:quality(80)/business-review.eu/wp-content/uploads/2024/06/Importance-Of-Company-Valuation.jpg)

Selling a business is a significant decision that requires careful planning and preparation. One crucial aspect that often determines the success of a sale is company valuation.

Understanding the value of your business not only helps in setting a realistic asking price but also prepares you for negotiations and ensures a smooth transaction process. In this article, we delve into why company valuation is vital and how it impacts the sale of your business.

Preparing to sell your business involves various critical steps, with company valuation being at the forefront.

This process not only determines the financial worth of your business but also shapes your approach to potential buyers. Let’s explore why company valuation is essential and how it can impact the outcome of your business sale journey.

What Is Company Valuation?

Company valuation is the process of determining the economic value of a business. It involves assessing various factors such as assets, liabilities, financial performance, market position, and future prospects to arrive at a fair market value.

Think of it as putting a price tag on all the hard work and dedication you’ve invested in building your business.

Understanding the value of your company serves several purposes. Primarily, it provides clarity on what your business is worth in the current market.

This knowledge empowers you to make informed decisions about selling, whether you’re looking to retire, pursue other opportunities, or simply cash in on your investment.

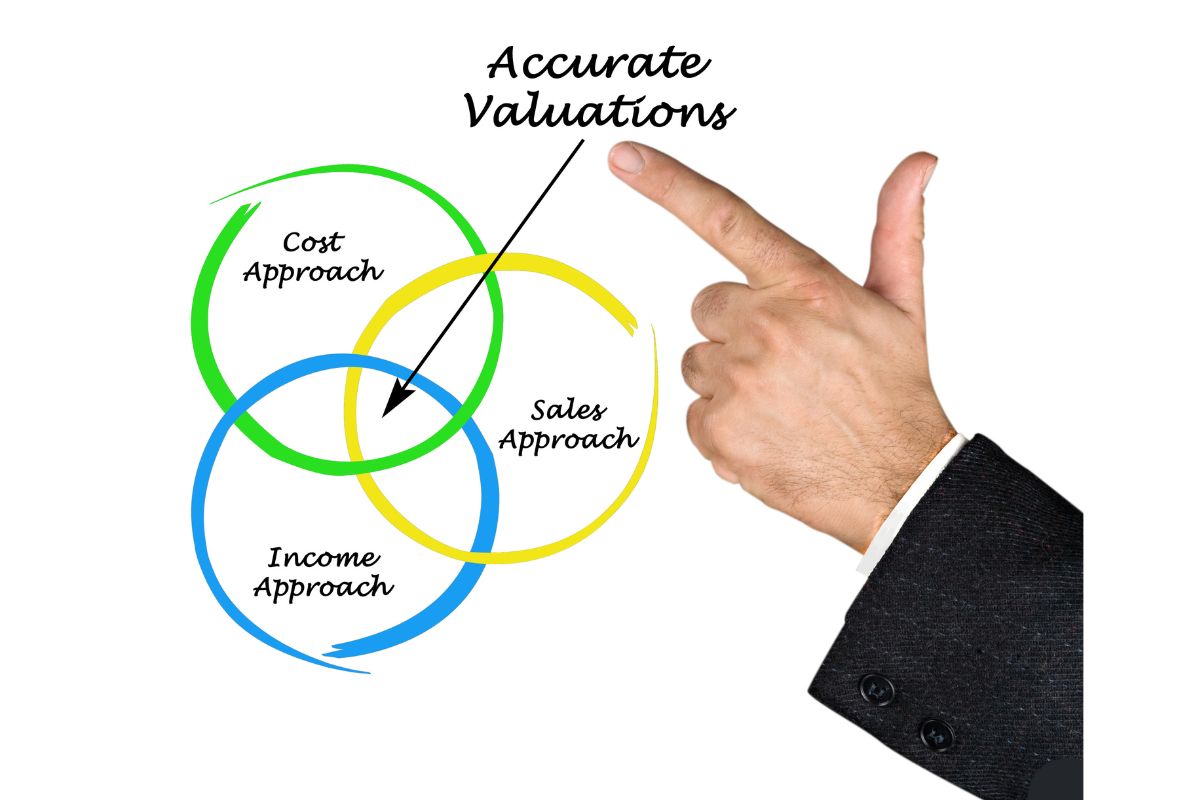

Methods Of Company Valuation

There are several methods used to value a company, including the Income Approach, Market Approach, and Asset-Based Approach. Each method has its nuances and is applied based on the nature of the business and industry dynamics.

Importance Of Accurate Valuation

Accurate company valuation is crucial because it directly influences the sale process. Overvaluing your business can deter potential buyers, while undervaluing it means you could be leaving money on the table.

A precise valuation sets realistic expectations and facilitates smoother negotiations. Ideally, company valuation should be conducted well in advance of putting your business on the market.

This allows ample time to address any discrepancies, enhance business value, and strategize based on the valuation results.

Getting A Professional Valuation

A professional valuation helps you understand your business’s market value. This involves analyzing your financial statements, assets, liabilities, and market conditions. An experienced appraiser can provide an objective view, ensuring you set a realistic price.

Factors influencing business worth

Several factors determine your business’s value, including:

- Profitability: How much profit your business generates.

- Market Position: Your business’s standing within the industry.

- Growth Potential: Future earnings and growth prospects.

- Assets: Tangible and intangible assets, such as equipment and brand reputation.

Understanding these factors helps you appreciate your business’s worth and identify areas for improvement.

Using Valuation To Enhance Business Value

Beyond preparing for a sale, company valuation can highlight areas where your business can improve to increase its value.

Whether it’s improving profitability, optimizing operational efficiencies, or diversifying revenue streams, knowing your business’s value can guide strategic growth initiatives.

Valuing a business is not without its challenges. Factors such as intangible assets, market volatility, and industry trends can complicate the process. Overcoming these challenges often requires a blend of financial expertise and industry knowledge.

Screening Potential Buyers

Not every interested party is a suitable buyer. Screening helps ensure you’re dealing with serious, qualified buyers.

Verify that potential buyers have the financial capacity to complete the purchase. This includes reviewing their financial statements and proof of funds.

Understand why the buyer is interested in your business and what their intentions are. Are they looking to grow the business or simply acquire assets?

Perform background checks to ensure the buyer has a good business track record and is capable of running your business successfully.

Professional Help: Hiring A Valuation Expert

Given the complexities involved, many business owners opt to hire professional valuation experts. These experts bring impartiality and technical proficiency to the process, ensuring a comprehensive and accurate assessment of your business’s worth.

Armed with a thorough company valuation, you enter negotiations with confidence and clarity. The valuation provides a benchmark for discussions, helping you justify your asking price and negotiate terms that align with the true value of your business.

Key Steps To Prepare Your Business For Sale

Preparing business for sale involves a series of strategic steps to ensure a smooth and successful transaction. By following these key steps, you can maximize the value of your business and position it attractively for potential buyers.

Conclusion

In conclusion, company valuation is not just a step in preparing to sell your business but a strategic tool that informs critical decisions throughout your entrepreneurial journey.

By understanding your business’s worth and leveraging it effectively, you can maximize the outcome of your business sale and transition into the next phase with confidence.

:quality(80)/business-review.eu/wp-content/uploads/2024/07/VGP-Park-Timisoara_-8thbuilding_iulie-24.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/22C0420_006.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/COVER-1-4.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/06/br-june-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/America-House-Offices-Bucharest-Fortim-Trusted-Advisors.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-33-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/07/BeFunky-collage-32-scaled.jpg)