:quality(80)/business-review.eu/wp-content/uploads/2023/01/unnamed-2023-01-16T220324.317.jpg)

If you’re hunting the market for the top payday loans, cash advance loans, and bad credit loans in the US, take the time to check out this Heart Paydays review. Doing due diligence and investigating the various options available to you when looking for payday loans is a responsible step in the right direction when making financial decisions. It’s best to know what to expect, how much is available as a cash advance, and how to process the application. This Heart Paydays review features insights into what the loan-finder platforms have to offer in terms of instant loans interest rates, highlights, eligibility requirements and the steps to apply for payday loans online.

What is Heart Paydays?

If you’re looking for the best lending options online, Heart Paydays is your best bet. Heart Paydays is a loan-finder platform that connects borrowers with providers of payday loans, cash advance loans, no credit check loans alternatives, bad credit loans, and installment loans online quickly and effectively. In the following Heart Paydays review, you will learn if Heart Paydays is legit and find out more about the same day loans and online payday loans on offer.

Highlights of Loans Via Heart Paydays

Below are a few of the highlights to expect when making use of Heart Paydays:

Flexible Payday Loans

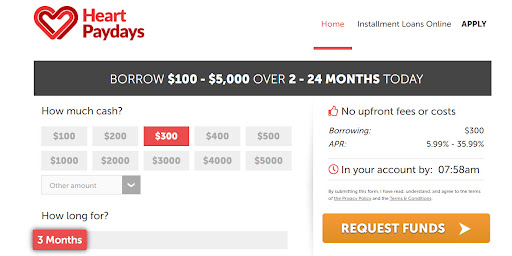

The flexible payday loans available via the Heart Paydays platform range from $100 to $5000.

Payday Loans for Unemployed Borrowers

Payday loans are available to unemployed borrowers if they’re generating at least $1000 per month via alternative means.

Payday Loans for Bad Credit

If your credit score is low, payday loans for bad credit are available if you can prove that you’re able to afford the loan. Bad credit payday loans typically come with high interest.

Low Interest Cash Advance Options

Cash advance options via the Heart Paydays platform come with low interest, between 5.99% and 35.99%.

Speedy Disbursements on Cash Advance Loans

Cash advance loans, once approved, are speedily disbursed. Payouts typically take between 24 and 48 hours.

Pros & Cons of a Cash Advance Via Heart Paydays

| Pros | Cons |

| Simple online application | High interest in some instances |

| Get up to 2 years to pay | |

| Funds paid out promptly | |

| Transparent lenders | |

| No credit and bad credit borrowers allowed |

Services Offered by Heart Paydays

No Credit Check Loans Alternatives Up to $5000

Alternatives to no credit check loans via the Heart Paydays platform are available up to $5000.

Flexible Repayments on No Credit Check Loans Alternatives

When applying for no credit check loans alternatives you can expect the terms to range from 3 to 24 months and come with weekly, fortnightly, or monthly debit options.

Reasonable Interest on Alternatives to No Credit Check Loans

No credit check loans alternatives available via Heart Paydays have reasonable interest ranging from 5.99% to 35.99%.

Reputable Bad Credit Loans Providers

Providers of bad credit loans on the Heart Paydays panel are reputable, accredited and transparent.

Bad Credit Loans for Low Income Earners

If you’re a low income earner, but earning at least $1000 per month, you can apply for bad credit loans between $100 and $5000 with 3 to 24 months to pay.

Eligibility Criteria for Bad Credit Loans Via Heart Paydays

- Income of $1000 p/m

- US citizens/residents only

- 18 years of age minimum

- US-based bank account with direct deposit

Need to Know

| How Long to Get Funds from Heart Paydays? | Applications take minutes, feedback takes 2 minutes and payouts generally happen between 24 and 48 hours |

| Maximum Loan Amounts Via Heart Paydays | Loans range from $100 to $5000 on the Heart Paydays platform |

| Fees/Costs Via Heart Paydays | Some lenders may charge establishment fees and there may be penalties on missed payments and contract breaches |

| Heart Paydays’ APRs | APRs range from 5.99% to 35.99% |

4 Quick Steps to Apply for Instant Loans with Heart Paydays

Step 1: Select Your Required Instant Loans Amount

Choose the instant loans amount you need between $100 and $5000, and select the available repayment option (between 3 and 24 months).

Step 2: Access and Complete the Instant Loans Application Form

Locate the instant loans application form on the Heart Paydays home page and input your personal details.

Step 3: Get Feedback on Instant Loans Applications in Just 2 Minutes

Within 2 minutes, you’ll know if a lender can assist. If they can, you’ll be presented with a loan option. You can decide if you wish to go ahead or not. If you do, the lender will set up the details of your contract directly with you and provide you with a contract that you will be required to read through.

Step 4: Get Your Installment Loans Payout Promptly

Once your signed contract is received, the lender can work on processing your installment loans online payout. This usually happens within 24 to 48 hours.

Why Choose Heart Paydays for Installment Loans?

Heart Paydays is a loan finder platform that takes the guesswork out of acquiring installment loans. Borrowers choose to use Heart Paydays to find the most suitable installment loans for them as it eliminates time wasting and additional fees. The application process is streamlined and hassle-free. Borrowers are quickly connected with lenders most likely to approve their loan request.

FAQ’s

Where Can I Get Same Day Loans?

If you want to get same day loans in a hurry, Heart Paydays is the perfect platform to get the process started. The loan application can be processed on the same day you apply, with payouts typically happening within 24 – 48 hours.

Am I Eligible for Same Day Loans?

If you want to be approved for same day loans, you’ll need to meet the borrowing requirements and prove you can afford the loan. The eligibility requirements are simple. You must be at least 18 years old (or the legal age to take out a loan in your state), a legal citizen or resident of the USA, and be earning at least $1000 per month. To receive your loan payout, you must have a US-based bank account that supports direct deposit. Lenders will want to carry out an assessment to see if you can afford the loan, so be prepared to provide a list of your monthly expenses.

What are the Steps to Apply for Same Day Loans Online?

The first step to applying for same day loans online is to select a loan finder company to use. Heart Paydays is a great loan finder to use. Once you’re on the home page, select the amount and term you require and then access the application form and input your personal details. The application form will require your full name and surname, address, banking information, employment details, and a list of your monthly expenses.

What Are the Best Online Payday Loans?

The best online payday loans are those that are easy to apply for and offer you quick access to the cash you need. The best online payday loans providers can certainly be found via the Heart Paydays platform, which features some of the most reputable and transparent lenders on the market. The best loans on the platform range from $100 to $5000.

What Are the Benefits of Online Payday Loans Compared to Bank Loans?

One of the biggest benefits of online payday loans is that they’re easier to get approved for than local bank loans. Not many banks will consider giving a payday loan to someone who is unemployed or with a bad credit score. Another benefit is that you can apply for payday loans online without the need to leave the comfort of your home or office. You won’t need to stand in queues, make lengthy telephone calls, send faxes or deal with any face-to-face meetings. Another great benefit is that the loans are flexible (between $100 and $5000) and the terms too (between 3 and 24 months).

Conclusion: Is Heart Paydays Legit?

Is Heart Paydays legit? It’s a valid question, especially when considering that financial scams are always cropping up. The good news is that Heart Paydays is a legitimate loan finder platform that connects borrowers with direct lenders. All lenders featured by the Heart Paydays platform are accredited, reputable, and transparent. The platform doesn’t charge borrowers for the service, and there seem to be no negative reviews of it online.

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-32-scaled.jpg)