:quality(80)/business-review.eu/wp-content/uploads/2015/06/oil.jpg)

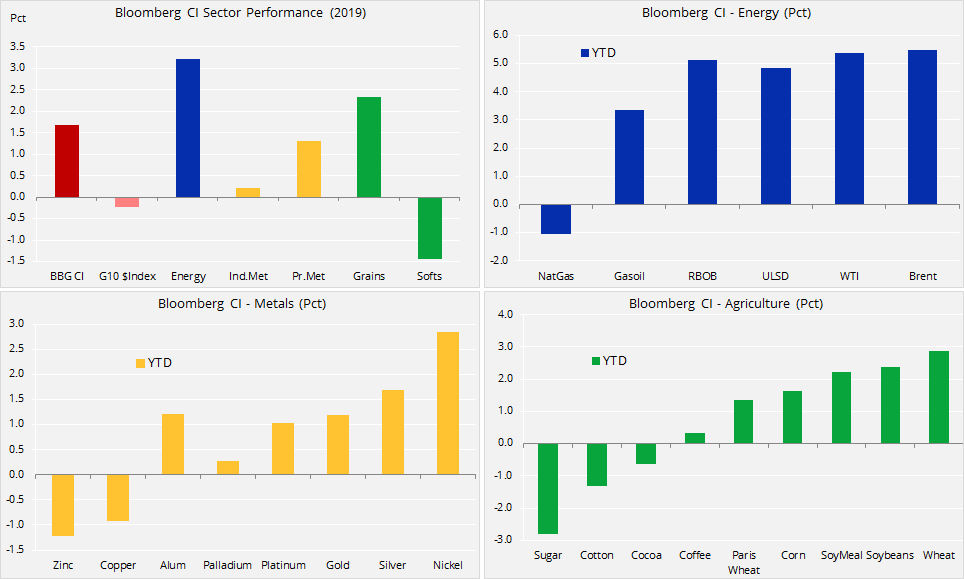

An analysis by Saxo Bank’s Head of Commodity Strategy, Ole Hansen, shows that the main focus points for commodity traders at the beginning of 2019 are the risk sentiment, the US-China trade war, fixed income and the Fed.

Hopes for a breakthrough have been raised as the impact of the trade war between the US and China begins to show up in weaker-than-expected economic data from the world’s two biggest economies.

While US stocks began January having recorded their worst ther December since the early 1930s, the currency market had been a sea of calm, at least up until this week. The first profit warning in 16 years from Apple, due to a slowdown in Chinese demand, sent a shiver through the markets and helped trigger a global risk-off wave.

This combined with an illiquid holiday market in Japan saw the Japanese yen rip higher. The AUDJPY cross, often seen as a proxy for the health of the Asian market, dropped by 7% before recovering all its losses once Tokyo reopened on Friday. These and other developments helped send the dollar lower for a third week, thereby providing some additional support for commodities.

Into this mix of uncertainty and volatility, commodities generally managed to kick off 2019 with gains across most sectors. The bellwether oil sector led from the front with global growth and demand concerns outweighed by a dramatic December production cut from Opec led by Saudi Arabia. Brent crude, which in late December found support at the critical technical and psychological USD 50/barrel level, was heading for its best week since last April.

Precious metals surged higher for a third week but calmer markets elsewhere and very overbought conditions – as revealed by the Relative Strength Index – have raised the need for consolidation. This phase now seems to have emerged with profit-taking seen in gold after it briefly touched USD 1,300/oz on Friday.

The table below shows how movements of the dollar, stocks and bonds have supported renewed demand for safe-haven assets such as gold. However, silver has been the best performer of the two on its historical cheapness to gold. Going forward, developments across these markets will help determine the strength of demand, and with that the direction.

Those looking for a longer-term bet on gold tend to use exchange-traded funds and this sector saw the biggest increase in total holdings last quarter since Q1’17. Hedge funds finally turned net-long at the beginning of December after holding a record net-short in COMEX gold futures back in early October.

