:quality(80)/business-review.eu/wp-content/uploads/2023/04/unnamed-22.jpg)

Finding yourself overindebted can be a source of immense stress, but with a debt management plan, you can get the breathing room required to get on top of your finances again. According to the Office for National Statistics, you’re not alone if you’re searching for a debt management plan. Their statistics show us that 22% of adults in Britain (approximately 11.5 million people) struggle to afford the cost of living and have applied for more credit or loans between 25 January and 5 February 2023.

A debt management plan in the UK can be set up with the help of an FCA (Financial Conduct Authority) approved debt solution advisor. And to get obligation free debt management plan advice, you must select an approved and accredited provider to ensure you’re acquiring reliable advice. There is no one-size-fits-all approach to getting a debt management plan.

What is a debt management plan? That’s what you’re about to learn! Below, we cover debt management plan pros and cons, debt management plan vs IVA info, and provide further information on what debt management plan companies offer while answering pertinent questions such as, “How long does a debt management plan last?”

Where to Find the Best Debt Management Plan UK – Quick Overview

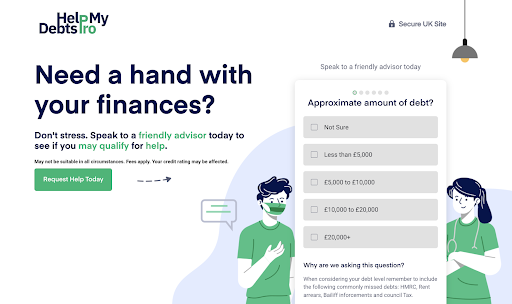

- Help My Debts Pro: Overall Best Obligation Free Debt Management Plan Options for Debts Over £5000

- Debt Nurse: Best Debt Management Plan Free From Obligation to Cover Credit Card, Personal Loans, Council Tax and Store Card Debt

- 123 Debt Fix: Best Debt Management Plan Calculator Presenting Options to Freeze Interest and Charges While Writing Off Debts up to £30000+

- Viva Debt Help: Best Place to Find Viable Debt Management Plan Examples and Advice from FCA Approved Debt Advisors

Best Debt Management Plan UK Options for 2023

1. Help My Debts Pro: Overall Best Obligation Free Debt Management Plan Options for Debts Over £5000

Help My Debts Pro is a platform that truly stands out because it offers applicants the opportunity to connect with debt solution providers offering obligation free debt management plan advice. You can make an application via the Help My Debts Pro platform if you have debts of £5000 or more. The debts that are covered include store cards, council tax, personal loans, and even credit cards. Application for obligation free debt management plan advice is simple. Visit the website, complete a quick debt assessment and wait for a professional debt solution provider to contact you. You can choose which debt solution works best for you, but rest assured that there’s no obligation.

Highlights of Obligation Free Debt Management Plan Options for Debts Over £5000 via Help My Debts Pro

- Cover debts from £5000 to £30000+

- Freeze charges and interest

- All advice is obligation free

- Peace of mind you’re being advised by FCA-approved debt advisors

- Simple application process

Pros of Enquiring About a Debt Management Plan via Help My Debts Pro

- Discreet process

- Connect with professional debt advisors

- Discover all the options available to you

Cons of Debt Management Plans Enquiries via Help My Debts Pro

- A debt management plan may not cover every expense you have.

Click Here to Visit the Official Website of Help My Debts Pro >>

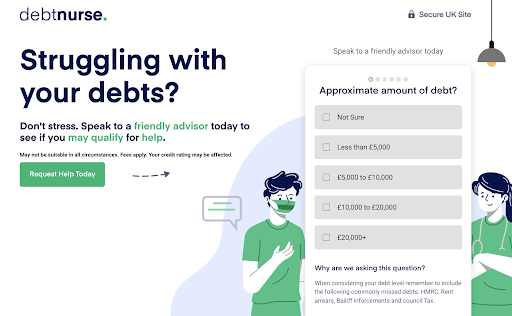

Debt Nurse: Best Debt Management Plan Free From Obligation to Cover Credit Card, Personal Loans, Council Tax and Store Card Debt

