:quality(80)/business-review.eu/wp-content/uploads/2023/05/payday-loans-florida.jpeg)

When financial troubles strike, and you need a helping hand, payday loans Florida are an option. While the local bank may offer cheaper rates, not all applicants are accepted by the bank, especially those who have less-than-perfect credit scores. By opting for short-term payday loans Florida online, you can access a variety of loan options with reasonable APRs and deal directly with lenders willing to assist individuals with all credit types.

You’ll find it quick and easy to apply for payday loans Florida online.

Best Payday Loans in Florida – Quick Overview

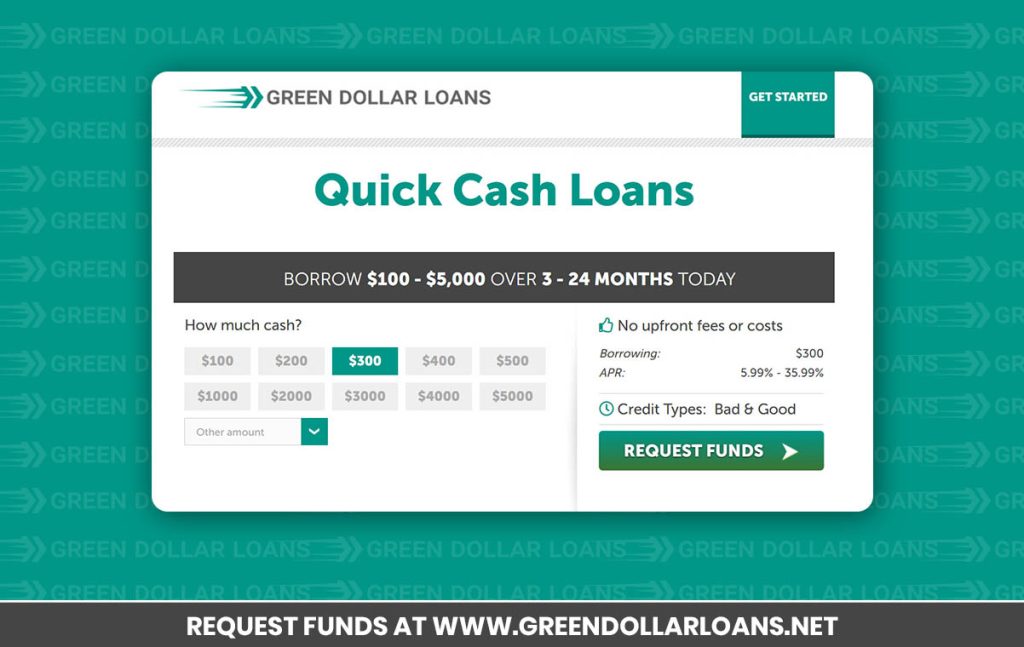

- Green Dollar Loans: Overall Best Payday Loans Online Florida for All Credit Types

