:quality(80)/business-review.eu/wp-content/uploads/2023/05/Personal-Loans-2023.jpg)

Personal loans provide a lump sum of cash you can use without restrictions and repay in fixed installments over a pre-agreed time frame. You can use personal loans to cover expenses like auto repairs, medical bills, debt consolidation, or home projects. Accessing personal loans has never been easier, thanks to loan providers. Whether you’re looking for personal loans for bad credit or other options, providers give you free access to direct lenders offering some of the best personal loans for your situation. Below we present our editor’s top picks of the best providers you can use to discover personal loans and apply for personal loans online.

Best Personal Loans For Bad Credit ✅ – Quick Overview

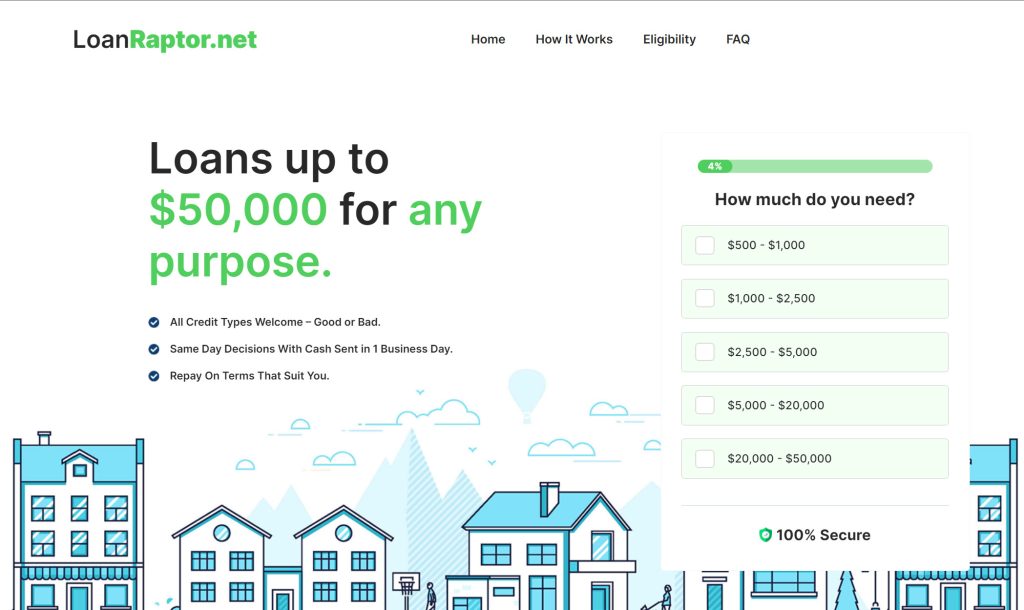

- Loan Raptor: Overall Best Personal Loans for Bad Credit up to $50k With Long-Term Repayment Options

