:quality(80)/business-review.eu/wp-content/uploads/2015/11/BusinessDevelopment2.jpg)

While Romania has made significant efforts to improve its macroeconomic conditions, local authorities need to take measures to increase the level of EU funds absorption, as they are one of the main drivers of the local economy.

Anda Sebesi

The favorable macroeconomic context has had a positive influence on the Romanian financial market in the first half of 2015. According to official statistics, the local gross domestic product (GDP) posted an annual growth of 3.7 percent in the first semester, higher than expected (3.3 percent). This growth ranks Romania fifth in the European Union after Ireland (7 percent), Malta (4.6 percent), Luxembourg (over 4.5 percent), Czech Republic (4.2 percent) and followed by Poland (3.5 percent), Slovakia (3 percent), Sweden (3 percent), Spain (2.9 percent), Hungary (2.8 percent) and Great Britain (2.7 percent). The same stats show that all the fields and industries in Romania contributed to this development, including wholesale, retail, transportation, hotels and restaurants. According to the most recent report of The Financial Supervisory Authority (ASF,) the information and communications sector contributed with 0.9 percentage points to the GDP growth in the first six months of this year.

The same report shows that there has been a structure change of the factors that have led to this economic growth during the mentioned period in comparison to the same period last year. While construction, financial brokerage (from the banking sector, insurance and private pensions) and public administration had a negative contribution last year by posting a decline in their activity, the situation changed this year with all posting an increase, respectively construction with 3.6 percent, financial brokerage with 2.2 percent and public administration with 2.1 percent.

As for the months to come, research conducted by the National Institute of Statistics (INS) in August shows both a positive and cautious perception of the local business environment regarding the evolution of the local economy in the near future. Hence, the managers of the companies active on the local market expect the industry and services to grow moderately, retail to increase more and prices to remain stable during August – October. As for the number of employees, the same research estimates their number to remain relatively stable across all the major sectors of the local economy during the aforementioned period.

According to the same ASF report that quotes the most recent forecast of the National Commission for Forecasts, the 2015 economic growth of 3.3 percent is sustainable as long as the decrease of the agricultural production due to the drought will be balanced by the increase of the service sector by up to 4 percent. Additionally, according to ASF, the inflation rate in Romania registered low fluctuations between January and June 2015 reaching their peak of 1.2 percent in May as a result of increased food prices before the VAT was cut from 24 percent to 9 percent for this category.

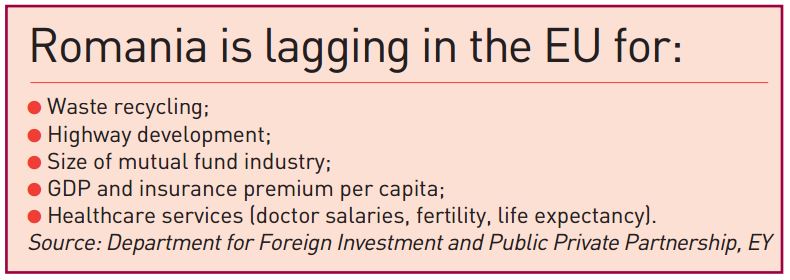

According to ASF analysis, Romania continued to improve its macroeconomic conditions due to sustained economic growth in comparison with the EU member states. In addition, it consolidated its financial balance by maintaining its budgetary and current account deficits at a low level. Considering the current economic situation and the objectives of the national program for reform, the European Commission issued some recommendations for Romania at the EU finance minister meeting in July. The main recommendations include taking all the needed measures to complete the technical assistance program, limiting the divergence from the budgetary deficit objective to a maximum of 0.25 percent of the GDP in 2015 as well as implementing the needed measures on the local labor market and adopting a law to reform the corporate governance of the state-owned companies.

EU funds absorption remains poor

At present, European Union funds available to Romania represent a significant source of

financing for economic growth. According to the IMF country report released in March, during the 2007–2013 programming period, Romania was eligible for EUR 19.1 billion (15.3 percent of the 2007 GDP) of external financing from the EU’s structural and cohesion funds. These funds were allocated across seven operational programs designed to foster Romania’s competitiveness and cooperation and convergence with other EU members. The operational programs for transportation and environment as well as primary infrastructure development were the largest, accounting for 46 percent of the available resources.

There is additional good news for the future, as Romania is eligible for another EUR 22.5 billion (13.7 percent of the estimated 2014 GDP) under the 2014–2020 programming period. According to the IMF report, six operational programs are being considered for this period, with the large infrastructure operational program allocated EUR 9.4 billion, part of which is contingent upon European Commission approval of a Master Transportation strategy.

There is, however, also less favorable news on the horizon, as Romania’s absorption of structural and cohesion funds is the lowest in the EU, despite a recent pick-up. As of early November 2014, Romania’s absorption rate, including pre-financing, was 50 percent, compared to an average 71 percent in other new member states. The human resources operational program has the lowest absorption rate of 41 percent among the operation programs. In addition, Romania has until the end of 2015 to absorb the remaining resources for each operational program (a cumulative EUR 8.6 billion, 5.3 percent of GDP) from the 2007–2013 programming period. Nonetheless, more important than the degree of absorption is the effectiveness with which the structural funds have been used.

According to the IMF, absorption of structural and cohesion funds for the 2007–2013 programming period has suffered largely due to domestic governance and capacity issues. These deficiencies have resulted in the suspension or interruption of some operational programs and the reimbursement of some of the amounts received. While some of the obstacles to absorption have been addressed, others remain. For example, beneficiary capacity and competence to identify, elaborate, and manage projects continues to be subpar. Public administration of the operational programs also faces deficiencies in evaluating and monitoring projects. Finally, it is possible that public officials may prefer to initiate and implement investment projects that are financed only by Romania’s central and local governments as these projects do not carry the level of monitoring and evaluation that accompanies EU-funded projects.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/Iulia-Surugiu-scaled.jpg)