:quality(80)/business-review.eu/wp-content/uploads/2021/05/Mihai-Chipirliu.jpg)

Against the backdrop of new outbreaks of the global Covid-19 virus, policy and volatility in demand and logistics during the Chinese New Year, disrupting the global supply chain will remain a problem until the second half of 2022. After an improvement in In the first half of 2021, global trade in goods contracted in the third quarter.

Production shortfalls are behind 75% of the current contraction in the global volume of trade, with the rest explained by logistic bottlenecks. In this context, a soft recovery in Q4 2021 is likely (+0.8% q/q after -1.1% in Q3 for trade in goods) but there is a risk of a double-dip in Q1 2022 as volatility in trade flows should remain the norm until the spring. Looking ahead, three factors will drive the normalization of trade from H2 2022: A cooling down of consumer spending on durable goods, given their longer replacement cycles and the shift towards sustainable consumption behaviors; Less acute input shortages as inventories have returned to or even exceeded pre-crisis levels in most sectors and capex has increased (mainly in the US).

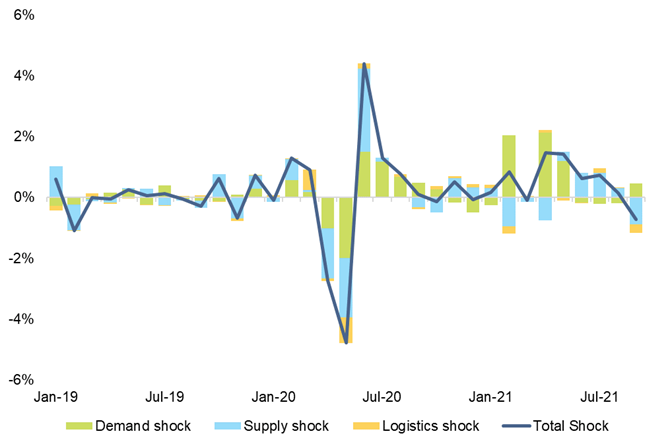

Euler Hermes estimates a VAR model based on global demand as well as the logistical conditions used. Analyzing deviations from the basic forecast, demand shocks contributed most of the positive growth to global trade growth in July 2020. On the other hand, supply has had a massive positive impact since the summer of 2020, but since then supply shocks have was quite volatile, most likely reflecting Covid-19 shocks. The most recent unexpected drop in global trade is mainly due to supply and logistics factors. Both had a cumulative negative effect of -1.2 percentage points on the monthly growth of global trade in September, with -0.3 percentage points for the logistics factor and -0.9 percentage points for supply.

Looking ahead, the factors that will determine the normalization of trade starting with the second half of next year are: consumer demand that will remain high due to excess savings during the crisis that will not be exhausted until 2023, reducing the shortage generated by increasing stocks to pre-crisis levels in most sectors and reducing transport congestion as capacity increases.

Consumer demand has peaked at unprecedented levels and is likely to stay above this trend, as excess savings during the crisis will not be exhausted until 2023. The cycle of long-term commodity replacement shows that the peak of supply chain bottlenecks would he should have passed. However, the demand for global trade will remain high next year, gradually moving towards self-regulated normalization. This is primarily due to fiscal incentives in response to Covid-19, which supported demand rather than supply, especially in advanced economies where governments have implemented fiscal and monetary support equivalent to about 25% of GDP. While this support is being phased out, fiscal policies remain relaxed in the US, the eurozone and China. In addition, surplus household savings will continue to support consumer demand until 2022 and 2023. In the US, analysts predict that the savings rate will reach pre-crisis levels (7.3% of disposable income) by the end of 2022, because the recovery of labor markets will support purchasing power in households. In Europe, surplus economies will support private consumption with 0.9% of GDP in 2022 and 0.5% in 2023, after 1.4% in 2021.

Consumers’ focus on durable goods rather than services will be much more timid in the future, even in a downward scenario of the new Covid-19 outbreaks. However, households are moving towards more sustainable consumption patterns, especially in advanced economies.

In terms of stocks, they have reached pre-crisis levels and production capacity is on an upward slope due to US capital increases. Following the depletion of stocks generated by the Covid-19 crisis in early 2020, manufacturers were forced to replenish rapidly in order to cope with the unprecedented return to demand in advanced economies. The shortage of raw materials was particularly high in Europe in 2021 and, to a lesser extent, in North America. Replenishment has clearly peaked in recent months, and the level of stocks in most sectors is already above average. In particular, the electronics, IT, telecommunications and household appliances sectors were able to significantly increase their stocks, despite the shortage of semiconductors. Even though it was unsuccessful due to the great difficulties in accessing semiconductors and the high costs of accumulating the goods produced, the automotive sector managed to record stocks.

Shipping congestion will be less acute as global orders for new ships and containers have reached record levels in recent months, accounting for 6.4% of the existing fleet. After reaching a peak in September 2021 at levels six to seven times higher than before the Covid-19 crisis, in the short term a gradual decline is expected to take place by the end of the year.