If you’re looking for the simplest way to write off debt incurred on your credit cards, via personal loans, in council tax, or on your store cards, Debt Nurse is a great place to start. This platform is well-known for connecting individuals with FCA-approved debt advisors in the most efficient way possible. All you need to do is complete an online debt assessment, and an advisor will contact you directly. With the help of the debt solution advisors that Debt Nurse puts you in touch with, you can freeze interest and fees on your outstanding debt and expect to reduce your total monthly expense outlay.

Highlights of Getting a Debt Management Plan Free From Obligation to Cover Credit Card, Personal Loans, Council Tax, and Store Card Debt via Debt Nurse

- Write off and reduce a variety of debts

- Simple enquiry route

- 100% online and discreet

- Options based on your particular financial situation

- No obligation advice

Pros of Debt Management Plans via Debt Nurse

- Connect with FCA-approved debt advisors

- Reduce monthly debts

- Find out if debts can be written off

Cons of Debt Management Plans via Debt Nurse

- Credit rating may be affected.

Click Here to Visit the Official Website of Debt Nurse >>

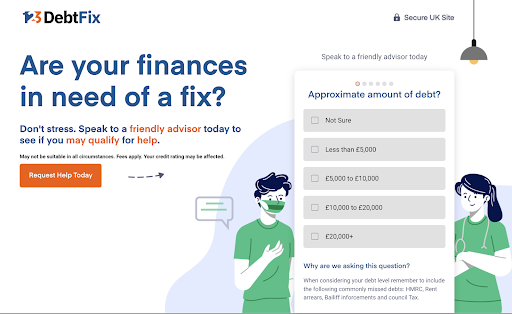

123 Debt Fix: Best Debt Management Plan Calculator Presenting Options to Freeze Interest and Charges While Writing Off Debts up to £30000+

123 Debt Fix is a viable platform to use if you want to free up some cash flow each month. 123 Debt Fix is a platform in tune with the challenges of overindebted Brits, and as such, provides a way for people to connect with FCA-approved debt advisors for further advice and guidance. With the help of a debt advice professional – that 123 Debt Fix will connect you with – you can reduce or write off debts up to £30000+ while freezing charges and interest. The right debt solution provider could act as an efficient debt management plan calculator to show you what your monthly expenses could look like if you took advantage of one of the debt management solutions recommended. Of course, all debt advice is obligation free.

Highlights of Using 123 Debt Fix to Connect with a Debt Management Plan Calculator Expert, Presenting Options to Freeze Interest and Charges

- Simple online debt assessment

- You won’t have to wait long for feedback/contact

- Advice provided by FCA-approved debt advisors

- Available to applications in £5000+ debt

- Reduce monthly debts effectively

Debt Management Plan Pros via 123 Debt Fix

- Help with debts up to £30000+

- All advice obligation free

- Fully understand the options available to you

Debt Management Plans Cons When Freezing Interest and Charges While Writing Off Debts Up to £30000+

- May not include secured debts.

Click Here to Visit the Official Website of 123 Debt Fix >>

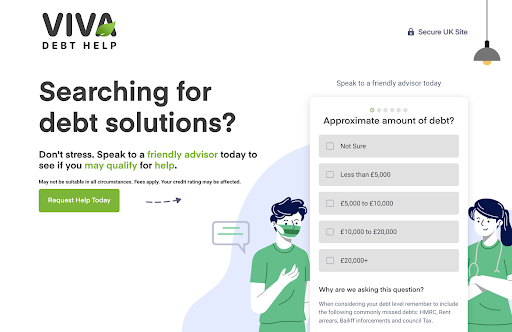

Viva Debt Help: Best Place to Find Viable Debt Management Plan Examples and Advice from FCA Approved Debt Advisors

If you’re wondering where the best place is to find the most viable debt management plan examples and advice, Viva Debt Help should be at the top of your list of options. FCA-approved debt advisors can be put in touch with you after you’ve completed a simple debt assessment on the Viva Debt Help website. With the help of professional debt solution advisors, the platform will connect you with; you can get assistance with reducing or writing off debts from £5000 – £30000+. In addition, you can gather no obligation advice and freeze fees and interest with the help of the right debt solution advisor.

