:quality(80)/business-review.eu/wp-content/uploads/2023/03/unnamed-8.jpg)

Payday loans Canada are short-term unsecured financing options designed to help carry you to your next payday. Think of payday loans Canada as small loans that help you catch your breath and tide you over as you wait to get paid. Today, payday loans Canada is a blanket term for all types of quick loans that help meet every American borrower’s needs, budgets, and circumstances. You can choose from different types of payday loans Canada, including e transfer payday loans Canada 24/7, e-transfer payday loans Canada 24/7 child tax, e transfer payday loans Canada 24/7 no credit check alternatives, and fastest e transfer payday loans Canada 24/7 no documents.

You can access some of the best online payday loans Canada from loan finders with quick and easy application processes, fast approvals, and inclusive lending criteria that considers borrowers with bad credit scores and informal occupations. Loan finders take the guesswork out of borrowing by matching you with direct lenders most likely to approve your application. Depending on your affordability, you can borrow payday loans Canada from $100 to $5,000 and repay in flexible terms from 3 to 24 months with reasonable interest rates from as low as 5.99%.

Read on to discover our editor’s top 5 loan finders of the best payday loans Canada, their ratings, what they offer, and how to apply today through a super simple process.

No Refusal Payday Loans Canada 2023 – Quick Overview

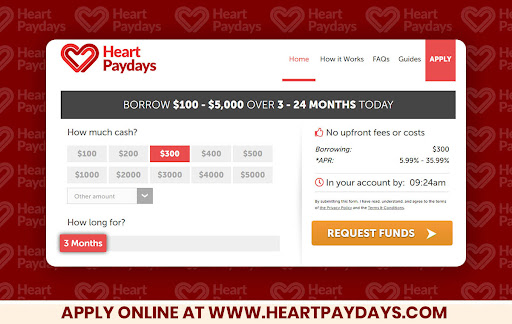

- Heart Paydays: Overall Best for e-transfer payday loans Canada up to $5000 with APRs No Higher Than 35.99%

- Big Buck Loans: Best for No Refusal Payday Loans Canada Alternatives for Unemployed Individuals Earning $1k p/m

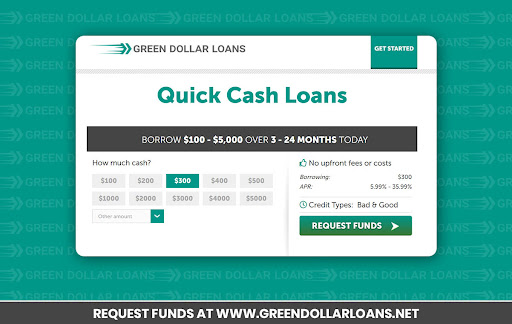

- Green Dollar Loans: Best for Emergency e-Transfer Payday Loans Canada for Borrowers in a Hurry for Cash

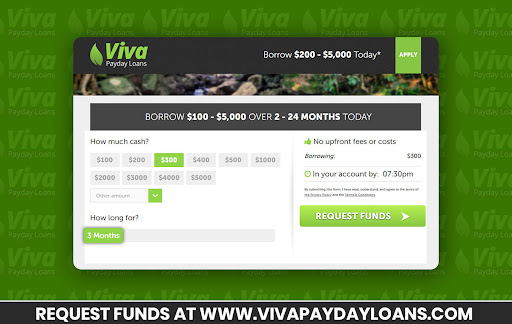

- Viva Payday Loans: Best for Getting the Fastest e Transfer Payday Loans Canada 24/7 No Documents for Students and First-Time Borrowers

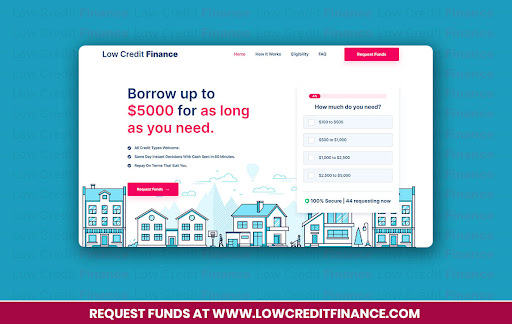

- Low Credit Finance: Best for Online Payday Loans Canada for Bad Credit Borrowers and Low-Income Earners

Best 2023 No Refusal Payday Loans Canada – Full Reviews

Heart Paydays: Overall Best for e-Transfer Payday Loans Canada up to $5000 with APRs No Higher Than 35.99%

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 9/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Heart Paydays ticks all the right boxes when you need fast cash. It features an easy application process with free access to direct lenders offering e-transfer payday loans Canada up to $5,000 with reasonable APRs that don’t exceed 35.99%. Borrowers with low or non-existent credit are considered, and you can choose how long you need to repay e-transfer payday loans Canada, from 3 to 24 months.