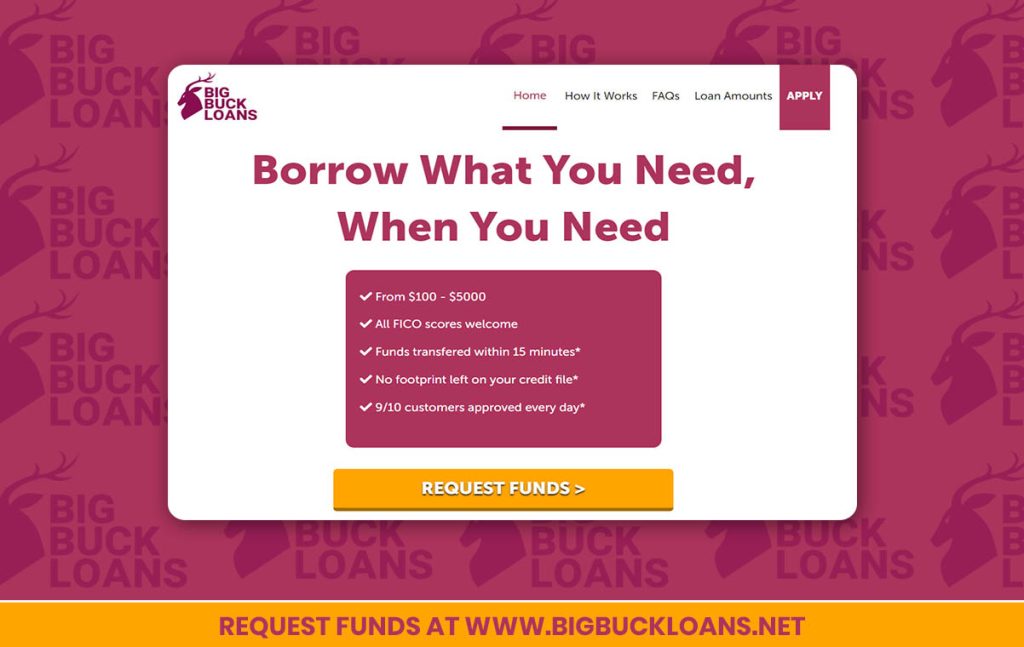

- Big Buck Loans: Best for Personal Loans with APRs Ranging from 5.99% to 35.99%

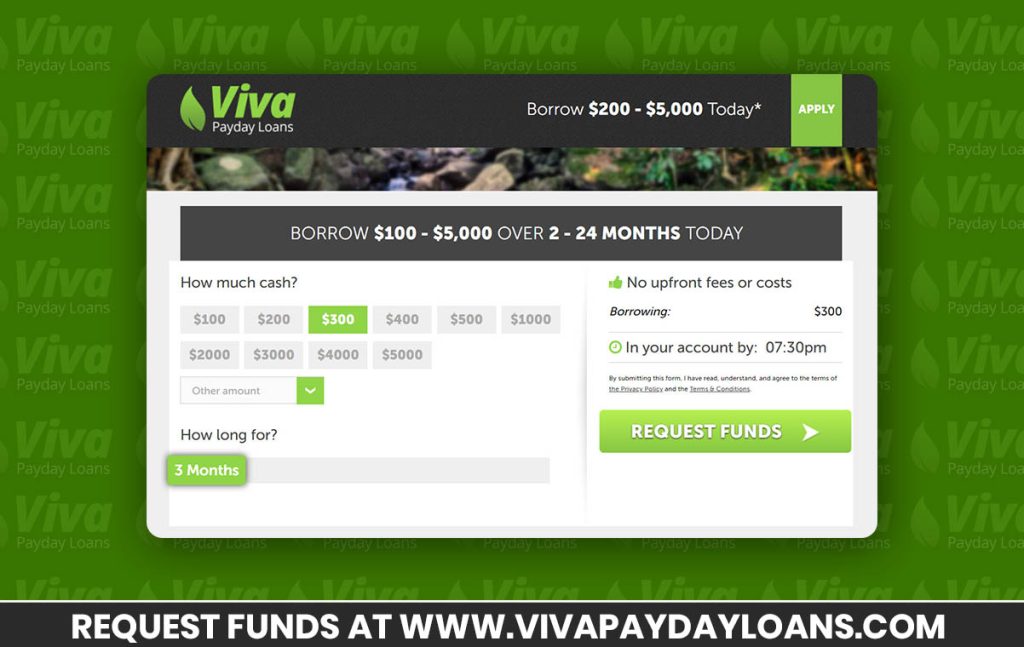

- Viva Payday Loans: Best Place to Find Alternatives to Discover Personal Loans Online from Reputable Direct Lenders Only

