:quality(80)/business-review.eu/wp-content/uploads/2022/12/unnamed-2022-12-08T213914.210.jpg)

Having poor credit can make life much more difficult when unforeseen financial circumstances arise. Unfortunately, traditional financial institutions rarely provide loans to borrowers with low credit ratings, so if your credit is bad, you’ll need to look for other emergency loan options. And gladly, bad credit personal loans with guaranteed approval can assist you right away. But finding the right direct lender to submit your application through must come first.

Despite having a large selection of bad credit loan providers, it can be challenging to identify one that will meet your needs. We’re here to introduce you to a business you can rely on if you’re having trouble finding a fair online loan for poor credit. Let’s take a closer look at 1F Cash Advance – the service that offers fair no credit check loan options with almost instant approval decisions.

1F Cash Advance Overview: Bad Credit Loans with Guaranteed Approval

If you’re looking for a trusted service that will do all the legwork for you, 1F Cash Advance is definitely worth considering. This payday loan company is more than just a lender. It’s a connecting platform that collects the most reputable and trusted direct lenders across the US and integrates them in a unified network you can access with the help of just one completed application form.

1F Cash Advance’s history dates back to 2019, when the company was created to help people overcome their financial difficulties and go through tough times together. Since then, it has gained popularity among borrowers with credit difficulties and urgent money needs. The service holds the crown for providing a full range of bad credit loan options that people can’t access in a bank or credit union. It teams up with bad credit direct lenders throughout the country and makes it possible to apply for payday loans from anywhere, even if there is no store in your city.

Pros & Cons of 1F Cash Advance

Pros

- A streamlined application process;

- No loan purpose restrictions;

- Any credit is acceptable;

- A free-of-charge service with no application fees;

- Fast direct deposits in your bank account without leaving your home.

Cons

- Can’t help you build your credit;

- An APR on some products may be high;

- No approval guarantees;

- Income verification is mandatory.

Why Should You Trust 1F Cash Advance?

Bad credit borrowers have high opinions of 1F Cash Advance’s products and services. You can find plenty of reviews using such trusted platforms as Trustpilot, Scamadviser, and Manta. Most consumers mention they always get money on time, and the company blows their minds with outstanding customer service and great options for bad credit.

The company’s CEO Latoria Williams is known for being an iconic figure in the payday lending industry. She is dedicated to helping individuals who get in difficult financial situations and doesn’t hesitate to speak out in support of people in need and those with poor credit scores. Latoria Williams is aimed at bringing the company into the ranks of the most recognizable services that help people with credit issues.

Here are some more reasons why the company should be considered reliable:

- Years of experience in lending money;

- 1F Cash Advance has 44 stores across the US, so you can visit one of them at any moment to solve your problems;

- Modern data protection services – your personal information is completely safe;

- The company is socially responsible and active;

- 1F Cash Advance is engaged in the educational process through its financial blog in order to increase the financial literacy of people who can’t manage their budgets efficiently.

Features & Highlights of 1F Cash Advance

A service that charges no fees

People can access no credit check loans without paying anything to a service. You can submit a form as many times as you wish without worrying about any application charges that will hit your wallet in the end.

Both offline & online applications are available

If you want to ensure you’re doing your business with a trusted company, you can visit any of its 44 stores in 24 states across the country. If there is no nearby location in your city or state, don’t worry. You can always apply for payday loans online.

Transparent terms of use and loan conditions

There are no hidden meanings in what you can read in terms of use or loan agreements. The company is solid to its principled stand, which involves staying open and fair. 1F Cash Advance doesn’t hide anything from its customers and is always ready to answer your questions, even delicate and provocative.

Using the service neither improves nor drops your credit score

Unlike a bank loan, a no credit check loan is an option that won’t be recorded in your credit report. This way, applying for any type of bad credit personal loan through 1F Cash Advance has no effect on your credit history, whether positive or negative.

Loan Options Offered by 1F Cash Advance

1F Cash Advance’s online loans with no credit check are available to everyone who seeks fast financial assistance. There are no certain groups that are not allowed to apply for bad credit loans online. You can submit your request directly by using the company’s website or a no credit check cash advance app. Here are some options for no credit check loans that you can access through 1F Cash Advance.

Bad Credit Loans with Guaranteed Approval

Guaranteed loans for bad credit refer to a form of a payday loan with a high approval rate for bad credit score borrowers. With this bad credit loan, you can typically obtain between $100 and $1,000 and make a repayment right after you receive your next salary.

No Credit Check Online Loans

Online loans with no credit check are borrowing solutions that don’t necessitate any hard financial screenings through major credit bureaus. Thus, no credit check loans may be a good way to obtain emergency cash, even if you have a poor credit history. These loans keep your credit score the same, even if you frequently apply within a short time interval.

Guaranteed Installment Loans for Bad Credit from Direct Lenders

An installment loan for bad credit is an option that can help you manage your debt without additional stress. It splits your loan cost equally by the number of months of your repayment period, which may be from 2 to 24 months. Thus, you will make fixed payments once a month until your loan expires.