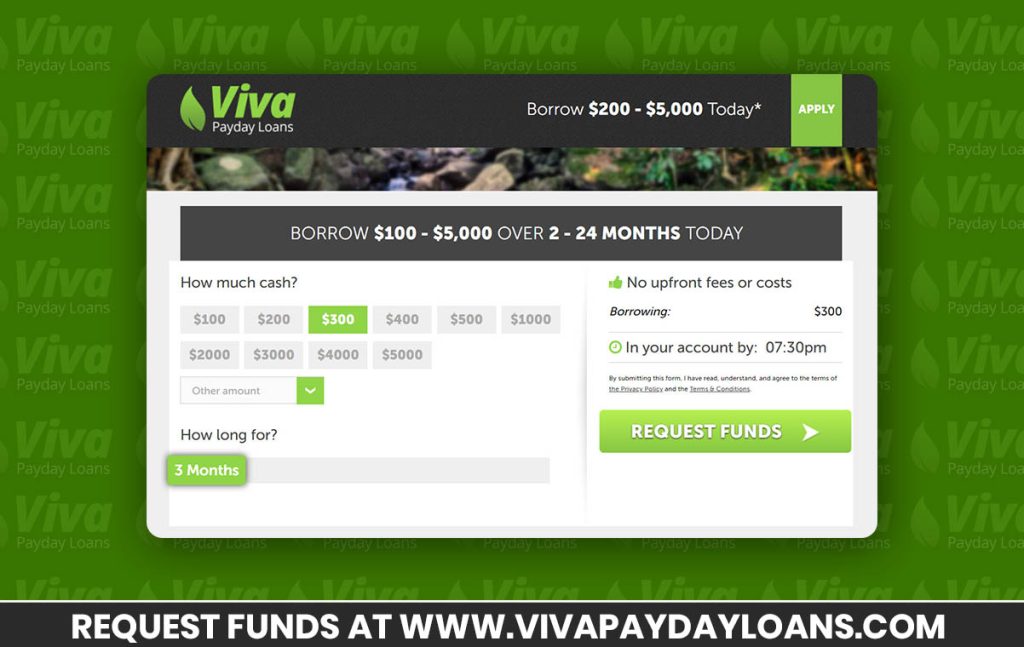

- Viva Payday Loans: Best Florida Payday Loans for Unemployed Individuals with Alternative Income Streams

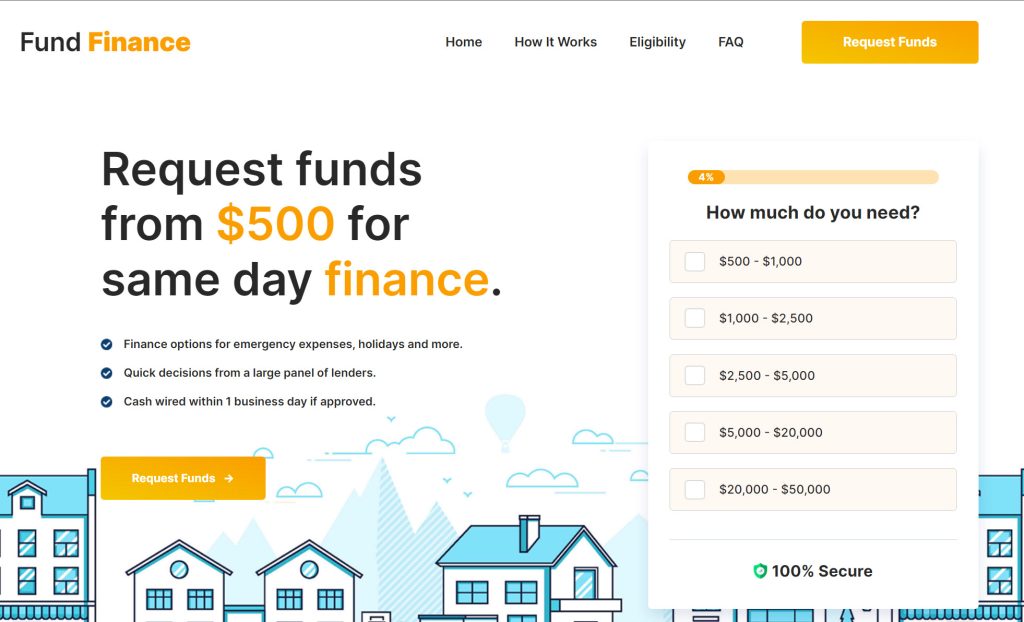

- Fund Finance: Best Online Payday Loans Florida with Quick Online Application and Speedy Disbursement of Funds