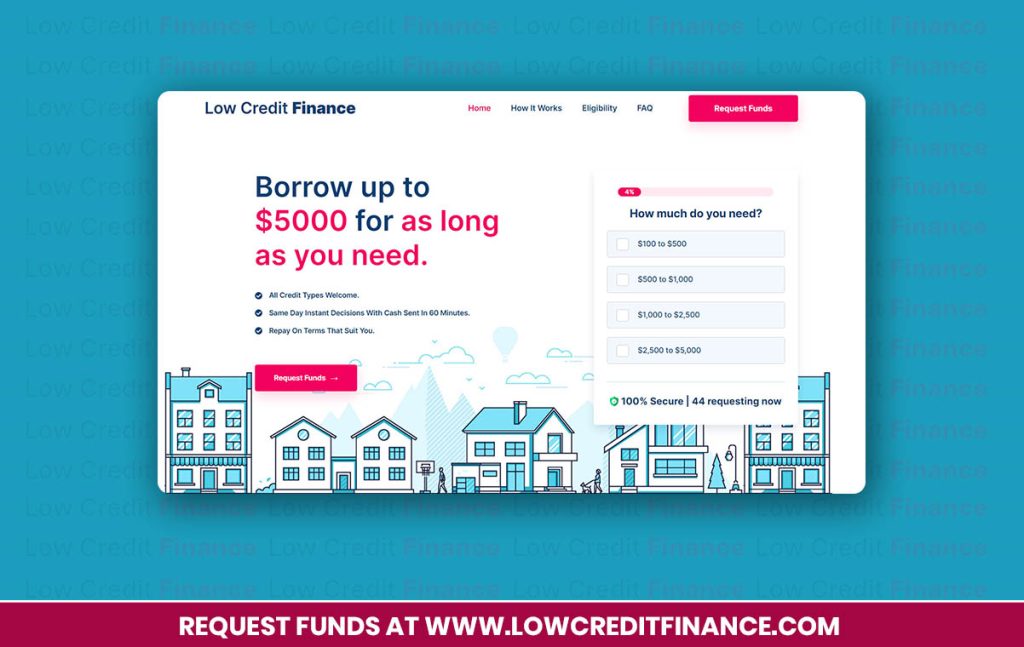

- Low Credit Finance: Best for Personal Loans Online with Installments Paid Over 3-24 Months

- Heart Paydays: Best for Chase Personal Loans Alternatives for Borrowers Looking for Short-Term Solutions

Small Personal Loans No Credit Check Online Guaranteed Approval Same Day – Full Reviews

Loan Raptor: Overall Best Personal Loans for Bad Credit up to $50k With Long-Term Repayment Options

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 9/10

- Variety of Products: 9/10

- Acceptance Rate: 9/10

- Customer Support: 9/10

Loan Raptor gives you access to high loan amounts regardless of your credit score through a hassle-free online process with quick approvals and extended repayment options.

Highlights of Personal Loans for Bad Credit up to $50k With Long-Term Repayment Options

- High loan amounts

- Borrow with bad credit

- Hassle-free online process

- Quick approvals

- Extended repayments

Eligibility for Personal Loans for Bad Credit up to $50k With Multiple Repayment Options

- 18+ years

- Steady income

- US citizen/resident

Fees on Personal Loans for Bad Credit up to $50k With Long-Term Repayment Options

- 5.99% to 35.99% APR

- Late payment fee.

Click Here to Secure Your Financial Future with our Top-rated Personal Loans >>

Big Buck Loans: Best for Personal Loans with APRs Ranging from 5.99% to 35.99%

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Big Buck Loans provides a fast and easy process to access affordable loans from direct lenders with immediate feedback, quick payouts, and reasonable APRs from 5.99% to 35.99%.

Highlights of Personal Loans with APRs Ranging from 5.99% to 35.99%

- A fast and easy online process

- Affordable loans

- Immediate feedback

- Quick payouts

- Reasonable APRs

Eligibility for Personal Loans with APRs Ranging from 5.99% to 35.99%

- Legal adult above 18

- Proof of ID and address

- Active US bank account

Fees on Personal Loans with Reasonable APRs

- Missed payment penalty

- APR from 5.99% to 35.99%

Click Here to Secure Your Financial Future with our Top-rated Personal Loans >>

Viva Payday Loans: Best Place to Find Alternatives to Discover Personal Loans Online from Reputable Direct Lenders Only

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Viva Payday Loans features a convenient online process to access multiple loan options from direct lenders with quick turnarounds, fast disbursements, and easy repayment terms.

