:quality(80)/business-review.eu/wp-content/uploads/2023/05/Bad-Credit-Loans-3.jpg)

If you have a bad credit score, chances are you’ve been searching for bad credit loans. After all, it makes sense to approach unbiased lenders regarding bad credit ratings, as they’re more likely to approve bad credit loans. However, some factors that borrowers should be aware of when hunting for loans for bad credit is that providers of bad credit loans, much like high street banks, are also regulated by US lending regulations. This means bad credit loans providers must conduct a mandatory credit check on all borrowers. In addition, borrowers must meet specific lending criteria to qualify for personal loans for bad credit.

Best Loans For Bad Credit ✅ May 2023 – Quick Overview

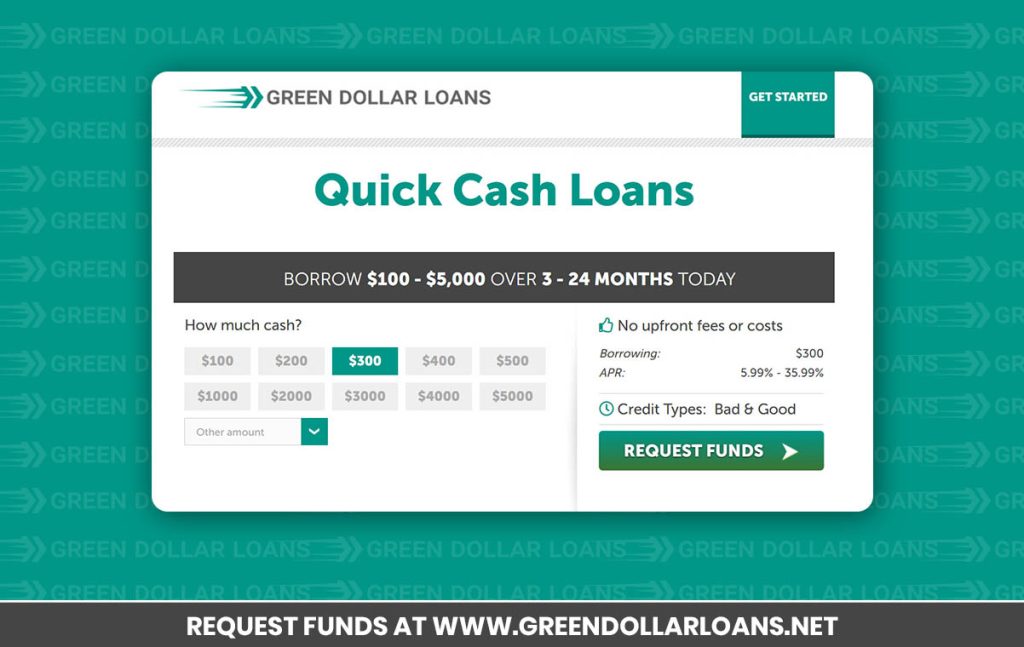

- Green Dollar Loans: Overall Best for Loans for Bad Credit Borrowers with Minimal Income and No Collateral to Offer as Security

