:quality(80)/business-review.eu/wp-content/uploads/2021/05/Bogdan_10.jpg)

Bogdan Ion, EY Romania & Moldova Country Managing Partner and EY CESA Chief Operating Officer, talks to Business Review about the key role of foreign direct investment (FDI) in Romania’s post-pandemic economic recovery and explains what the country should do to attract more foreign investors.

By Anda Sebesi

FDIs will play a crucial part in the local economy’s post-pandemic recovery. What adjustments should Romania make in order to become more attractive for investors?

FDI will be at the foundation of economic recovery over the coming years. The 2020 edition of the EY Attractiveness Survey shows that foreign investors think Romania should focus on developing education and skills, supporting high-tech and innovative sectors and encouraging investments in major infrastructure and urban projects. 35 percent of surveyed investors were looking to invest in supply chain and logistics projects, while 34 percent were interested in projects in the manufacturing sector.

In this context, infrastructure investments, particularly transport infrastructure, can attract investors from areas like production and logistics. Romania has the potential to become a European supply hub, since many players are planning to re-enter the European market. Over the next few years, the National Resilience and Recovery Plan (PNRR) will play a major role, as infrastructure, skill development, and innovation are some of its key components. Significant additional support is also expected in the energy sector through several instruments: The Modernisation Fund, the 2021-2027 Just Transition Operational Programme, the 2020-2030 Innovation Fund. The absorption of these funds at the national level could turn Romania into a very attractive destination for foreign investments, thanks to both its human capital and local resources. In this sense, significant public investment in education is also needed in order to keep up with innovation and remain competitive in terms of local workforce.

Lastly, stability within the political and fiscal environment will play an important role in attracting investors, who are aware of geopolitical dynamics. Romania has made significant improvements in the past decade, taking important steps in the fight against corruption and adapting its fiscal policies. Still, the Corruption Perceptions Index from Transparency International places Romania on the 69th spot out of 180 countries, illustrating the fact that much remains to be done in order to obtain the long-term trust of investors at a larger scale.

Which of Romania’s economic sectors have the highest growth potential in the post-pandemic period?

Based on the answers of over 100 global investors included in our EY Attractiveness Survey, agriculture, IT, transportation, and automotive are the main drivers of Romania’s economy. The agri-food sector ranked first among the industries that will foster local economic growth. And since agriculture has a strategic importance for Romania, it needs coherent policy and financial support to propel its modernisation and contribute to economic growth in a sustainable manner. This financial support is integrated into the National Resilience and Recovery Plan.

Manufacturing is another sector with a high potential to become a driving force for Romania. The development of the industrial sector should be carried out considering the European efforts towards a sustainable and green economy and the need for large investments in infrastructure.

Finally, the Romanian IT sector has experienced significant growth over the last decade, considering its competitive advantage in terms of qualified workforce. With the pandemic having accelerated the adoption of technology, the digital sector has a chance to become the most important industry in Romania. According to the same EY Attractiveness Survey, last year 29 percent of investors saw the IT sector as the engine of the Romanian economy. We have just witnessed the largest IPO of a Romania-born company on the NYSE – UiPath – a tech company valued at EUR 20 billion. However, digital infrastructure inside the public administration remains poor, so major investments are still needed for the public sector to be efficient. The National Resilience and Recovery Plan supports Romania’s objectives in this sector too, as the digitalization of the public administration is another key element of this plan.

Last year brought us the opportunity to advance digitalization in medical and educational services. In the future, this will lead to significant annual cost savings, improve the population’s access to these services, and accelerate the growth of the private components of these two sectors. The new EY Attractiveness Survey for Romania, which will be launched on June 16, may change the ranking of industries perceived as having high potential for the country, considering the accelerated digitalization and the impact of the pandemic on foreign investors’ perceptions and priorities, which will be reflected in this year’s survey results.

To what extent do you think Romania was prepared to face a crisis before the pandemic started?

The COVID-19 pandemic had a significant impact across the world. However, it also triggered unprecedented responses through economic recovery packages which have managed to limit the damage caused by lockdown measures and by the slowdown in global trade.

A very important factor that contributed to Romania’s economic resilience after the coronavirus outbreak was its highly competitive mobile and fixed telecommunications infrastructure and especially the high degree of broadband penetration. These were the result of a strong historical competition between operators in this sector, which led to significant investments in their networks, making them capable to support the move to teleworking.

In Romania, the COVID-19 pandemic overlapped with a pre-existing health crisis, so issues such as poor organisation, material shortages, and the lack of a well-developed infrastructure were all exacerbated by the pandemic. Contrary to all predictions, the Romanian economy proved to be resilient, thanks to both direct infusions of cash – through economic recovery programmes and non-reimbursable fund schemes –and an increase in public investments.