Highlights of Alternatives to Discover Personal Loans Online

- Multiple loan options

- Quick turnarounds

- Fast disbursements

- Convenient online process

- Easy repayments

Eligibility for Alternatives to Discover Personal Loans Online

- 18 years of age and above

- Government-issued ID

- Legal US citizen

Fees Expected on Discover Personal Loans Online Alternatives

- 5.99% to 35.99% APR

- Late payment fee

Click Here to Secure Your Financial Future with our Top-rated Personal Loans >>

Low Credit Finance: Best for Personal Loans Online with Installments Paid Over 3-24 Months

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Low Credit Finance allows you to apply from anywhere through a streamlined online process and access small to medium-sized loans with fast responses and flexible installment payments.

Highlights of Personal Loans Online with Installments Paid Over 3-24 Months

- Apply from anywhere

- Streamlined online process

- Small to medium-sized loans

- Fast responses

- Flexible repayments

Eligibility for Personal Loans Online with Installments Paid Over 3-24 Months

- Minimum age of 18 years

- Proof of steady income

- Pass the affordability assessment

Fees on Personal Loans Online with Installments Paid Over 3-24 Months

- Missed payment penalty

- APR from 5.99% to 35.99%

Click Here to Secure Your Financial Future with our Top-rated Personal Loans >>

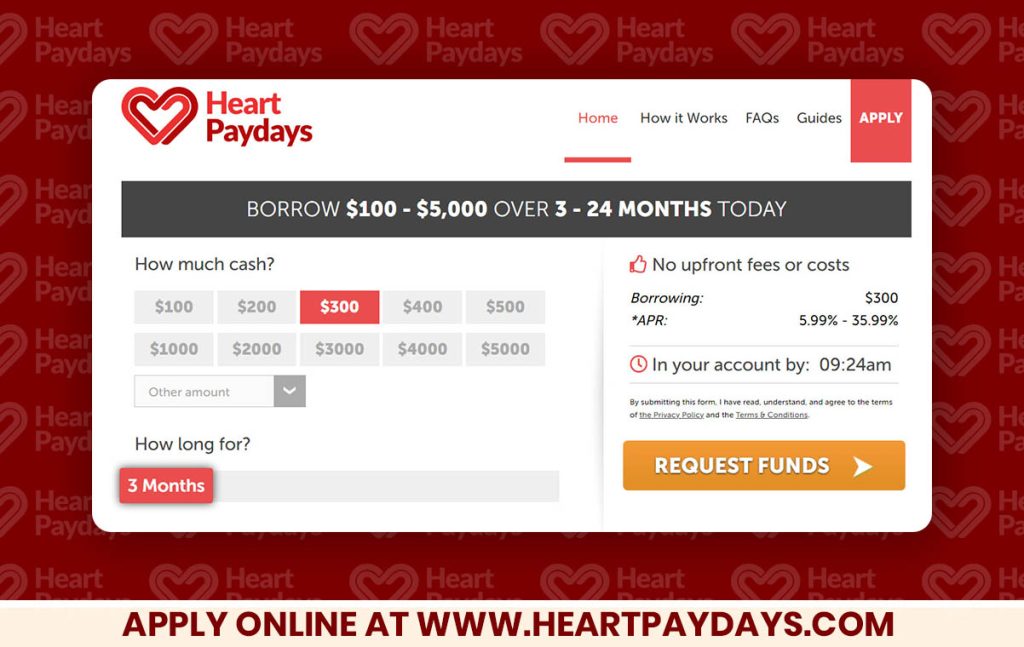

Heart Paydays: Best for Chase Personal Loans Alternatives for Borrowers Looking for Short-Term Solutions

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 7/10

- Customer Support: 8/10

With Heart Paydays, you can apply in minutes and connect to inclusive lenders offering tailored terms, 2-minute feedback, and swift payouts.

Highlights of Chase Personal Loans Alternatives

- Apply in minutes

- Inclusive lenders

- Tailored terms

- 2-minute feedback

- Swift payouts

Eligibility for Chase Personal Loans Alternatives for Borrowers Looking for Short-Term Solutions

- 18+ years

- Proof of ID and address

- Steady income

Fees on Chase Personal Loans Alternatives for Borrowers Looking for Short-Term Solutions

- 5.99% to 35.99% APR

- Late payment fee.