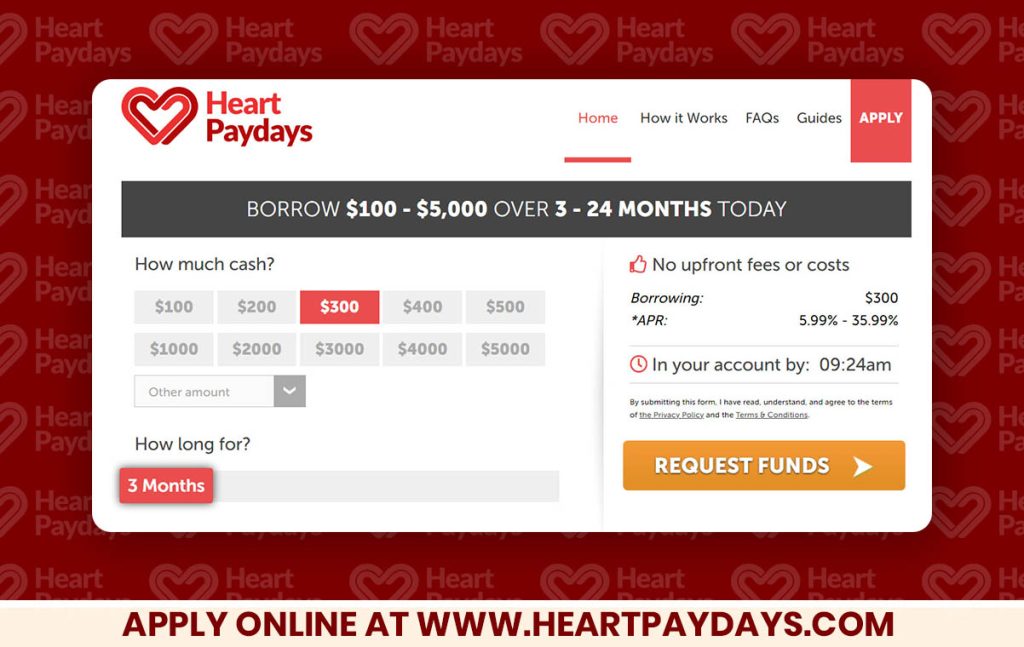

- Heart Paydays: Best for Personal Loans for Bad Credit up to $5000 with up to 24 Months to Repay the Loan

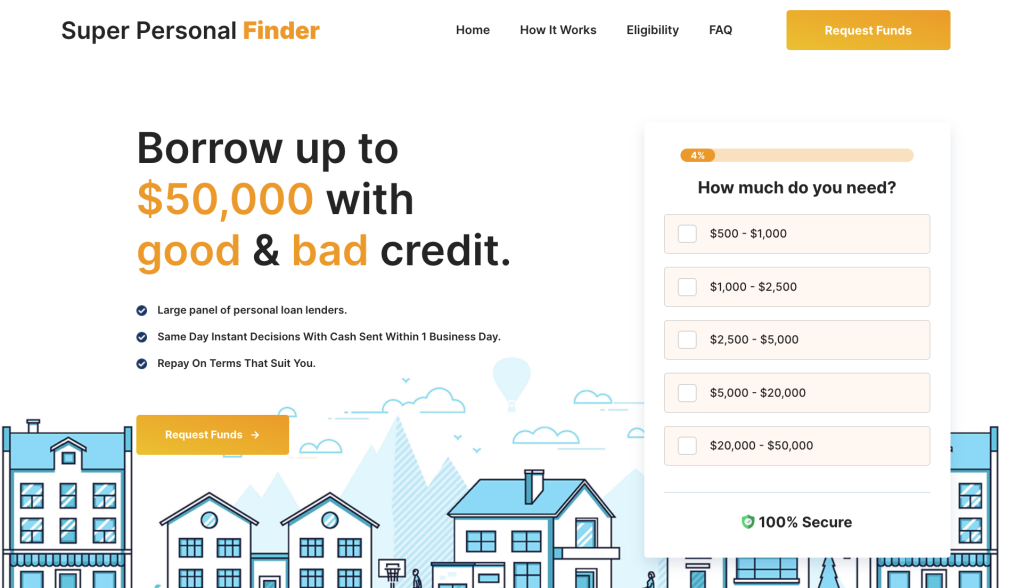

- Super Personal Finder: Best for Bad Credit Car Loans up to $50,000 with 10+ Years to Pay