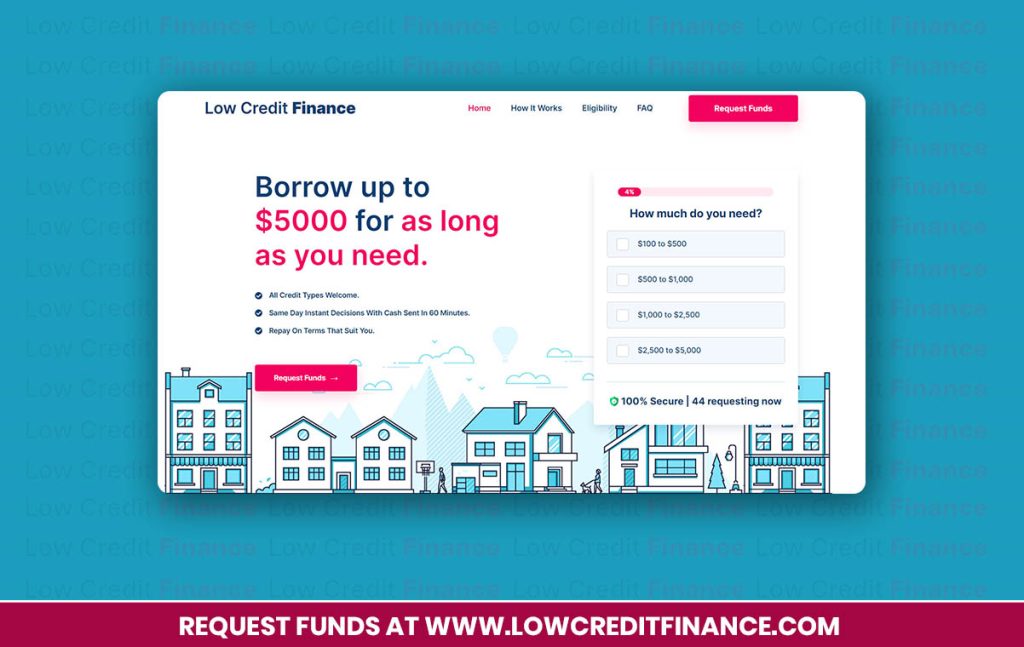

- Low Credit Finance: Best Payday Loans in Florida for Flexible Amounts and Terms with Reasonable APRs

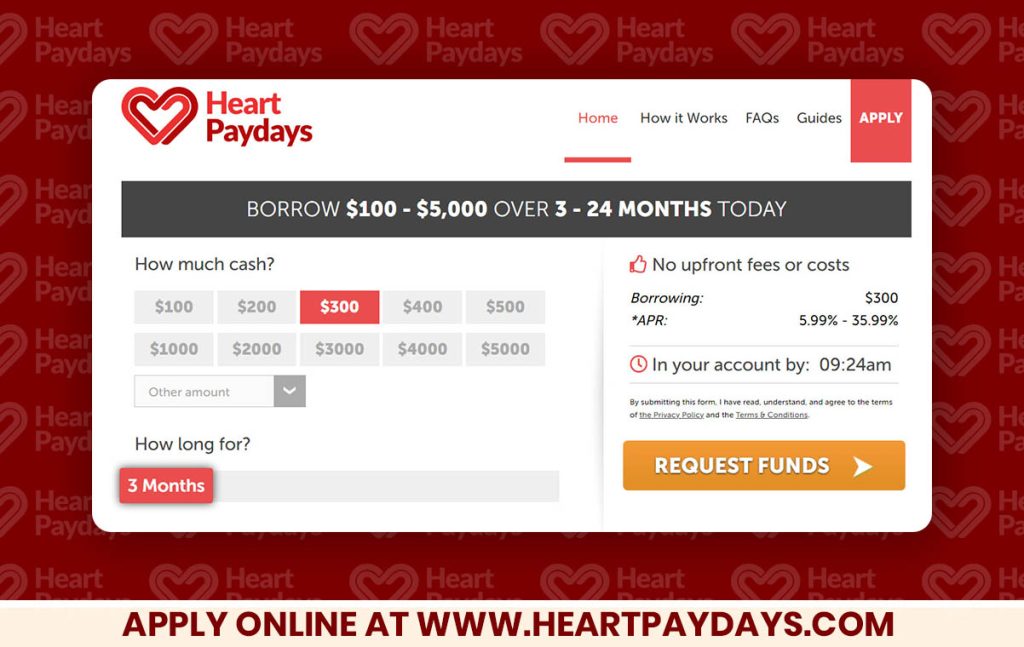

- Heart Paydays: Best Online Payday Loans Florida with Speedy Direct Deposit and Minimal Red Tape

In fact, most companies offering payday loans online Florida provide a simple application process that takes just a few minutes. Thereafter, you’ll know the outcome of your application within 2 minutes and can expect a speedy payout. To make the process of selecting a provider of Florida payday loans, we’ve compiled a convenient list for you. Each online payday loans Florida provider we recommend is reviewed in full below.