Click Here to Secure Your Financial Future with our Top-rated Personal Loans >>

How We Chose the Top Providers of Low Interest Personal Loans

We carefully selected providers based on the following basic requirements:

- Flexible amounts and repayments

- Inclusive terms

- Easy eligibility criteria

- Quick payouts

- Reasonable APRs

Types of Low Interest Personal Loans Mississippi

Same Day Feedback Low APR Personal Loans North Dakota

These allow you to know whether or not you qualify on the same day you apply and feature low APRs from 5.99%.

Emergency Personal Loans with Bad Credit Mississippi

These are suitable for fast cash access, thanks to quick approvals and processing.

Car Personal Loans with Bad Credit North Dakota

These allow you to access the funds you need for car financing regardless of your credit score.

Unemployed Personal Loans with Bad Credit Mississippi

Suitable for borrowers with no formal job but with an alternate source of income.

Features and Factors of Personal Loans Bad Credit

Disbursement of Personal Loans Bad Credit

Lenders disburse funds as soon as possible after getting approved and finalizing the loan process.

Small Personal Loans Providers

Providers are honest, reputable, trustworthy, and open about their terms and fees.

Small Personal Loans APRs

APRs range from 5.99% to 35.99%.

Repayment Terms on Bad Credit Personal Loans Guaranteed Approval $5,000 Alternatives

You can choose a suitable term from 3 to 24 months and make repayments weekly, fortnightly, or monthly.

Top 5 Bad Credit Personal Loans Guaranteed Approval $5,000 Alternatives Florida

| Best Providers of Personal Loans No Credit Check Alternatives | Pros | Cons |

| Loan Raptor |

|

|

| Big Buck Loans |

|

|

| Viva Payday Loans |

|

|

| Low Credit Loans |

|

|

| Heart Paydays |

|

|

How to Apply for Personal Loans No Credit Check Alternatives – California

Follow these 4 steps on the Loan Raptor platform:

Step 1: Select the Required Bad Credit Personal Loans Amount & Term

Indicate how much you wish to borrow and how long you need to repay. Lenders offer up to $50,000 with repayments of up to 10+ years.

Step 2: Fill Out the Bad Credit Personal Loans Application Form

Complete the online form with your personal, employment, income, and expenditure details and hit the submit button

Step 3: Get Feedback on Personal Installment Loans Applications Speedily

You’ll get feedback within 2 minutes, and if you qualify, a suitable lender will reach out and send you a loan contract. Review it carefully, then sign and return it.

Step 4: Get Your Personal Installment Loans Payout

The lender will send the approved loan amount to your account as soon as possible.

FAQs

What is the Minimum Amount I Can Borrow with Small Personal Loans for Bad Credit?

The minimum amount you can borrow is $100.

Can I Use Small Personal Loans for Bad Credit to Improve My Credit Score?

Yes. They’re usually small and affordable, so you can make timely repayments and improve your credit score quickly.

What APR Can I Get with the Best Personal Loans for Fair Credit?

You can expect an APR ranging from 5.99% to 35.99%. With fair credit, you can access the lowest rates possible as lenders try to remain competitive.

How Long Can I Repay the Best Personal Loans for Fair Credit?

You can choose a suitable repayment period from 3 to 24 months or up to 10+ years, depending on your preferences or how much you borrow.

How Do Lenders Determine Affordability for Online Personal Loans?

Lenders compare your income with your monthly expenditure to determine how much you have left over for loan repayments.

Can I Borrow Online Personal Loans without a Bank Account?

Yes. Some lenders specialize in helping unbanked Americans and can send the loan to a prepaid or debit card.

Can I Access Personal Loans when Unemployed?

Yes. All you need is an alternate income source like rental income, pensions, dividends, benefits, freelance or self-employment earnings.

Conclusion

Thanks to its hassle-free online process, Loan Raptor is an excellent choice for accessing personal loans from direct lenders. You can apply for high loan amounts of up to $50K, no matter your credit score, and get quick approvals and long repayment periods of up to 10+ years.

RELATED GUIDES:

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

:quality(80)/business-review.eu/wp-content/uploads/2015/08/key-interest-BNR.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2020/04/fotografie-OTP.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2013/02/Garanti.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)