Highlights of e-Transfer Payday Loans Canada up to $5000 with APRs No Higher Than 35.99%

- Easy application process

- Free access to direct lenders

- Reasonable APRs

- Borrow with low or non-existent credit

- Fast payouts

Eligibility Criteria to Apply for Highlights of e-Transfer Payday Loans Canada up to $5000 with APRs No Higher Than 35.99%

- At least 18 years of age

- Monthly income of at least $1,000

- Legal US citizen/resident

Fees and APRs Charged on Highlights of e-Transfer Payday Loans Canada up to $5000 with APRs No Higher Than 35.99%

- 5.99% to 35.99% APR

- Missed repayment fee

Big Buck Loans: Best for No Refusal Payday Loans Canada Alternatives for Unemployed Individuals Earning $1k p/m

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 8/10

- Acceptance Rate: 8/10

- Customer Support: 8/10

Big Buck Loans partners with some of the most inclusive lenders in the US and will match you with them free of charge. A streamlined online process connects you to direct lenders offering no refusal payday loans Canada alternatives for unemployed borrowers earning $1,000 per month from any alternative source of income. You can borrow from $100 to $5,000, get funded quickly, and make flexible repayments in 3 to 24 months.

Highlights of No Refusal Payday Loans Canada Alternatives for Unemployed Individuals Earning $1k p/m

- Inclusive lenders

- Streamlined online process

- Alternative sources of income accepted

- Quick funding

- Flexible repayments

Eligibility Criteria to Apply for No Refusal Payday Loans Canada Alternatives for Unemployed Individuals Earning $1k p/m

- Minimum age of 18 years

- Earn at least $1,000 monthly

- Pass the affordability assessment

Fees and Interest Rates Charged on No Refusal Payday Loans Canada Alternatives for Unemployed Individuals Earning $1k p/m

- Late repayment fee

- 5.99% to 35.99% APR

Green Dollar Loans: Best for Emergency e-Transfer Payday Loans Canada for Borrowers in a Hurry for Cash for Borrowers in a Hurry for Cash

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 9/10

- Variety of Products: 8/10

- Acceptance Rate: 8/10

- Customer Support: 9/10

Green Dollar Loans is an excellent choice when you’re facing an emergency. You can apply for emergency e-transfer payday loans Canada within minutes and get approved faster than it takes to visit a traditional branch. Lenders offer affordable loan amounts ranging from $100 to $5,000 with speedy disbursements and tailored repayment terms ranging from 3 to 24 months.

Highlights of Emergency e-Transfer Payday Loans Canada for Borrowers in a Hurry for Cash

- Apply within minutes

- Fast approvals

- Speedy disbursements

- Tailored repayments

- Affordable loan amounts

Eligibility Criteria to Apply for Emergency e-Transfer Payday Loans Canada for Borrowers in a Hurry for Cash

- 18+ years of age

- Regular $1,000 income p/m

- Proof of ID and address

Fees and Interest Rates Charged Emergency e-Transfer Payday Loans Canada for Borrowers in a Hurry for Cash

- 5.99% to 35.99% APR

- Missed repayment fee.

Viva Payday Loans: Best for Getting the Fastest e Transfer Payday Loans Canada 24/7 No Documents for Students and First-Time Borrowers

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

If you’ve been struggling to access loans because you’re a student or first-time borrower with no credit history or formal job, Viva Payday Loans is here to help. You can apply for fastest e transfer payday loans Canada 24/7 no documents from anywhere through a convenient online process with immediate responses, quick turnarounds, and small to medium-sized amounts from $100 to $5,000.