Online Best Payday Loans in Florida Guaranteed Approval 2023 – Full Reviews of Providers

Green Dollar Loans: Overall Best Payday Loans Online Florida for All Credit Types

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 9/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 9/10

You won’t just find payday loans Florida at Green Dollar Loans; you’ll find some of the best in the USA. We rank this loan-finder platform as our overall best provider of payday loans online Florida for all credit types. You can apply for payday loans Florida using their streamlined online application form. And if you’re approved, the payout can be expected pretty soon thereafter.

APRs are generally between 5.99% and 35.99%, but this depends on your current credit score, affordability, and the competitiveness of the lender. You can expect loans from $100 to $5000 to be on offer, with terms that range from 3 to 24 months.

Highlights of Green Dollar Loans’ Payday Loans Online

- Simple financial solutions

- Options for all credit types

- Quick processing

- 3 to 24 months to pay

- Speedy decisions

Eligibility to Apply for Payday Loans Online Via Green Dollar Loans

- 18+ years old

- Income must be suitable and regular

- Only US citizens/residents allowed

Fees on Bad Credit Personal Loans Guaranteed Approval 5000 Alternatives

- APRs of 5.99% to 35.99%

- Penalties may be charged on late payments.

Click Here To Request Funds Online Today! >>

Viva Payday Loans: Best Florida Payday Loans for Unemployed Individuals with Alternative Income Streams

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 9/10

- Variety of Products: 9/10

- Acceptance Rate: 8/10

- Customer Support: 8/10

Viva Payday Loans is our second-best choice due to its quick and easy online application process. The platform is designed to offer financing options to all credit types and doesn’t turn unemployed borrowers away if they’re earning an alternative income. Here, you’ll find some of the best Florida payday loans for all types of borrowers, ranging from $100 to $5000.

Freelancers, contractors, self-employed individuals and those with a side hustle can use their bank statements or latest tax returns to prove the loan’s affordability. Via Viva Payday Loans, you can access amounts between $100 and $5000 and get up to 24 months to pay.

Highlights of Viva Payday Loans’ Best Florida Payday Loans for Unemployed Individuals

- Quick, uncomplicated applications

- Seamless loan setup

- Amounts up to $5k

- 24 months to pay

- Reasonable APRs

Eligibility to Apply for Florida Payday Loans for Unemployed Individuals

- USA citizens/residents with a local bank account

- Steady income

- 18+

Fees on Payday Loans for Self-Employed, Contractors, and Side-Hustlers

- APRs charged on all approved loans

- Penalties charged for contract breaches.

Click Here To Request Funds Online Today! >>

Fund Finance: Best Online Payday Loans Florida with Quick Online Application and Speedy Disbursement of Funds

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Fund Finance is a unique loan-finder platform that catches our eye because of its very flexible loan amounts and terms. You can apply for online payday loans Florida that range from $500 to $50,000 via the platform. The repayment options are flexible too, with most borrowers getting up to 10+ years to settle their loans.

What’s great about Fund Finance is that they provide loan options to all credit types and have a reputation for effectively matching borrowers with lenders most likely to approve and service their loan request. You’d expect the APRs to be higher than the norm in the industry due to the sheer flexibility of its offerings, but Fund Finance’s panel of lenders charge the typical range between 5.99% and 35.99%.

Highlights of Online Payday Loans Florida with Quick Online Application and Speedy Disbursement of Funds

- Max APR of 35.99%

- Flexible loan amounts

- 10+ years to pay

- Simple finance options

- Borrow up to $50k

Eligibility to Apply for Speedy Online Payday Loans Florida

- Proof of stable income

- Valid ID with proof of USA citizenship/residency

- Must be of age (18+)

Fees on Online Payday Loans Florida via Fund Finance

- Penalties may apply to missed payments

- APRs between 5.99% and 35.99%.