Supply in Europe could be postponed after 2022

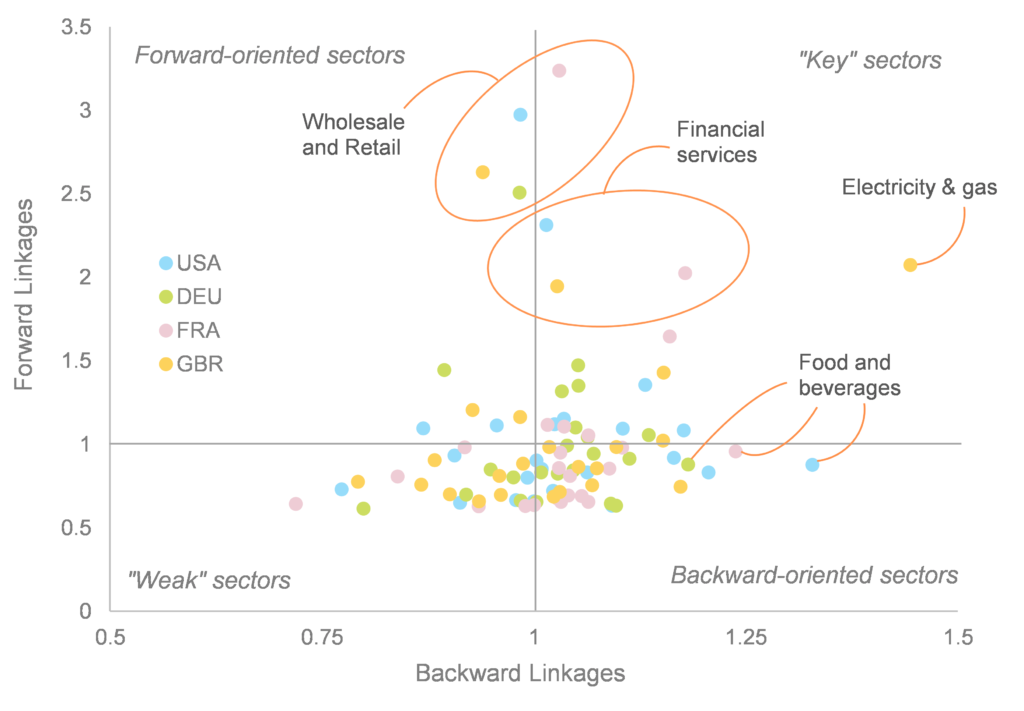

Stimulating demand in Europe without fixing supply issues can only be inflationary. Europe is more at risk compared to the US when it comes to the heavy reliance on intermediate inputs from abroad. In the absence of production capacity increases and investments in port infrastructure, the normalization of bottlenecks in Europe could be delayed beyond 2022 if demand remains above potential (our baseline scenario). More precisely, the household equipment, consumer electronics, automotive and machinery and equipment sectors are most vulnerable to input shortages. Using the OECD 2018 Input-Output tables, we compute the Hirschman–Rasmussen Backward Linkages (BL) and Forward Linkages (FL) indices[1]. In our sample including 23 sectors, 14 have a BL above one in the US, 16 in Germany, 17 in France and 12 in the UK. This means that a majority of sectors are heavily reliant on intermediate inputs. Only nine sectors in the US, eight in Germany, six in France and seven in the UK have a FL above one. Using these two metrics, we can group sectors into four segments: “key” sectors that have BL and FL above one, “weak” sectors that have BL and FL below one, forward-oriented sectors that have BL below one but FL above one and backward-oriented sectors that have BL above one and FL below one.

As European companies are less advanced with investments below normal levels, they rely more on above average capacity utilization rates to meet higher demand. Euler Hermes analysts have predicted a potential return on investment in Europe in 2022, given favorable financing conditions and high corporate cash flow. Surveys show that most companies have postponed investment decisions in 2021 due to supply chain blockages and a shortage of raw materials.

Semiconductors are the only key input for all sectors

Asia-Pacific countries account for about 90% of global semiconductor exports and over 70% of global production capacity (Japan, South Korea, China and Taiwan), making the global production sector very vulnerable. Despite higher volumes than in the pre-pandemic years, Asia and the United States are able to buy more semiconductor products than Germany, Europe’s largest industrial country. Thus, the world should rely more on increasing semiconductor production capacity in Taiwan than on the US, Europe or China.

China is a risk to Europe

A 10% drop in EU imports from China could be an obstacle of more than -6% for the metals sector, more than -3% for the automotive sector (including transport equipment) and more than -1% for computers and electronics. China is essential for Europe to export tin, copper, zinc and magnesium. Overall, the sectors most affected are metals (base metals and fabricated metal products) and cars (motor vehicles, trailers and semi-trailers, transport equipment). However, companies cannot replace China with other suppliers for these raw materials. In addition, the impact could be stronger through intermediate goods imported from China.

However, moving production back to or near the country of origin remains more in the discussion stage. Despite supply chain disruptions, so far no clear trend has been seen to move production back to or near the country of origin. The only exception is the United Kingdom, which has been plagued by Brexit. However, protectionism has reached a record high in 2021 and will remain high in the form of non-tariff trade barriers (eg subsidies, industrial policies).