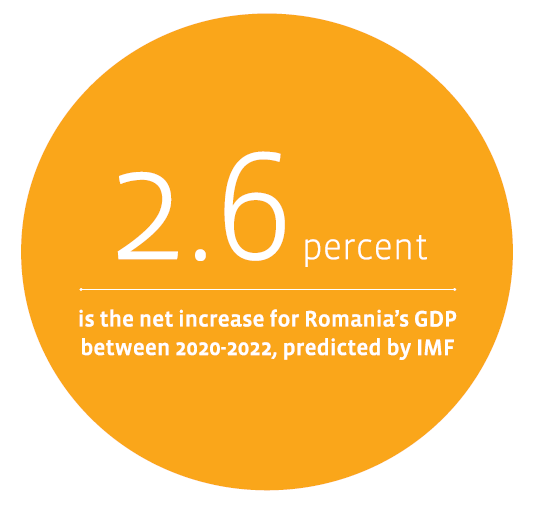

The IMF predicts a 2.6 percent net increase for Romania’s GDP between 2020-2022, more than double the EU average of 1 percent. By comparison, in 2008-2010, Romania’s GDP dropped by 0.8 percent. Furthermore, the unemployment level shows that the additional financial support and the job retention policies have kept Romania’s unemployment rate stable, with only a minor increase of 0.6 percent (according to Eurostat) between February and December 2020 (compared to 1 percent for the same period of 2008). This is well below the EU average of 1.9 percent, proving that the pandemic’s impact on the labour market was better managed in Romania than in other European countries.

In any case, regardless of how prepared Romania was when the pandemic started, what is most important now is maintaining market optimism regarding the country’s recovery, as the sentiment can attract investments in this uncertain context.

Foreign investments have mostly targeted the largest cities of Romania, which are drivers of the country’s economic growth. How do you think the gap between these growth poles and the rest of the country could be reduced, in order for economic development to no longer only be concentrated in certain areas?

Our studies frequently show that poor infrastructure, which limits the development of certain regions, is a factor that investors take into account when deciding where to invest. Investments in infrastructure represent a way to direct investors’ interest towards other areas besides large metropolitan areas, therefore the acceleration of certain infrastructure projects will put geographical areas which are now economically isolated on the investment map. Additionally, introducing fiscal facilities designed to stimulate investments and economic activity outside the big cities could also generate economic growth in other parts of our country.

Keeping highly qualified workforce from leaving Romania has always been a challenge for our country. What is the current situation and how could the pandemic context help the country retain its talent?

A significant share of the qualified workforce that was living abroad returned to Romania for various reasons during the pandemic, which significantly reduced their mobility. In addition, the number of students who decided to study abroad (many of whom will turn into future Romanian expats) dropped as well during this period. The exact impact of the pandemic on the number of Romanian university graduates who will leave the country could be determined in the next three to four years. This will generate an increase of domestic consumption and bring indirect added value. As for achieving a long-term retention of talent in Romania and having these individuals generate direct added value by working for multinationals or local/entrepreneurial companies, I unfortunately don’t think that the pandemic has dramatically changed the situation. I think we need a country strategy to both retain high-skilled workers in Romania as well as to involve workforce from other countries in local projects.

What are your recommendations for Romanian authorities in terms of planning for future foreign investments?

Supporting education, adopting new technologies, and investing in infrastructure (especially transport and energy infrastructure) should be top priorities for Romania. According to last year’s EY Attractiveness Survey, foreign companies believe that investments in these sectors could increase Romania’s competitiveness. Yet, according to preliminary results of the upcoming annual survey, these priorities seem to have changed in 2021. We’re noticing a greater focus on sustainability, environmental policy, and technology adoption among investors, while the financial stimulus programs offered by governments might not play such a significant role to attract foreign investment.

Equally, authorities should focus on encouraging the creation of intellectual property in Romania by offering various facilities, including fiscal incentives. Such policies will enable the retention of the tech entrepreneurial companies’ IP in Romania and can support the attraction of more investments in the long term, because well-consolidated and protected intellectual property rights generate direct foreign investments.

Governmental support for future investments could be decisive for many investors who are already present in the country, because it can influence their companies’ performance and resilience to shock. The National Resilience and Recovery Plan is therefore an opportunity for the Romanian economy to recover and develop its vulnerable sectors as well as to attract long-term investors. Romania will benefit from significant funds for green energy, public sector digitalization, reskilling, and upskilling. So, a strong dialogue between decision-makers and the private sector to ensure the efficient absorption of these funds is crucial for the development of foreign investments in the future.

:quality(80)/business-review.eu/wp-content/uploads/2024/06/Bogdan-Ion-EY-Romania.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/06/R5C_0289_VenusFive_ro-PRINT-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/12/Screenshot-2023-12-19-at-12.44.31-PM.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/03/Screenshot-2024-03-13-at-1.31.16 PM.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)