Click Here To Request Funds Online Today! >>

Low Credit Finance: Best Payday Loans in Florida for Flexible Amounts and Terms with Reasonable APRs

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

At Low Credit Finance, you will find some of the best payday loans in Florida that come with flexible amounts and terms. You can borrow any amount from $100 to $5000; the attached terms are usually between 3 and 24 months. With APRs that start as low as 5.99% and don’t exceed 35.99%, you’ll find many options available via this loan-finder site reasonable.

If it’s the best payday loan in Florida you’re looking for; Low Credit Finance will not disappoint. You’ll connect with lenders offering direct deals, so you won’t have to go through a third party, saving you time and, of course, money.

Highlights of Payday Loans in Florida with Flexible Amounts and Terms

- Direct lenders

- Up to 2 years to pay

- Low APR starting points

- Flexible amounts

- Bridging cash available

Eligibility for Payday Loans in Florida with Reasonable APRs

- Must be at least 18 years old

- US citizen/resident with local bank account and stable income

Fees on Bad Credit Best Personal Loans Guaranteed Approval 5000

- Max APR 35.99%

- Min APR 5.99%

Click Here To Request Funds Online Today! >>

Heart Paydays: Best Online Payday Loans Florida with Speedy Direct Deposit and Minimal Red Tape

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 7/10

- Variety of Products: 8/10

- Acceptance Rate: 7/10

- Customer Support: 8/10

Heart Paydays offers online payday loans Florida with quick applications and payouts. There’s minimal red tape involved in the application process, and if you’re earning a stable income and can afford the loan you’re applying for, you’re likely to be connected with a lender willing to service your loan request. Online payday loans Florida available via Heart Paydays range from $100 to $5000 with 3 to 24 months to pay. The APRs, while higher than that of the local bank, are reasonable for the industry, starting from 5.99% and going no higher than 35.99%. In addition, the application process is quick and easy, making Heart Paydays a top loan-finder choice.

Highlights of Heart Paydays’ Best Online Payday Loans Florida

- Reasonable APRs for the industry

- Up to 2 years to pay

- Borrow up to $5k

- Min loan amounts of $100

- Simple repayment options

Eligibility for the Best Online Payday Loans Florida via Heart Paydays

- 18+ to apply

- Local US bank account with direct deposit

- Steady income

Fees on the Best Online Payday Loans Florida with Speedy Direct Deposit

- 5.99% to 35.99% APR

- Fees charged on late/missed payments.

Click Here To Request Funds Online Today! >>

How We Chose Our Top Providers of Online Payday Loans Florida No Credit Check Alternatives

We looked for providers offering:

- Simple loan models that are easy to apply for

- Reasonable fees that don’t break the bank

- Options that suit all credit types

- Access to direct lenders

Types of Alternatives to Online Payday Loans Florida No Credit Check

Emergency Florida Online Payday Loans

When there’s an emergency to pay for, time is of the essence. You can apply for online payday loans Florida no credit check alternatives via any of the above recommended loan-finder platforms and expect quick applications with access to flexible amounts and terms.

Student Florida Online Payday Loans

As a student, costs can become overwhelming. You can apply for student Florida online payday loans to cover the cost of study materials, courses, housing and more.

Auto Online Payday Loans in Florida

With auto online payday loans in Florida available at each of our top five recommended loan-finder platforms, you can quickly and easily process an application and get the cash you need.

Home Renovation Online Payday Loans in Florida

Revamping your home will cost money. You can apply for online payday loans in Florida up to $5000 to help with home renovation costs.

Features and Factors of Payday Loans on Florida 2023

Terms Associated with Payday Loans on Florida BLVD

Payday loans on Florida BLVD generally range from 3 to 24 months unless you’re taking out a loan higher than $5k, in which case, some lenders offer up to 10+ years to repay.

APRs Linked to Payday Loans Florida Online

You can expect APRs on payday loans Florida online to range from 5.99% to 35.99%.

Deal with Payday Loans Florida Online Direct Lenders

When setting payday loans Florida online in place, you can expect to deal with direct lenders. This minimizes the possible costs associated with your loan.

