:quality(80)/business-review.eu/wp-content/uploads/2014/06/gasstation_3262014103316AM.jpg)

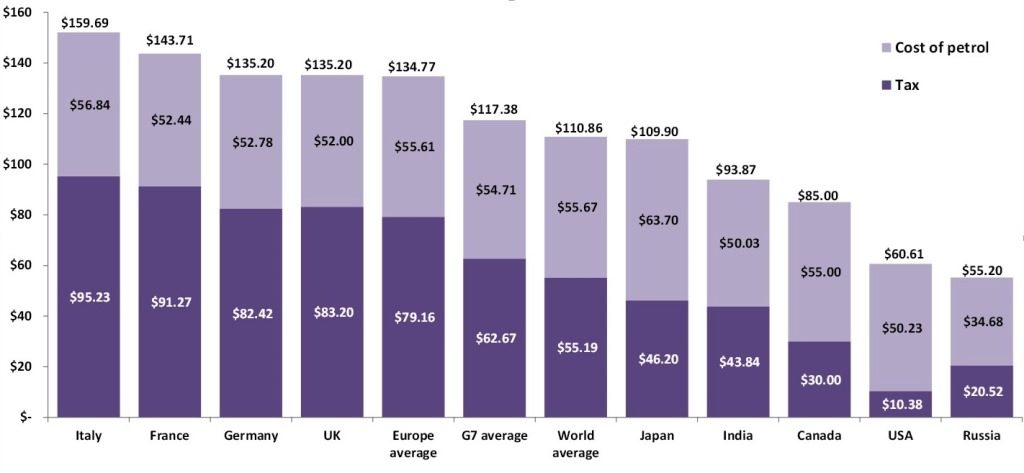

Romania is in top ten countries with a high tax rate according to a study conducted by UHY, the international network of accounting and consultancy experts. The taxes represent 52 percent in the total cost of the gasoline, while in Europe the average is 59 percent and globally is 50 percent.

Companies in Romania are paying 4 percent higher than the world average, expressed as a percentage of the fuel price, which generates a major disadvantage for them and has the potential to slow down economic growth, according to a new study by UHY.

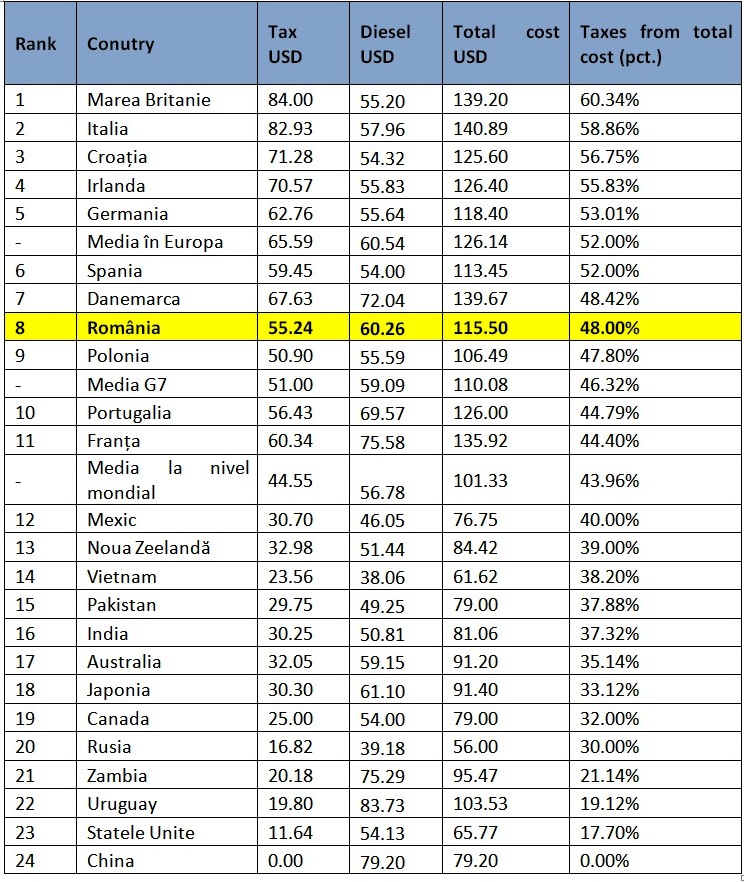

The study explains that in Romania, taxes represent an average of 52 percent of the cost of the gasoline price and 48 percent of the cost of the gasoline price, as opposed to the world average of 50 percent and 44 percent, respectively.

