:quality(80)/business-review.eu/wp-content/uploads/2018/08/PG_Turcia_1.png)

The Turkish crisis continues to unfold with the national currency weakening further to the 7.00 Turkish lira against the USD, a level seen as critical and if it continues on this trend will be able to deplete the excess of the major Turkish banks, throwing the country into a banking crisis, according to a analysis made by Peter Garnry, Head of Equity Strategy at Saxo Bank.

Turkish equities are already down 61 percent in USD terms since early February, which is a staggering relative wealth decline for the 17th largest economy in the world (according to 2017 International Monetary Fund figures). The key topic of today’s session, however, has been contagion risk into the emerging markets space in general but particularly into Europe through the region’s banking exposure to Turkey.

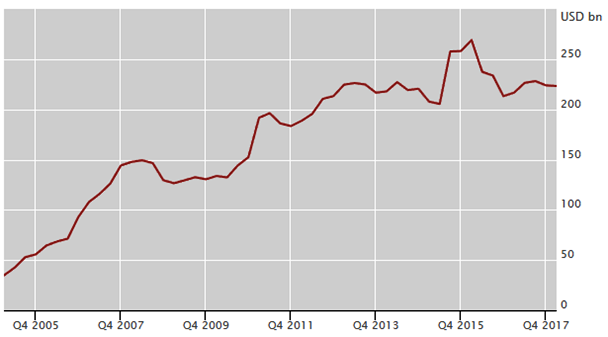

According to the Bank of International Settlements there were foreign bank claims on Turkey worth USD 223.3 billion, with Spanish and French banks holding the largest claims worth USD 80.9 billion and USD 35.1 billion respectively. The foreign bank claims have grown significantly since 2005 as Turkey’s current deficit worsened materially from a surplus in 2002 to being -5.2% on average in the period Q4’05-Q1’18.

The foreign bank claims figure is large, but to give some perspective the foreign bank claims were around USD 300 billion on Greece going into the financial crisis and USD 150 billion in the summer of 2010 on a much smaller GDP.

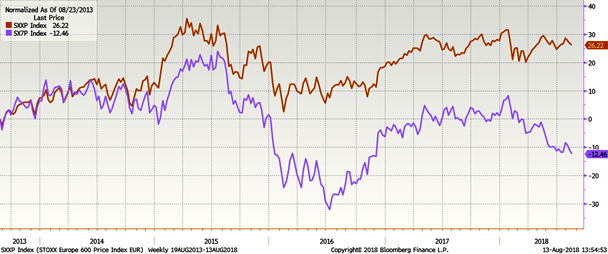

When we look at performance among European banks, both Spanish and French banks have incurred steep losses in the past six weeks, and are only surpassed in this area by Italian banks. However, Italian banks are driven by another set of factors including rising government bond yields as investors are nervous about the new government’s plan to increase fiscal spending through flat tax and citizens’ income schemes.

Interestingly enough, we observe weakness among German banks as well but here the link is back into Italy and much less about Turkey. The signal that the credit default swap market is sending today is that the probability of Turkey defaulting on its foreign obligations is moving significantly higher and unless we see some positive reaction from Ankara, the crisis could escalate further this week.

Right now, markets are volatile as risk models are sending out decisions to reduce EM risk but it’s important to understand that most major EM countries do not have the same external funding requirements as Turkey and as such there should be no material contagion.

If that was the case we would have expected to see gold being more bid; in fact gold dipped below USD 1,200/oz in today’s session. The Spanish and French claims on Turkey are not large enough to materially eat away capital; furthermore, the European financial system and the Markit iTraxx Europe Subordinated Financial Index (measuring credit quality among European banks on their subordinated debt) still trades at historically low levels, not signaling widespread panic. “In our view, European banks may soon be bought against European equities as a mean-reversion play,” says Peter Garnry.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/PROSPE1.jpe)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)