Regarding Romania, with the current account deficit growing after the first part of the pandemic and a budget deficit well above the limits allowed under normal conditions, an investment in the semiconductor segment does not seem a tangible reality.

The reason may be related to both budgetary constraints and the dependence of the automotive sector (as the main representative of the local production sector) on the decisions taken at the level of parent companies. Even so, the investment effort in building semiconductor production facilities seems to be an unequal struggle, in which the European Union itself has much to gain from its competitors in Asia or the United States. In this regard, we recall the $ 50 billion announced by President Biden to support the semiconductor industry as part of the infrastructure investment plan or the $ 5.2 billion with which Japan supplemented its 2021 budget for the same purpose.

Last but not least, production in Europe will have to avoid a race of subsidies initiated by the big countries – France and Germany, a race in which Romania will probably have a modest participation at most – and that through the input given by multinationals in the automotive sector already existing locally. Other local sectors directly dependent on this key input would be less visible, with the electronics and computer segment generally having production facilities in Asian countries.

“If heavy metals and machined metals are needed in recent years from geographically closer countries (either in the EU, Turkey, Ukraine, Belarus or the Balkan countries), in terms of semiconductors and metals in their composition the situation is much different. At least in the short term, in the conditions of an improving supply chain, the necessary seems to be provided also from China (the main non-EU country contributing to Romania’s trade deficit) or from other Asian countries “, says Mihai Chipirliu, CFA, Risk Director Euler Hermes Romania.

Prospects for global trade in the period 2022-2023

The volume of global trade is expected to gradually return to the long-term pre-crisis average, with an increase of + 5.4% in 2022 and + 4.0% in 2023. shipping, costs and a strong dollar pushed up prices in 2021 (growth in value estimated at + 18.8% in 2021) is expected to reverse this upward trend in 2022, below the 2017-2018 highs.

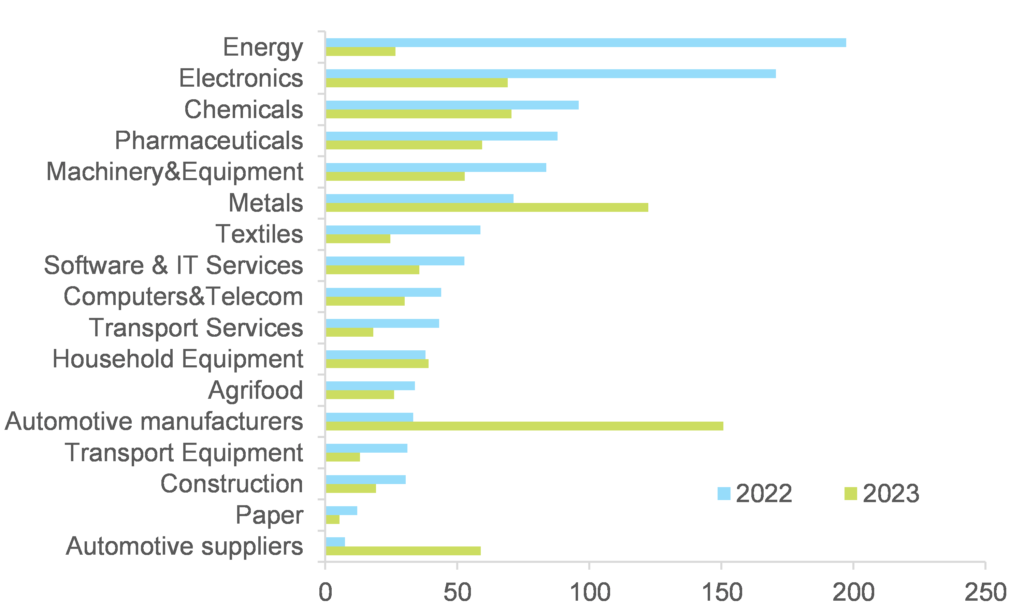

Experts point to growing global imbalances: the US will record record trade deficits (around $ 1.3 billion in 2022-2023), reflected by a record trade surplus in China ($ 760 billion on average). Meanwhile, the eurozone will also have a larger-than-average surplus of about $ 330 billion. In terms of export earnings, Asia-Pacific will continue to be the main winner over the next few years (over $ 3 billion in 2021-2023). The energy, electronics, machinery and equipment sectors will improve in 2022, but the main winner of global exports in 2023 should be the automotive sector, due to the number of outstanding works and small investments in 2021.

[1] Hirschman–Rasmussen Backward Linkages (BL) measure the intensity of intermediate inputs. They indicates that a sector demands inputs from other sectors in order to produce. If the BL index for a specific sector is above one, it means that a change in demand for that sector will increase output in the rest of the economy. Symmetrically, the Forward Linkages (FL) shows an economic activity that supplies intermediate inputs to the rest of the economy. A sector with an FL index above one will benefit more than others if there is a positive demand shock in all sectors.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/WhatsApp-Image-2024-04-12-at-1.45.27-PM.jpeg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)