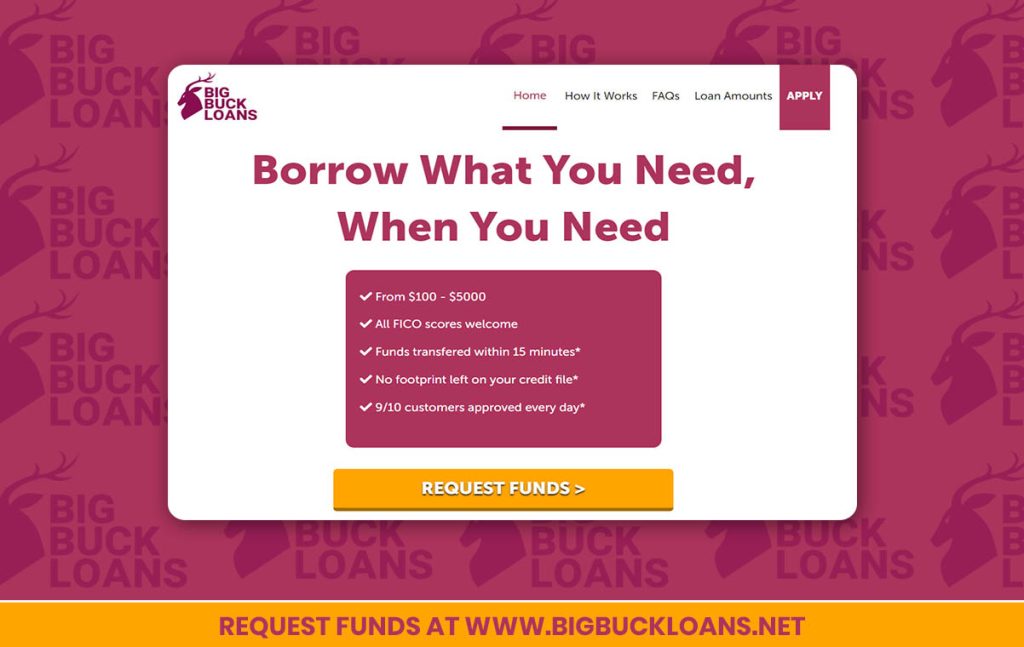

- Big Buck Loans: Best for Urgent and Emergency Installment Loans for Bad Credit Borrowers in Need of Cash Right Now

- Low Credit Finance: Best for Small Bad Credit Loans Guaranteed Approval Alternatives with Amounts Starting at $100

Of course, this might leave you thinking that applying for bad credit loans will be pointless, especially if your credit score requires a little polish! On the contrary, if bad credit borrowers applying for bad credit car loans meet the lending criteria and pass the lender’s assessments, installment loans for bad credit are often entirely possible, even with a below-par credit rating!

Applying for bad credit loans or bad credit loans guaranteed approval alternatives is simple when using a trustworthy loan-finder site. After completing a single online application, borrowers are linked directly to lenders offering a veritable buffet of online loans for bad credit. This guide showcases the top US providers offering loans with bad credit and details how to apply for bad credit auto loans.

Same Day Bad Credit Loans Guaranteed Approval with No Credit Check ✅ – Full Reviews

Green Dollar Loans: Overall Best for Loans for Bad Credit Borrowers with Minimal Income and No Collateral to Offer as Security

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 9/10

Green Dollar Loans is the bad credit borrowers ally! Instead of stipulating that borrowers meet unrealistic lending criteria for loans for bad credit, lenders at Green Dollar Loans make things straightforward.

Here, borrowers won’t have to earn a top-dollar wage or provide expensive collateral as security. Instead, borrowers earning a regular income who can prove affordability are welcome to apply for loans for bad credit between $100 and $5000 with up to 2 years to pay. In addition, they won’t be charged exorbitant APRs on loans for bad credit, as these start at a low 5.99% and usually go no higher than 35.99%.