Bad Credit Personal Loans with Guaranteed Approval (up to $5,000)

People with poor credit scores can get a reasonable alternative to traditional personal loans when they apply through 1F Cash Advance. Bad credit personal loans (up to $5,000) offer you more flexibility compared to payday loans. They provide higher loan amounts along with convenient repayment schedules, so you can use them as a long-term solution.

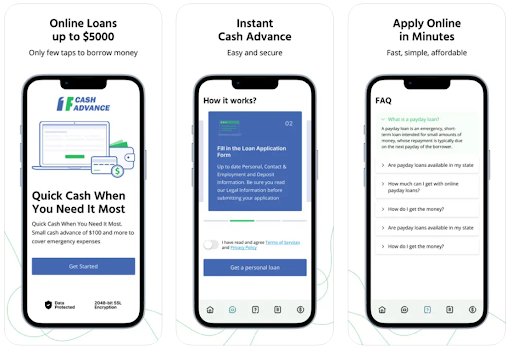

More Options to Choose from – Borrow Money Through 1F Cash Advance App

1F Cash Advance takes care of its customers and listens to their opinions to improve the way the service works and make the interaction more efficient. The company launched a convenient no credit check cash advance app that you can use each time when you need money fast. This app works without any access to your laptop. You can easily download it on both AppStore (for iOS) and Google Play (if you’re an Android user) and enjoy all the benefits of the ability to access prompt financial assistance at any moment.

All you need to get a no credit check loan through an app is to install it on your smartphone and follow a few simple steps. Just fill out a plain form and get a guaranteed loan approval decision after a lender makes all the required checks. Don’t worry; it won’t be displayed in your credit report and won’t drop your credit score. The whole application procedure is even faster than when you apply through the website.

How to Receive The Funds?

The way you can obtain a loan is always up to you. The company allows you to reserve the right to submit both online and in person. However, you will get money directly in your bank account in both cases. The funds are transferred via direct deposit, so it usually doesn’t take more than one business day to access them.

How Much Money Can I Get With 1F Cash Advance?

The company offers a wide array of financial products, so the exact sum you can get is determined by the type of loan you apply for. For example, payday loans generally come with amounts of $100 to $1,000, while installment loan amounts can reach $5,000. However, there are other equally important factors a lender will take into account when checking your request. They include your income, credit utilization, and debt-to-income ratio. Thus, if you’re overburdened with other debt or have a low income for a requested amount, a lender can approve you for a smaller sum.

Get Online Loans for Bad Credit with 1F Cash Advance – How to Get Started

With 1F Cash Advance, the whole loan application process comes down to filling out an online application form. Let’s see what the submission procedure looks like step by step:

- Pre-application: Once you complete a loan request form, 1F Cash Advance sends your application details to its database of partner loan providers. This way, your loan request reaches many lenders at once.

- Review an offer. A lender that can fulfill your request sends you an answer after conducting a soft pull. If approved, you can either accept it if you’re satisfied with the proposed conditions or try your luck again to get a better offer from another lender. It doesn’t drop your credit score or leave any other traces on your credit report.

- Accept an offer: After you get a suggestion from a lender and find it reasonable, you need to agree with loan terms by putting a digital signature on a loan contract.

- Receive the funds: After a direct lender gets an agreement that is signed by you, it makes a direct deposit of the required sum in your bank account. You can typically access money as soon as the next business day.

- Repay your loan within the agreed period: Your loan terms can fluctuate depending on the kind of loan you apply for. Check out your loan agreement to find out what your payment schedule is and stick to it without delays to avoid late fees.

Eligibility Criteria

- Be an adult and legally responsible for your actions;

- Have a US residence confirmation;

- Demonstrate your monthly income that is no less than $1,000;

- Have a valid bank account, email, and mobile phone number.

Customer Service

1F Advance is a service that always stays in touch with its customers. You can contact the company in case of any questions associated with the borrowing options it offers and the loan process it provides. Here are the ways to contact 1F Cash Advance:

- Send a letter using the following address: 1F Cash Advance, LLC, 1942 Broadway St., STE 314C, Boulder, CO 80302;

- Contact the company online: use the info@1firstcashadvance.org email or fill out a feedback form on the website;

- Get in touch by phone: call the company at (888) 847-2909 (the number is typically used to apply);

- Ask your questions on social networks: the company’s representatives are available on LinkedIn, Facebook, Twitter, and YouTube.

Most company’s stores have convenient working hours that are 8 AM to 10 PM Monday to Friday and 9 AM to 6 PM on Saturday. Thus, if you’re going to apply for no credit check loans offline or visit a branch for any other question, it probably won’t be a problem for you to find a couple of minutes within their working hours that will be convenient for you.

Terms & Fees

The company uses different loan terms for different types of loans. You may be required to make payments once a month for up to two years or get a loan with a bi-weekly repayment period.