Highlights of Using Viva Debt Help to Connect with FCA-Approved Debt Advisors Providing Viable Debt Management Plan Examples and Advice

- Get advice from qualified professionals

- Find out if a debt management plan is right for you

- Reduce monthly expenses

- Get assistance coming to agreements with creditors

- Relieve the stress of being under financial strain

Debt Management Plan Pros via Viva Debt Help

- Reduce or write off debts over £5000

- Get help with any debt amount up to £30000+

- Pay off your debts in five years (in most instances)

Debt Management Plans Cons via Viva Debt Help

- Not all creditors accept reduced payment arrangements.

Click Here to Visit the Official Website of Viva Debt Help >>

What is a Debt Management Plan & How Did We Choose The Best Providers of Debt Management Plans in the UK?

A debt management plan is the process of renegotiating your debts with creditors. After that, you can pay off your debts at a rate that’s more affordable to you. When choosing the right platforms to connect individuals with accredited debt solution providers, we looked for platforms offering the following:

- Simple websites with a debt assessment form that isn’t confusing

- Direct access to FCA-approved debt solution advisors

- Advice and assistance on all debt types, including business debt, council tax debt, festive period debt, and rent arrears, to name a few

- No false promises – just straightforward advice and guidance with reducing and writing off debt

Types of Debt Management Plans to Choose From

You can choose from several types of debt management plans with the help of an FCA-approved debt solution provider. Some of the options are mentioned below. A professional debt advisor can help you decide which is the best option for you.

IVAs (Individual Voluntary Arrangements) – Debt Management Plan vs IVA

Individual voluntary arrangements are a form of debt management plan UK that can be used to pay off your debts over an agreed period of time. This is a legally binding agreement, and during the course of the IVA, creditors cannot charge you interest or chase you for payments. You must make the agreed payments on time, and if your financial situation improves, you must advise your IVA provider. There are no minimum or maximum limits for IVAs. What’s the difference between an IVA and a debt management plan? Fees for IVAs are typically higher than a debt management plan. Also, while an IVA is a form of insolvency and a legal agreement, a debt management plan is an informal arrangement with creditors.

Mortgage with Debt Management Plan

You may think getting a mortgage with a debt management plan is impossible, but it’s not. You can approach a lender specialising in mortgages to people with debt problems. Even if your debt management plan affects your credit score, it doesn’t mean you will never be eligible for a mortgage.

Debt Relief Orders

A debt relief order is an arrangement that’s quicker, easier, and cheaper than bankruptcy. This insolvency measure in the UK could involve various approaches. For some, it means wiping out all debt (bankruptcy), while for others, it could mean setting an easier payment schedule with creditors, reducing interest rates, or negotiating a lower amount to pay back than is owed.

What is a Debt Management Plan, How Does it Work, And How Long Does a Debt Management Plan Last?

A debt management plan is an informal agreement between overindebted individuals and their creditors to pay back debts considered “non-priority.” Non-priority debts include loans, store cards, credit cards, and similar. With this type of agreement, you pay one set amount to a debt manager, who then splits the amount between your creditors. When acquiring the services of a debt management plan provider, they handle the creditor for you and set everything in place for you.

One thing to note is that a debt management plan is not a legally binding agreement. So, how long does a debt management plan last? As a non-binding agreement, there’s no minimum period, and the agreement can be cancelled at any time. Life after a debt management plan is straightforward. When the plan ends, you can shut down the paid-off accounts or start up full payments. Your credit score will be affected but can recover over time. It will take 6 years for the record of your debt management plan to be removed from your credit history.

