490 million last year, out of which RON 132 million went into the modernization of the distribution network.

Alstom, the French engineering group that will be taken over by US-based General Electric, earlier this year announced plans to turn Romania into a specialized center for power and transport markets in Eastern Europe. The company aims to hire up to 50 IT specialists in the next three years. It operates in Romania through four entities active in transport, infrastructure, grids and the manufacturing of energy equipment.

Challenging environment for dairy market

French dairy group Danone, which is the biggest yoghurt maker in Romania, reported last year a net loss of RON 5 million, its first loss in the last six years. The company’s turnover fell 5 percent to RON 481 million in 2013 against the previous year, according to business daily Ziarul Financial, quoting data from the Ministry of Public Finance.

Last year, the company was hit by flat consumption and lower consumer spending, according to Dieter Schulz, Danone’s general manager for South-East Europe. He attributed the results partially to the pricing of raw materials and financial hedging. The GM added that this year the dairy market will remain challenging, as consumers are still cautious, while production costs could further rise.

Meanwhile, French dairy group Lactalis closed three production units and two milk processing facilities in Romania last year, according to Ziarul Financiar. Locally, the company controls the dairy group LaDorna. It is still producing milk and cheese in Romania.

Players ring the changes in telecom

The main focus on the telecom market in the past year has been the roll out of the 4G high-speed data network. French telecom operator Orange announced this spring that it would be expanding its 4G network in 90 cities and testing 4G+ networks in six.

Orange Romania saw revenues go up by 4.9 percent to EUR 230 million in the first quarter of this year, on the back of the growing number of mobile internet users. The telecom operator had close to 10.4 million clients at the end of the first quarter.

Orange has invested around EUR 250 million in Romanian since the end of 2012, including EUR 130 million in 2013. The operator has put money into clearing the 900MHz spectrum, developing its 4G network and upgrading the rural and urban network.

Meanwhile, telecom equipment maker Alcatel-Lucent plans to expand its headcount in Romania, although globally it will cut 10,000 jobs. The company is doing research and development (R&D) in Bucharest and Timisoara sand plans to reach 1,600 employees at the end of 2015. At present it has around 1,500 staff, half of whom are working in R&D, according to Michael Combes, CEO of the group. He said the company has invested over EUR 100 million in Romania. The French firm reported a turnover of RON 324.8 million last year, up 27 percent against the previous year, according to data published by the Ministry of Public Finance.

Retail in expansion mode

French companies maintain a strong presence on the Romanian retail scene, and judging from recent news, this presence should expand even further. Only last week it was announced that French DIY group Adeo had bought bauMax’s 15 local stores. Adeo, which already owns a Leroy Merlin DIY outlet in Bucharest, will thereby further increase its local footprint.

Older players present on the local market, such as Carrefour and Auchan, have also continued to invest locally, despite the fact that in general sales have stagnated or even dropped. Carrefour’s sales inched up last year to a level similar to the one posted in 2008, although the retailer has expanded its network in the meantime. It opened 52 stores in 2013, out of which only one outlet was a large-scale hypermarket, and focused instead on opening smaller supermarkets and proximity stores.

In addition to the traditional expansion, last year Carrefour also became the first local large FMCG retailer to venture online. It opened its online store last July, confident that although online grocery sales are still subdued in Romania, the local market will “burn phases” over the next year and their share of total grocery sales will surpass the average on Western European markets.

At present the retailer runs a network of 150 stores in Romania: 25 hypermarkets, 80 supermarkets, 44 proximity stores and one online store. But the French firm wants to further expand its local presence. In April it posted a recruitment ad for the new Supeco stores it plans to open in Romania. Supeco is a retail brand present so far only in Spain where it was launched last year. Four stores have opened since. The concept is a mix between a discounter and cash&carry store.

The Carrefour Group reported a turnover of RON 5.1 billion in Romania last year, while its net profit reached close to RON 140 million. Company representatives said the estimates for this year were confidential. “The retail market showed signs of recovery in the first half of 2014, which makes us optimistic regarding the next semester,” Andreea Mihai, the retailer’s marketing director, told BR.

She said that Carrefour plans to open two new hypermarkets this autumn, one in Bucharest, on the Vulcan platform, and the other in Targu-Jiu. “Domestic demand is growing, most probably as a result of the slight increase in the minimum wage and low inflation. The labor market has also registered an improvement – the unemployment rate has gone down and the number of advertized jobs has gone up,” said Mihai.

But it was Auchan that was the most active French retailer in Romania by far last year. After officially taking over the 20 Real hypermarkets it bought from the German Metro group as part of a regional deal, it increased its local network to 31 outlets.

The company thereby more than doubled its turnover last year to RON 4.6 billion (approximately EUR 1 billion), but also reported a EUR 15 million loss. It now hopes to reach breakeven this year or the next, according to company representatives.

And Auchan has more investment plans for the local market. It has allocated an investment budget of some EUR 100 million this year, which, in addition to the money used for the rebranding of the remaining Real hypermarkets, will go into Auchan Drumul Taberei, a project that will feature a hypermarket and office space in Bucharest, and works on the EUR 60 million Coresi Brasov, the shopping center being developed by Immochan, the real estate division of Auchan, in Brasov.

Besides all this, Auchan has also recently reached an agreement to buy the space that formerly hosted 12 Real hypermarkets and shopping gallerias, according to media reports.

Merger cements market

The proposed merger of cement giants Lafarge and Holcim will also require divestitures as the companies seek to receive anti-trust approval to seal the deal. According to business daily Wall Street Journal, the firms plan to shed plants and businesses that generate more than USD 4 billion in revenue. Most of the proposed divestitures will be made in Europe. Under this plan, France’s Lafarge is set to sell its assets in Romania, according to the WSJ.

Lafarge Romania has two cement factories in Medgidia and Hoghiz. It also owns a division for aggregates, concrete and additional services. The firm holds a 30 percent market share in Romania, similar to Swiss Holcim and Carpatcement, which is part of German HeidelbergCement. The Romanian cement market is estimated to be worth around EUR 600 to 700 million (7 million tons).

ovidiu.posirca@business-review.ro

[/restrict]

:quality(80)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Schneider-Electric-anunta-castigatorii-Sustainability-Impact-Awards-2023-in-Romania-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Premier-Energy-Group-1.jpg)