Direct lenders don’t have a unified interest rate and fee. Interest rates typically fluctuate from lender to lender and from state to state. Your credit history, financial situation, and the type of your loan also play a role. Typically, an annual percentage rate doesn’t come cheap. An average payday lender collects an additional $10 to $30 for each $100 borrowed. This way, the average APR on payday loans is nearly 400%.

Conclusion

1F Cash Advance can be an excellent option for people with bad credit scores who are looking for a quick way to find a trusted direct lender. However, the service doesn’t make any decisions and money transfers and can be used as a linking platform only. Keep in mind that submitting an online application form is not an approval guarantee. Thus, you need to wait for a response from a payday loan lender after you apply. Also, the offers you get through it may be expensive if you have a low credit score. Thus, pay attention to the loan conditions that are specified in a loan agreement.

Methodology

The first step we take is collecting data and estimating all the public information that is available in open sources to carefully evaluate the company’s reliability. At this stage, we also contact customer support and carefully select companies that meet our standards of service, transparency, and honesty. After we’ve made a preliminary list of loan providers, each of them goes through an analysis we make, taking into account the following key factors:

- Cost of loans (includes interest rates and additional fees);

- Loan specifics;

- Basic requirements;

- Other characteristics (reputation, speed of the funding process, etc.).

The providers we’ve picked are rated on a scale of zero to ten for each category, where zero is the worst possible score. After all, we calculate the results and determine the overall star rating for each payday loan company.

What Are Bad Credit Loans (Guaranteed Approval)?

Bad credit loans with guaranteed approval can be your ally in solving money problems with a bad credit score. This borrowing option refers to a form of accessible financial assistance that doesn’t reject borrowers based on their credit scores or spoil their credit histories. This happens because these bad credit loans with guaranteed approval don’t come with main credit bureau checks. Whether you decide to apply for personal installment loans or get payday loans, direct lenders won’t access your credit report information.

No credit check loans (guaranteed approval) are of various kinds and forms that help them meet different people’s needs. Here are several types of secured and unsecured loans with no credit check that you can access with bad credit.

No credit check payday loans

There are solutions provided by payday lenders called payday loans. They let you acquire a little cash advance until your next paycheck arrives. A payday loan is one of the most convenient solutions for consumers with poor credit. Payday loans range in sums from $100 to $1,000 and must be repaid between 14 to 31 days.

Personal installment loans

A personal installment loan can meet your longer-term needs due to an expanded repayment period that is up to 24 months. No credit check installment loans allow you to divide your total loan cost into smaller monthly payments instead of repaying it all at once. These emergency loans offer more flexibility to people with limited incomes.

Personal loans for bad credit

Personal loans for bad credit are a replacement for traditional bank loans. A abd credit personal loan allows borrowers with any credit to get up to $15,000 and make repayments in fixed monthly installments within up to 60 months.

Car title loans

Auto title loans are a secured alternative to payday loans that are usually cheaper. Unlike unsecured debt, these secured loans require collateral in the form of your vehicle. This way, you can get a lower interest rate but can lose your car in case of repayment delays.

How Do No Credit Check Loans for Bad Credit Work?

No credit check loans for bad credit offer a streamlined loan process. First, you decide on a type of loan that will suit your budget. Next, you fill out an application form and wait for a lender’s response. After a loan provider checks your solvency and decides whether or not you can get a loan, you will receive an answer. If positive, you will get a loan amount on the next business day after signing the loan documents. In the end, you need to repay the loan in one lump sum or by making equal loan payments once a month.

What Influence Do Loans for Bad Credit with Instant Approval Have on Your Credit History?

Bad credit loans with guaranteed approval don’t have any influence on your credit history. As lenders don’t access your credit report details through major credit bureaus, there is nothing to worry about in the context of your credit score. However, get ready to go through a soft pull that a lender performs to determine your creditworthiness.

Things to Know About Guaranteed Approval Loans

Let’s start with the main thing: guaranteed approval loans actually give no 100% guarantee to a borrower. These cash loans are just easier to get with bad credit. At the same time, a lender can still deny your loan request if it thinks you won’t repay the money when due. Also, guaranteed loans for bad credit are often expensive. Therefore, you need to think twice before obtaining one and use it only as an emergency fund.

Final Thoughts About Online Loans with No Credit Check

While banks and credit unions are very exacting when it comes to bad credit score borrowers, bad credit loans (guaranteed approval) can help you out quickly and without strict requirements. However, you don’t need to expect you will get the same loan conditions that bank loans offer. When you have a poor credit score, online loans for bad credit may be your one and only option, so lenders can use this fact as an excuse for high interest rates. If you’re looking for no credit check loans (guaranteed approval), try to deal with trusted lenders only and keep in mind what kind of loan you obtain.

:quality(80)/business-review.eu/wp-content/uploads/2015/08/key-interest-BNR.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2020/04/fotografie-OTP.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2013/02/Garanti.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)