Please note that due to the US government shutdown the CFTC has not issued any Commitments of Traders reports since the week of December 18.

The COT report provides an important weekly insight into the size and direction of positions held by hedge funds across key futures markets from currencies to bonds and not least commodities.

The outlook for gold into 2019 looks promising at this stage. We believe that it may take some time for stocks to recover with news from the US-China trade negotiations and Q4 earnings likely to set the short-term direction. The Federal Reserve is widely expected to further reduce its current call for another two rate hikes this year.

The dollar, as usual, holds the key for gold and at this stage we see the risk of further dollar weakness, although it may not fully emerge before the second half of this year.

After rallying by $138 since August and following its best quarterly performance since Q1’17, gold looks set to pause after briefly touching USD 1,300/oz. Given the recent strength and changed sentiment towards safe-haven assets, we suspect a correction could run out of steam before USD 1,265/oz; bulls may only begin to worry on a break below USD 1,250/oz as the potential for further gains remain elevated.

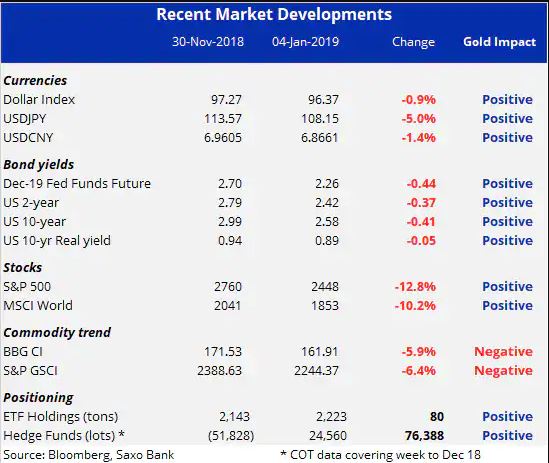

Crude oil is beginning to show signs of support following the +40 percent collapse since last October. Since hitting the key technical and psychological $50/b level last week it has managed to recover strongly due to an improved outlook for both supply and potentially also demand.

On the supply side, the Dallas Fed in its Q4 Energy Survey said that the region’s oil and gas sector growth had stalled amid the sharp oil price decline. The (anonymous) comments from top oil and gas executives provide a good insight into the renewed stress caused by the dramatic price slump.

US shale oil production growth is likely to slow following the price slump, but if the 2014 to 2016 sell-off is anything to go by it may take up to six months before the impact becomes visible in the data which for now continue to show year-on-year growth close to 2 million barrels/day.

While doubts are being raised by US production growth going forward, Opec responded strongly to the worsening outlook by slashing December crude oil production by the most since January 2017. Monthly production surveys from Bloomberg and Reuters both showed that Opec had cut production by around 500,000 barrels to 32.6 million barrels/day. The slump was led by a voluntary reduction from Saudi Arabia (420,000 b/d) and unplanned reductions from Iran (120,000 b/d) and Libya (110,000 b/d).

While supply reductions may begin to provide some support, the demand outlook needs to stabilise as well. The previous sell-off occurred during a time of rising demand; on that basis producers found it relatively easy to trim output and change the direction of oil. This time is different with Opec and other producers not only having to deal with a renewed pickup in US production which may take months before slowing.

They also must worry about the global outlook for growth and demand, something over which they have no control. The fact that China (the world’s biggest importer of oil) and the US (the biggest consumer) are fighting a trade war is a matter of concern. This concern, however, has yet to be reflected in the official forecasts from Opec, the EIA, and the IEA. During the past six months they have only reduced global demand growth by an average of 100,000 b/d to 1.4 million.

Having found support at USD 50/b, Brent crude oil is now challenging resistance at USD 57.50/b, the November low. A break higher could see a return to the previous consolidation area around USD 60/b.”

:quality(80)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Schneider-Electric-anunta-castigatorii-Sustainability-Impact-Awards-2023-in-Romania-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Premier-Energy-Group-1.jpg)