What Are a Debt Management Plan Pros and Cons, and Features & Factors?

Debt management plan pros and cons, features and factors to be aware of are listed below:

FCA Approved Debt Management Plan Companies

When using a platform like Help My Debts Pro, you will only be connected with reputable, reliable, FCA-approved debt management plan companies.

Associated Disadvantages of Debt Management Plan

One of the debt management cons you need to be aware of is that your credit score may be affected by a debt management plan.

Debts Covered by an IVA or Debt Management Plan

Generally, unsecured debts considered non-priority debts can be covered by a debt management plan.

According to Latest Debt Management Plan Reviews; These Debts Are Generally Covered by Debt Management Plans

Multiple debts can be covered, including business debt, unsecured debt, council tax debt, credit card debt, mortgage arrears, utility bill debt, student loan debt, gambling debt, debit cards, festive period debt, student loans, payday loans debt, and even logbook loans debt.

Debt Management Plan Review: The Cost Of A Debt Management Plan

What is the cost of a debt management plan? Most debt management plan providers will charge a fee for their services to cover their time and their business costs. Professional debt solution providers will charge you upfront or take a monthly fee from the money you hand over to pay your creditors.

3 Quick Steps to Apply for a Debt Management Plan in the UK

Follow the steps below to apply to be connected with FCA-approved debt management plan advisors in the UK via the Help My Debts Pro platform:

Step 1: Complete the Simple No Obligation Form with Your Debts Info

Access the application form on the Help My Debts Pro website. Simply follow the prompts, inputting your particulars as you go.

Step 2: Wait for a Call from a Qualified FCA-Approved Debt Advisor

Once your information is received, Help My Debts Pro will connect you with a qualified debt solution advisor who will provide obligation free advice on a debt management plan.

Step 3: Find a Solution to Reduce Your Debts

Of the solutions offered to you, you can decide what is best suited to your situation. There’s no obligation to accept any of the recommended solutions.

FAQs

I Am In a Debt Management Plan And Need a Loan – Can I Apply for a Loan?

Most High Street banks will reject applications for a loan from individuals in the middle of a debt management plan. That said, debt management plans are informal, so nothing is legally stopping you from applying for a loan.

How Long Does a Debt Management Plan Affect Your Credit Rating?

Starting from the date your debts are paid off or defaulted, the debt management plan record will be on your credit history for 6 years.

Can I Get a Loan While On a Debt Management Plan?

Yes, you can get a loan while on a debt management plan, but it’s best to speak with your debt management advisor first, as some creditors may wish to end their agreement with you if you take on further debt.

Can I Get a Mortgage with a Debt Management Plan?

Yes, there are some specialised lenders who will provide a mortgage to individuals on a debt management plan.

How Does a Debt Management Plan Work?

In most instances, the individual will hire a debt management advisor to assist with setting a debt management plan with creditors. It’s an informal arrangement whereby creditors agree to allow individuals to pay off their debt over a longer period or reduce the interest or total amount of debt to assist.

Conclusion

Finding the right debt solution can seem stressful at the best of times. However, when working with a platform such as Help My Debts Pro, you can expect to be connected with professional, qualified, FCA-approved debt advisors who can extend helpful guidance so that you can make an educated decision about the right debt solution for you.

OTHER GUIDES:

Disclaimer: All debt solutions should be very carefully considered. The websites advertised in this paid promotion do not provide debt advice. If you complete the form and provide permission to be referred, they will pass your details onto a regulated debt advice solution provider. All the partners they use are regulated by the Financial Conduct Authority to provide debt counselling. The websites advertised work exclusively with trusted debt solution providers. If you proceed with one of their solution options, they may receive a fee for introducing you to them. The websites advertised are lead generation companies who pass your details onto third parties in order to help you with your debt solution.

:quality(80)/business-review.eu/wp-content/uploads/2024/02/unnamed-53.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)