Highlights of Loans for Bad Credit Borrowers with Minimal Income

- No collateral required as security

- Low-income earners welcome

- Straightforward lending criteria

- Competitive APRs from 5.99%

- Unbiased lenders

Eligibility Criteria for Loans for Bad Credit Borrowers with Minimal Income

- Under 18 years prohibited

- US citizenship/residency

- Active US bank account

Fees on Loans for Bad Credit Borrowers with Minimal Income

- Early loan settlements incur costs

- APRS of 5.99% to 35.99%

Apply for a Bad Credit Loan and Get Back on Track Today! >>

Heart Paydays: Best for Personal Loans for Bad Credit up to $5000 with up to 24 Months to Repay the Loan

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 8/10

- Variety of Products: 8/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Unsurprisingly, Heart Paydays is the next top provider of personal loans for bad credit. Not only do they offer bad credit borrowers substantial loan values up to $5000, but larger personal loans for bad credit can be repaid in affordable installments over a lengthy 24 months! As a result, qualifying borrowers in search of a larger lump sum can feasibly apply and repay personal loans for bad credit without breaking the proverbial bank!

Of course, smaller loans and shorter loan terms are available, starting at $100 and 3 months, respectively. Like all loans, personal loans for bad credit attract APRs set by individual lenders and can vary between 5.99% and 35.99%. It’s worth noting that higher APRs are often negotiable (lender dependent) as most providers of personal loans for bad credit want to remain competitive.

Highlights of Personal Loans for Bad Credit up to $5000 with up to 24 Months to Repay the Loan

- Up to $5000 available

- Affordable set installments

- Repayment terms up to 24 months

- Reasonable APRs from 5.99%

- Easy online application process

Eligibility Criteria for Personal Loans for Bad Credit up to $5000 with up to 24 Months to Repay the Loan

- Proof of regular income

- Adult candidates only

- US applicants with permanent residency

Fees on Personal Loans for Bad Credit up to $5000 with up to 24 Months to Repay the Loan

- Penalty fees apply for late payments

- APRs up to 35.99%

Apply for a Bad Credit Loan and Get Back on Track Today! >>

Super Personal Finder: Best for Bad Credit Car Loans up to $50,000 with 10+ Years to Pay

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 8/10

- Variety of Products: 9/10

- Acceptance Rate: 9/10

- Customer Support: 8/10

Borrowers hunting for the best bad credit car loans won’t be disappointed with Super Personal Finder’s offerings. Instead of a few hundred dollars, borrowers who meet the loan criteria can apply for sizeable bad credit car loans up to $50000! Further flexibility can be seen in the generous loan terms extending to 10+ years. But the good news doesn’t stop there; APRs on bad credit car loans are reasonable and start at just 5.99%. With sizeable lump sums, practical repayment terms, and affordable APRs, it’s no wonder Super Personal Finder has snatched a comfortable mid position on our list!

Applying for bad credit car loans is easy via Super Personal Finder; once the borrower has completed the online form, their application is reviewed by multiple lenders on the platforms panel. Those who can assist reach out, and from there, the agreement is finalized and paid out by the direct lender.

Highlights of Bad Credit Car Loans up to $50,000 with 10+ Years to Pay

- Sizeable loans of $50000

- Generous loan terms (10+ years)

- Affordable monthly installments

- Straightforward loan criteria

- Access to direct lenders

Eligibility Requirements for Bad Credit Car Loans up to $50,000 with 10+ Years to Pay

- Applicants over 18 years

- Proof of US residency

- US bank account in applicant’s name

Fees on Bad Credit Car Loans up to $50,000 with 10+ Years to Pay

- Penalty fees and additional interest applied for missed payments

- APRs determined by the lender from 5.99% to 35.99%.

Apply for a Bad Credit Loan and Get Back on Track Today! >>

Big Buck Loans: Best for Urgent and Emergency Installment Loans for Bad Credit Borrowers in Need of Cash Right Now

Quick Ratings

- Decision Speed: 8/10

- Loan Amount Offering: 7/10

- Variety of Products: 8/10

- Acceptance Rate: 8/10

- Customer Support: 8/10

Need cash in a flash? Big Buck Loans is the answer! Applications for installment loans for bad credit via Big Buck Loans can be made entirely online, negating the need for time-consuming appointments, phone calls, and lengthy decisions.