Highlights of Getting the Fastest e Transfer Payday Loans Canada 24/7 No Documents for Students and First-Time Borrowers

- Apply from anywhere

- Convenient online process

- Immediate responses

- Quick turnarounds

- Small to medium-sized loans

Eligibility Requirements to Apply for the Fastest e Transfer Payday Loans Canada 24/7 No Documents for Students and First-Time Borrowers

- 18+ years of age

- Proof of ID and address

- Pass the affordability assessment

Fees and Interest Rates Charged on the Fastest e Transfer Payday Loans Canada 24/7 No Documents for Students and First-Time Borrowers

- Late payment fee

- 5.99% to 35.99% APR

Low Credit Finance: Best for Online Payday Loans Canada for Bad Credit Borrowers and Low-Income Earners

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 7/10

- Customer Support: 7/10

Gone are the days when bad credit or low income made it impossible to access a loan. With Low Credit Finance, you’re matched with swift direct lenders who consider all credit scores and income levels. You can borrow affordable online payday loans Canada for bad credit from $100 to $5,000 with flexible terms customized to your budget for easy and affordable repayments from 3 to 24 months.

Highlights of Online Payday Loans Canada for Bad Credit Borrowers and Low-Income Earners for Bad Credit Borrowers and Low-Income Earners

- Borrowers with all credit scores considered

- Affordable loans

- Flexible terms

- Easy repayments

- Swift lenders

Eligibility Requirements to Apply for Online Payday Loans Canada for Bad Credit Borrowers and Low-Income Earners

- At least 18 years of age

- Legal US citizen/resident

- Active bank account with direct deposit

Fees and APRs on Online Payday Loans Canada for Bad Credit Borrowers and Low-Income Earners

- Missed payment penalty

- 5.99% to 35.99% APR

How We Chose the Best Providers of Guaranteed Payday Loans No Matter What Canada 24/7 Alternatives

We looked for loan finders offering:

- A convenient online loan process

- Easy eligibility criteria

- Inclusive lending, regardless of credit score, occupation, or income level

- Flexible loan amounts and repayments

- Fast disbursements

Types of Alternatives to Guaranteed Payday Loans No Matter What Canada 24/7 Alternatives

Unsecured Alternatives to Guaranteed Payday Loans No Matter What Canada 24/7 Alternatives

Unsecured alternatives to guaranteed payday loans no matter what Canada 24/7 alternatives are ideal if you don’t want to risk your valuable assets for a loan. You can borrow from $100 to $5,000 without any collateral and repay in 3 to 24 months.

Guaranteed Payday Loans No Matter What Canada 24/7 Alternatives for Unemployed Individuals

Guaranteed payday loans no matter what Canada 24/7 alternatives for unemployed individuals are designed for borrowers who don’t have a formal job but have an alternate source of income like pensions, benefits, dividends, freelance earnings, trust proceeds, or alimony.

Student Alternatives to Guaranteed Payday Loans No Matter What Canada 24/7

Student alternatives to guaranteed payday loans no matter what Canada 24/7 are suitable for young adults without a credit history and formal employment. They feature small to medium-sized loans from $100 to $5,000 that are easy to repay in 3 to 24 months.

Emergency Low Income e Transfer Payday Loans Canada 24 7 Canada

With emergency low income e transfer payday loans Canada 24 7 Canada, you don’t have to wait around when you need quick cash. They feature quick applications, fast processing, and swift approvals, provided you’re eligible and can afford loan repayments.

Factors and Features of Low Income e Transfer Payday Loans Canada 24 7 Canada

Expected Costs on Low Income e Transfer Payday Loans Canada 24 7 Canada

You can expect interest rates ranging from 5.99% to 35.99% for low income e transfer payday loans Canada 24 7 Canada. Your risk profile and credit score can influence the rate you get from the lender.

Repayment Flexibility for Low Income e Transfer Payday Loans Canada 24 7 Canada

You can choose how long to repay low income e transfer payday loans Canada 24 7 Canada from 3 to 24 months..

Reputable Lenders Offering Low Income e Transfer Payday Loans Canada 24 7 Canada

You’ll only be matched with reputable, licensed, and honest lenders when applying through loan finders.

e Transfer Payday Loans Canada 24/7 No Credit Check Alternatives Disbursement

The lender will send the approved amount for e transfer payday loans Canada 24/7 no credit check alternatives directly into your account.

Top Five Providers of e Transfer Payday Loans Canada 24/7 No Credit Check Alternatives

| e Transfer Payday Loans Canada Providers | Pros | Cons |

| Heart Paydays |

|

|

| Big Buck Loans |

|

|

| Green Dollar Loans |

|

|

| Viva Payday Loans |

|

|

| Low Credit Finance |

|

|

How to Apply for e Transfer Payday Loans Canada 24/7 No Credit Check Alternatives

How to apply for e transfer payday loans Canada 24/7 no credit check alternatives via Heart Paydays:

Step 1: Select How Much You Need for Instant Payday Loans Canada

The first step is capturing how much you need through instant payday loans Canada and a suitable repayment period. Lenders offer instant payday loans Canada from $100 to $5,000.