Payday Loans Florida Laws

The recommended top providers of payday loans Florida are all compliant with unique payday loans Florida laws. Payday loans are legal in Florida but come with limits on the amount a borrower can loan. The laws in place protect borrowers from becoming over-indebted. As such, lenders must carry out credit checks and ensure that borrowers can afford the loan installments.

Top 5 Best Online Payday Loans for Bad Credit in Florida ✅

| Best Providers of Online Payday Loans for Bad Credit Florida | Pros | Cons |

| Green Dollar Loans |

|

|

| Viva Payday Loans |

|

|

| Fund Finance |

|

|

| Low Credit Finance |

|

|

| Heart Paydays |

|

|

How to Apply for Florida Payday Loans Online 2023 ✅

There are four simple steps to follow on the Green Dollar Loans website:

Step 1: Select the Amount and Term to Start Your Payday Loans Lake City Florida Application

Use the drop-down menus and sliders to indicate how much you need when applying for payday loans Lake City Florida.

Step 2: Access the Payday Loans Florida No Credit Check Alternative Application Form Online

When the payday loans Florida no credit check alternatives application form appears, follow the simple prompts to complete your application.

Step 3: Expect Fast Payday Loans Florida Feedback

When applying for fast payday loans Florida, feedback on your application will be provided within 2 minutes.

Step 4: Approved Payday Loans in Florida Online Are Paid Out Quickly via Direct Deposit

Once approved, payday loans in Florida online are paid out quickly via direct deposit into your local USA bank account.

FAQ’s

How Many Payday Loans Can You Have in Florida?

Florida payday loans come with laws attached. No borrower can have more than one outstanding payday loan at a time.

What is the Cooling-Off Period for Payday Loans Online Same Day Florida?

While payday loans online same day provide feedback on the same day you apply, they are only paid out within 24 to 48 hours. The cooling-off period – the time in which you have to change your mind about accepting the loan – is typically 24 hours.

Can I Get Payday Loans Florida Bad Credit?

Yes, you can get payday loans Florida bad credit. However, if you can’t prove that you can afford the loan, you may not have much luck with your application. Affordability is important.

What is the APR on Payday Loans Florida?

Most short-term lenders offer APRs between 5.99% and 35.99% on payday loans Florida.

How Quick Is it to Apply for Payday Loans Online Florida?

Most applications for payday loans online Florida take a few minutes to complete. You’ll need to fill in a brief application form with your particulars, including your name and address, ID, employment details, and a list of your current income and expenses. Thereafter, the lender will indicate if they can assist you. This takes about 2 minutes, thanks to the automated system. You’ll spend a few more minutes setting everything in place directly with the lender. Payouts aren’t instant – you’ll have to wait between 24 and 48 hours for payments to be made.

Am I Eligible for Florida Payday Loans?

If you’re 18+ years old, are a resident or citizen of the USA, and earn a steady income, you’re eligible to apply for Florida payday loans. That said, you will need to also provide documents to be eligible. Make sure you have digital copies of your valid ID, proof of address, and proof of income.

What Are the Perks of Opting for Online Payday Loans Florida?

For starters, if you’re turned away from the bank, you may still be likely to get approved for online payday loans Florida. These loans are quick and easy to apply for, they’re available to bad credit borrowers, and they pay out quickly. What’s more, is that they come with flexible amounts and terms to meet an array of financial requirements.

Conclusion

When seeking out the best payday loans Florida, using a loan-finder platform such as Green Dollar Loans – or any of the other recommended loan-finders above – will help you save time, money and effort. You can find a deal that suits your financial situation and won’t have to stress about dealing with unscrupulous lenders, as all the lenders on the panels are approved, accredited, and transparent. If it’s time to look for financial aid and you’re in the market for viable payday loans Florida, visit the Green Dollar Loans platform today.

ALSO READ:

- Best Online Payday Loans Texas

- Payday Loans Instant Approval California

- Cash Advance Loans Upto $5000

- Best Payday Loans In Illinois

- Payday Loans Ohio USA

- Best Payday Loans in Virginia

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

:quality(80)/business-review.eu/wp-content/uploads/2023/11/Important-Factors-To-Consider-Before-Applying-For-A-Loan.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)