In the UK, the country with the highest tax in the UHY study, taxes rise up to 60 percent of the cost of diesel, while in Germany this figure is 53 percent of the cost.

However, the UHY points out that in September 2018, the Romanian Ministry of Finance proposed to remove the over-excise duty on fuel. In September 2017, the government increased excise duty on fuel, but this measure generated lower incomes than estimated.

In many major economies in Europe, taxes are considerably lower in the price of gasoline and diesel, including:

- Japan, where 42 percent of the cost of gasoline and 33 percent of the cost of diesel are taxes;

- Canada, where taxes represent 35 percent of the cost of gasoline and 32 percent of the cost of diesel;

- The United States, where taxes represent 17 percent of the cost of gasoline and 18 percent of the cost of diesel.

Higher fuel charges mean that in order to fill the fuel tank with a Ford Transit gasoline truck in Europe – an example of an enterprise-specific expenditure – USD 135 is spent on average and USD 109 in Romania, compared to USD 111, representing global media.

The high level of excise duties and fuel taxes in Europe is the main factor contributing to the high prices of gasoline, diesel and liquefied petroleum gas.

The cost of a full tank of a Ford Transit diesel fuel is 24 percent higher on average in European countries and 9 percent higher in Romania. Since diesel is the fuel used by most commercial vehicles, this burdensome burden is mainly driven by businesses.

Also, the price of liquefied petroleum gas (LPG) is more expensive with 2 percent in Europe and 6 percent in Romania, a greener alternative to gasoline or diesel.

“High fuel taxes affect almost all businesses and ultimately can hinder economic growth in Romania,” said Camelia Dobre – managing partner at UHY Audit CD in Romania. “Eugen Teodorovici’s proposal to eliminate over-excise duty on fuels could be useful for companies in Romania. As our study shows, they already pay on average higher costs in the form of fuel price taxes than most of their international competitors.”

“For any government, gas and gas charges are a key instrument to reduce greenhouse gas emissions and can be used to finance infrastructure spending. However, for companies, especially small and medium-sized enterprises (SMEs), these taxes may represent a significant operational cost, especially in the retail and distribution sectors. There must be a balance to ensure that these fuel costs and taxes do not become restrictive. The relatively lower levels imposed by developed economies, such as Canada, compared to their international competitors in Europe, are proof that such a balance can be reached,” said Dobre.

“Governments can consider initiatives such as freezing excise duty on fuel or even cutting tariffs. There must be greater international co-operation so that such a major gap between fuel prices in different countries will no longer exist.”

UHY has studied fuel taxes and prices in 24 countries around the world, analyzing the cost of gasoline, diesel and LPG / Autogas and the percentage of the price that comes from these taxes.

France ranked first in terms of taxes representing the highest percentage of the total gasoline price – 64, while Denmark ranks first in the UHY study, being the most expensive country with a total cost for a full of USD 160.

Filling a Ford Transit with Gasoline – the proportion of cost that represents fuel price and taxes (major economies and global average)

Filling a Ford Transit tank with gasoline: breakdown of fuel cost and taxes

Filling a Ford Transit tank with diesel Tank: breakdown of fuel cost and fees

:quality(80)/business-review.eu/wp-content/uploads/2024/07/vodafone-RO.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-37-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/04_ThinkPad_T14s_6_Business_Coworking.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/Iulia-Surugiu-scaled.jpg)