:quality(80)/business-review.eu/wp-content/uploads/2019/08/card-payment-shopping-DT.jpg)

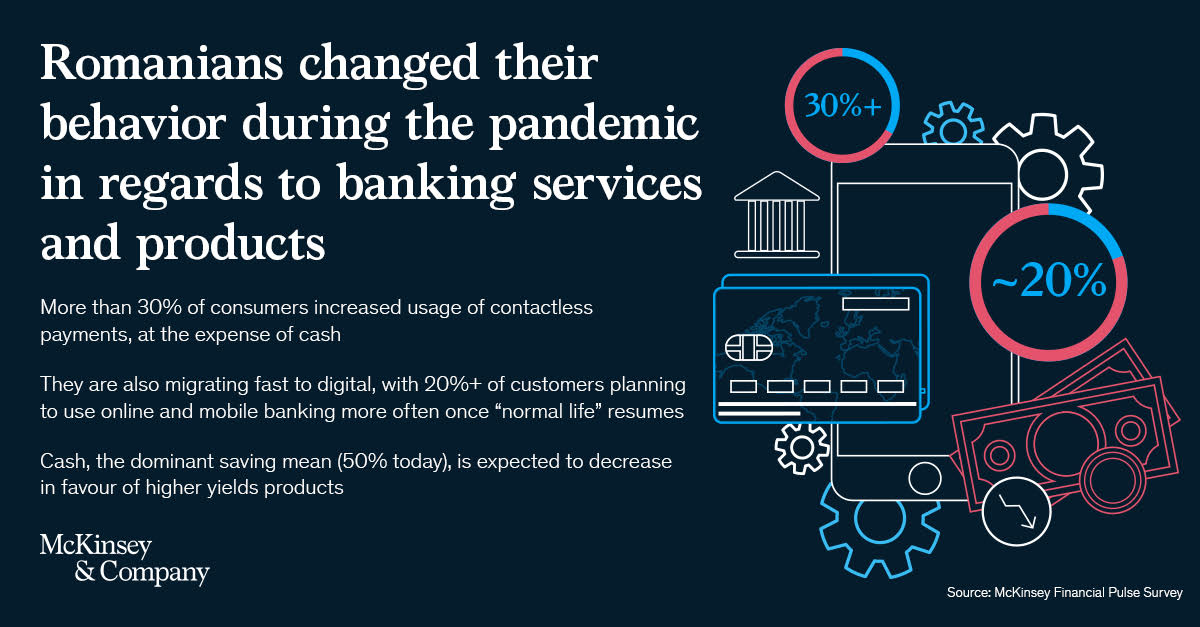

Over 30 percent of Romanian consumers increased their usage of contactless payments, at the expense of cash, according to the findings from the latest “Financial Pulse Survey” conducted by McKinsey & Company. This trend is likely to continue, as over 40 percent of respondents intend to reduce or stop using cash altogether in the next months.

Moreover, when interacting with their banks, Romanians are migrating fast to digital channels, as around 20 percent of them expect to use their mobile devices or desktops more often to access banking services as the crisis ends, compared to nearly 10% across European countries (albeit from a different base).

As almost 50 percent of consumers in Romania have experienced reduction in income and savings during the last period, thus revealing a financial fragility, according to the initial set of data extracted by McKinsey & Company, we expect Romanians to change their behaviors vs. spending and saving in the new context. The main reason is the likely economic recession as most of the questioned Romanians (64 percent) stated they are concerned about it, while 45 percent prefer to be cautious regarding the spending and trying to build a cash position. Other reasons for reduced household spending are the job insecurity and the potential healthcare costs for them and their families.

Therefore, given the current uncertainties, Romanians are prone to adopt behaviors that are more cautious. Even though cash (including current bank accounts) is by far the main mean of saving for Romanians, with over 50 percent today, bank deposits and other financial products (asset management, life insurance, etc.) allocation is expected to increase by 4 and 5 percentage points, respectively.

“Cash and real estate allocation, the most popular ways of saving and investing amongst Romanians, are expected to decrease by 12 and 3 percentage points, during the next period, according to the data in our study. On the other hand, the population’s preference for more complex saving products becomes visible, potentially in search of increased yields, while still having good liquidity. It is not obvious how the banks can address these needs in the low-interest-rate environment forecasted”, says Alexandru Filip, Managing Partner at McKinsey & Company’s Bucharest Office and Leader of the firm’s Digital and Analytics Practice in Central Europe.

Among the customers focused on saving options, 15 percent intend to open a term deposit in the next months, while 13 percent look for a savings account.

On the other hand, there are also Romanians who would like to continue to get loans, potentially to give them more flexibility to manage the liquidity squeeze. In the following months, even though there is not a clear differentiation by product type, 7 percent of the interviewed consumers stated they intended to get a general-purpose loan, respectively auto loans, while 6 percent considered acquiring a credit card or a mortgage. The highest propensity for such lending services comes from the persons with a household income of over RON 10,000.

„Banks, but also other financial players have now the opportunity to fulfill their social responsibilities and stand by their customers, while addressing their changing needs. These financial institutions should develop the most relevant products, for example, to identify attractive saving or refinancing solutions for their customers. Equally, they should accelerate the digital journeys and increase focus on new tech. As banks can have a prominent role in guiding the consumers towards economic recovery, while reinventing themselves”, concluded the Managing Partner at McKinsey & Company’s Bucharest Office and Leader of the firm’s Digital and Analytics Practice in Central Europe.

The two initial sets of findings from the local “Financial Pulse Survey”, communicated recently, showed that: 54 of Romanians consider their current financial situation as being weak. Almost 50 percent of consumers have experienced reduction in income and savings, while less than 33 percent have been able to reduce household spending. 60 percent have savings worth 4 months or less to handle a potential loss of job or income reduction. Moreover, 52 percent of local customers would want their bank to waive late fees on the credit card or loan payment. Over 70 percent of the customers used mobile and online banking services during this period.

The “Financial Pulse Survey” was conducted in Romania in June 2020 and included more than 500 respondents. Results have been adjusted so that figures reflect the overall Romanian population aged 18-80.

:quality(80)/business-review.eu/wp-content/uploads/2018/09/Cosmin-Vladimirescu-Country-Manager-Mastercard-Romania.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)