Instead, borrowers simply access the platform via their phone, tablet, or computer, complete the straightforward online application, press submit and wait approximately 2 minutes for feedback! In addition, supporting documentation like bank statements, wage slips, or utility bills can be digitally uploaded, saving additional time and speeding up the application process. It’s no wonder Big Buck Loans is every borrower’s choice regarding quick installment loans for bad credit in a hurry!

Repayment terms offered on installment loans for bad credit range between 3 and 24 months with APRs of 5.99% to 35.99%, determined by the lender.

Highlights of Urgent and Emergency Installment Loans for Bad Credit Borrowers in Need of Cash Right Now

- Fast online application

- Digital document copies accepted

- 2-minute response time (approximate)

- No face-to-face appointments

- Fast disbursement on approval

Eligibility Requirements for Urgent and Emergency Installment Loans for Bad Credit Borrowers in Need of Cash Right Now

- Proven affordability

- Restricted to adult candidates only

- US passport holder/residency visa

Fees on Urgent and Emergency Installment Loans for Bad Credit Borrowers in Need of Cash Right Now

- Zero upfront loan finding fees

- 5.99% – 35.99% (APR)

Apply for a Bad Credit Loan and Get Back on Track Today! >>

Low Credit Finance: Best for Small Bad Credit Loans Guaranteed Approval Alternatives with Amounts Starting at $100

Quick Ratings

- Decision Speed: 9/10

- Loan Amount Offering: 8/10

- Variety of Products: 7/10

- Acceptance Rate: 7/10

- Customer Support: 8/10

Borrowers needing bad credit loans guaranteed approval alternatives are assured of a wide choice at Low Credit Finance! While larger loan values of up to $5000 are on offer, borrowers looking for smaller lump sums to plug a financial hole will find they can apply for bad credit loans guaranteed approval alternatives as low as $100.

In addition, lenders at Low Credit Finance offer flexible repayment terms ranging from 3 to 24 months, depending on the loan value. For example, smaller loan values tend to attract shorter repayment terms, while larger loans can be spread in equal installments over a longer period. APRs on bad credit loans guaranteed approval alternatives are standard and range from 5.99% to 35.99%.

Highlights of Small Bad Credit Loans Guaranteed Approval Alternatives with Amounts Starting at $100

- $100 loans on offer

- Flexible loan terms

- Easy installment plans

- Budget-friendly

- Fast application process

Eligibility Criteria for Small Bad Credit Loans Guaranteed Approval Alternatives with Amounts Starting at $100

- US applicants only

- US bank account (direct deposit)

- Applicants above minimum age (18+)

Fees on Small Bad Credit Loans Guaranteed Approval Alternatives with Amounts Starting at $100

- Missed/late payment penalties applied

- Up to 35.99% APR

Apply for a Bad Credit Loan and Get Back on Track Today! >>

How Did We Choose the Best Providers of Online Loans for Bad Credit?

When comparing options, we selected providers of online loans for bad credit based on the following:

- APRS between 5.99% to 35.99%

- Convenient online application

- Flexible repayment terms

- Direct access to reputable lenders

- Impartial lending practices

Types of Online Loans for Bad Credit 2023

Unsecured Loans with Bad Credit

Collateral-free loans between $100 and $5000 with 3 to 24 months repayment terms offered to borrowers meeting the loan criteria.

Home Improvement Loans with Bad Credit

Loans up to $5000 with 24 months to pay furnished to qualifying borrowers earning a regular wage.

Bad Credit Auto Loans

Loans up to $50000 with 10+ years to pay provided to borrowers who qualify.

Unemployed Bad Credit Auto Loans

Flexible loan amounts from $100 to $5000 offered to qualifying borrowers earning an income via non-traditional means (self-employed, contractor, freelancer).