Step 2: Complete the Instant Payday Loans Canada Application Form

You only need a few minutes to complete the online application form to give lenders the information to verify that you qualify for a loan.

Step 3: Feedback on Instant Payday Loans Canada Provided in Minutes

Once you submit the completed application form, you’ll know whether or not you qualify for instant payday loans Canada within 2 minutes. If a third-party lender can assist you and you want to proceed, you will deal directly with them to set up a loan contract.

Step 4: Funds for Instant Payday Loans Canada Disbursed Quickly

Read the contract you get from the lender carefully, paying close attention to the terms and conditions of instant payday loans Canada. Once satisfied, simply sign and return the contract to the lender. The lender will deposit the approved loan amount directly into your account as soon as possible.

FAQ’s

How Do Lenders Determine Affordability For e-Transfer Payday Loans Canada 24/7 Child Tax?

When you apply for e-transfer payday loans Canada 24/7 child tax, the lender will look at your income and monthly outgoings to determine how much you have left over that can go toward monthly loan repayments. They also consider your debt-to-income ratio when assessing your application and deciding whether you’re a reliable borrower. You can improve your affordability by paying off debts, increasing your income, or reducing your monthly expenditure.

Can I Borrow e-Transfer Payday Loans Canada 24/7 Child Tax With Bad Credit?

Yes. But you need access to specialized lenders who don’t automatically turn you down because of low or non-existent credit scores. You can access such lenders by applying for e-transfer payday loans Canada 24/7 child tax through loan finders like Heart Paydays. Instead of focusing on your credit issues, such lenders concentrate on your affordability when assessing your application.

How Do e-Transfer Payday Loans Canada 24/7 No Credit Check Alternatives for Unemployed Borrowers Work?

e-Transfer payday loans Canada 24/7 no credit check alternatives for unemployed borrowers are short-term loans suited for borrowers who don’t have a formal job. To qualify, you need to have an alternate source of income where you earn at least $1,000 monthly and prove affordability. Such alternate sources include rental income, dividends, benefits, pensions, child support, trust proceeds, and part-time and freelance earnings. You can borrow from $100 to $5,000 and repay in 3 to 24 months using income from any source.

How Can I Improve My Chances of Getting Approved for e-Transfer Payday Loans Canada 24/7 No Credit Check Alternatives?

You can improve your chances of getting approved for e-transfer payday loans Canada 24/7 no credit check alternatives by providing honest and accurate information on your application and choosing an amount you can comfortably afford to repay.

How Much Can I Borrow With e-Transfer Payday Loans Canada 24/7 No Credit Check Alternatives?

Depending on your affordability, you can borrow from $100 to $5,000. Lenders determine affordability by comparing your income with your monthly expenses and seeing how much you have left that can go towards monthly loan repayments.

Will Applying for Payday Loans Online Canada Impact My Credit Score?

No. Your credit score will not be impacted when you apply for installment loans online Canada through loan finders like Heart Paydays. The platforms feature easy prequalification with soft credit checks that don’t impact your credit score, and you can apply with multiple lenders at once with a single application. Thanks to tailored terms, you can quickly repay the amount you borrow and improve your credit score in no time.

Who Do I Contact With Questions On My Payday Loans Online Canada?

Once you’re matched with a lender, you’ll deal with them directly to finalize the deal, so you’ll need to contact them directly if you have questions about your payday loans online Canada contract. You’ll only get connected to reputable and transparent lenders with readily available contact information. Your lender will inform you of the easiest and fastest way to contact them when finalizing the deal.

Conclusion

Payday loans are a short-term financing option that can help you access the funds you need without worrying about your credit score, income level, or occupation. You can access the best payday loans online from direct lenders at Heart Paydays. The platform features a quick and easy application process, quick approvals, and fast disbursements that allow you to borrow from $100 to $5,000 and repay in 3 to 24 months with reasonable interest rates from 5.99% to 35.99%. If you need quick cash, apply today through a few simple steps at Heart Paydays!

ALSO READ: How To Borrow Money From Cash App

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

:quality(80)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/02/Maria-Rousseva-CEO-of-BRD-Groupe-Societe-Generale.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/01/pexels-mikhail-nilov-7731323-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)