Features and Factors of Personal Loans with Bad Credit

Disbursement of Funds on Approved Personal Loans with Bad Credit

On approval, the lender quickly pays the funds directly into the borrower’s US bank account.

Reputation of Lenders Providing Personal Loans Bad Credit

Lenders are trustworthy, transparent, and regulated by US law.

Amounts and Terms on $500 Tribal Installment Loans

Loan amounts can vary between $100 and $500 up to $5000 depending on the borrower’s needs, with flexible loan terms ranging between 3 and 24 months.

Costs Charged on Personal Loans Bad Credit

All costs are detailed in the loan agreement. However, APRs tend to be between 5.99% and 35.99%, with additional fees applied for early settlement and late or missed payments.

Top 5 Small Loans for Bad Credit Guaranteed Approval

| Best Small Loans for Bad Credit | Pros | Cons |

| Green Dollar Loans |

|

|

| Heart Paydays |

|

|

| Super Personal Finder |

|

|

| Big Buck Loans |

|

|

| Low Credit Finance |

|

|

How to Apply for Bad Credit Personal Loans Guaranteed Approval $5,000 Alternatives

Follow these simple steps on the Green Dollar Loans platform:

Step 1: Select the Bad Credit Personal Loans Guaranteed Approval $5,000 Alternatives Options and the Term Required

Access the Green Dollar Loans platform and choose a loan value between $100 to $5000 with a preferred loan term of 3 to 24 months.

Step 2: Complete the Same Application Form Online for Car Loans for Bad Credit and Other Types of Bad Credit Loans

Click on the application form and input your personal details, including your name, US address, employment information, and banking details.

Step 3: Speedy Feedback Provided on Car Loans for Bad Credit and Other Types of Loans

Once you submit your application, you can expect a response from potential lenders in approximately 2 minutes.

Step 4: Expect Quick Payout on Approved Bad Credit Personal Loans

Finalize the loan agreement directly with the lender, who will deposit the funds into your US bank account as quickly as possible.

Bad Credit Loans Online Guaranteed Approval Upto $5000

FAQs

How Can I Get Bad Credit Personal Loans Quickly?

You can quickly access bad credit personal loans using a loan finder like Green Dollar Loans. After completing a single application form, you will be linked directly to multiple lenders who can assist.

Are Loans for Bad Credit Online Credit Checked?

Yes. All loans, including loans for bad credit online, must be credit checked according to US regulations. However, a bad credit score doesn’t equate to instant loan rejections, as lenders review additional factors when making their final decision.

How Fast Are Bad Credit Loans Online?

Applications for bad credit loans online via platforms like Green Dollar Loans are simple and quick. The online form takes minutes to complete, and feedback is usually received in approximately 2 minutes.

Where Can I Get The Best Loans for Bad Credit?

The best loans for bad credit can be accessed using a trustworthy loan finder like Green Dollar Loans. Once the online application is complete, borrowers are linked directly to lenders offering a wide selection of loans for bad credit.

Are Loans for People with Bad Credit Restricted?

No, the funds may be used for expenses, medical bills, groceries, holidays, gifts, and more.

Are Small Personal Loans for Bad Credit Possible?

Yes. Small personal loans for bad credit offered via lenders at Green Dollar Loans start at just $100 but can extend to $5000 depending on the borrower’s needs.

Can I Get $5000 With Bad Credit Loans?

Yes. Bad credit loans range from $100 to $5000 with easy repayment terms of 3 to 24 months.

Conclusion

It’s easy to see why Green Dollar Loans outstrips the competition. With their straightforward online application process, quick feedback, speedy disbursement, and unbiased lenders, they’re certainly ahead of the proverbial pack!

RELATED GUIDES:

- Best IVA Debt Advice UK

- Best Debt Management Plans UK

- Best Credit Card Debt Help UK

- Debt Relief Order UK

- Cash Advance Apps Like Dave

- Payday Loans Alternatives To Ace Cash Express

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/Iulia-Surugiu-scaled.jpg)