:quality(80)/business-review.eu/wp-content/uploads/2016/01/Sao_Paulo_Stock_Exchange-950x550.jpg)

Estimates for the last quarter of the year are balanced between optimistic and pessimistic. A Saxo Bank analysis shows that Q4 will have a lower risk, with a US Dollar Index peak in December (alongside “Fed’s neutral interest rate”) and China finally bringing significant incentives to the online environment.

Steen Jakobsen, economist and CIO at Saxo Bank, has put together the most important trends of the quarter. Read his complete analysis below:

“I just came back after a crowded travel program that only confirmed that our main macro script, “The Four Horsemen”, is really making its way into the global economy. The four horseman are:

- The amount of money: in collapse;

- The price of money: increases rapidly;

- Globalization: in collapse;

- Energy price: growing (and acting as a consumer tax).

The energy price has been corrected since we initiated the Four Riders, but the full impact of past rises in prices has clearly been seen in global consumption, along with the “lending mass” that is at its lowest level in decades and a Federal Reserve that is more aggressive than any other Volcker period since the 1980s.

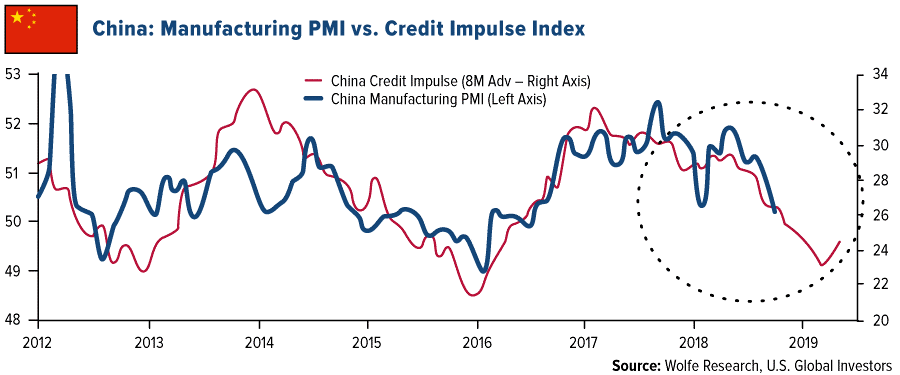

How do we keep going from here? A continuing negative evolution? Still low risk? I think timing becomes clear: Q4 will have a lower risk; the peak of the US Dollar Index will be held in December (alongside a “neutral Fed interest rate increase”), and China will finally bring important incentives to the online environment.

In 2018, China was largely on the pause while local businessmen and bureaucrats waited for the next phase of the country’s industrial revolution. What we often fail to appreciate in the West is how China views its recent history as 30 years of battle during the reign of Mao Zedong, followed by 40 years of “reforms and opening” determined by Deng Xiaoping’s decision 1989.

In other words, China has followed two paths over the last 70 years: one of hardships and one of change. Now, the “third way” or the phase between the present moment and the 100th anniversary of the PRC in 2049 must now be decided.

As far as I was the last time in China, two major catalysts were triggered:

First, president Xi came into contact with the private sector in a change of almost 180 degrees to previous policy. This is a clear sign that the private sector must play a role in the third period, which will most likely be called “an opening with Chinese characteristics”. The big question that remains is whether China’s distrust private sector will be calmed down by the Party’s recent support, which includes tax cuts and substantial political support.

Secondly, the support given by the Chinese business party was a public acknowledgment that the 40th anniversary of Deng’s policy will be celebrated. This was seen as extremely important in confirming that Beijing will adopt “openness and reforms”.

In my opinion, many of the negative data observed in 2018 came from this “indecision” – the lack of clear signs about Beijing’s commitment to reforms has led companies to be held back. This should now clarify the situation, as illustrated by the following recent press release on XinhuaNet:

“Xi Jinping, the secretary general of the Central Committee of the Communist Party of China (CCP), chaired the fifteenth meeting of the central committee on Wednesday to deepen general reform. Xi, who is also China’s chairman and chairman of the Central Committee Military and director of the Central Committee for the deepening of the general reform, called for “maintaining the high bar on reform and opening up and achieving the overall objective of improving and developing the Chinese socialism system and modernizing China’s system and its ability to govern. He also called for intensified efforts to advance reform and opening up in the new era. In order to celebrate the 40th anniversary, concrete actions are needed to facilitate the implementation of the reform, “the document said, adding that local authorities should impose tough measures against the ‘formalities for bribery and bureaucracy’ practices.”

These two changes make me relatively confident that China will follow the path of acceleration we have foreseen since Q1 ’19.

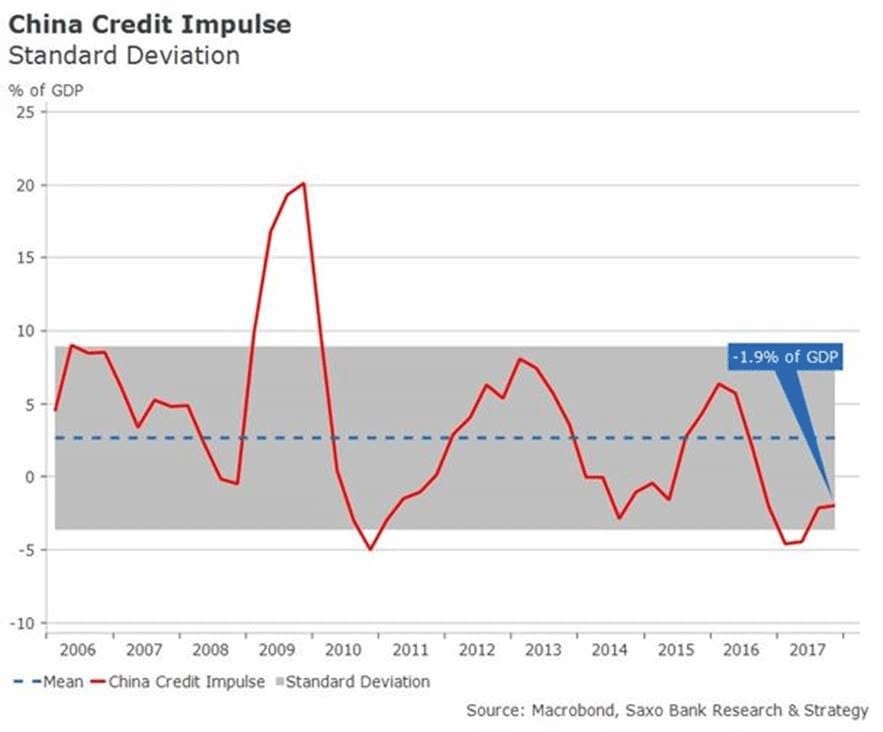

I have often said that China was in a worse situation than the figures showed, and that, most likely, the result would be a new stimulus to the lending momentum.

Look at the considerable size of China’s lending momentum, from + 5 percent of GDP to -5 percent!

This is the consequence of the reduction in indebtedness and the fight against corruption / pollution, along with the above-mentioned 2018 indecision regarding new investments and projects. The way is clear now, in our opinion, but we start from a really low activity level, so the recovery will be slower than normal. For this reason, T1 will be a brave one, however, however, a quarter in which we feel confident.

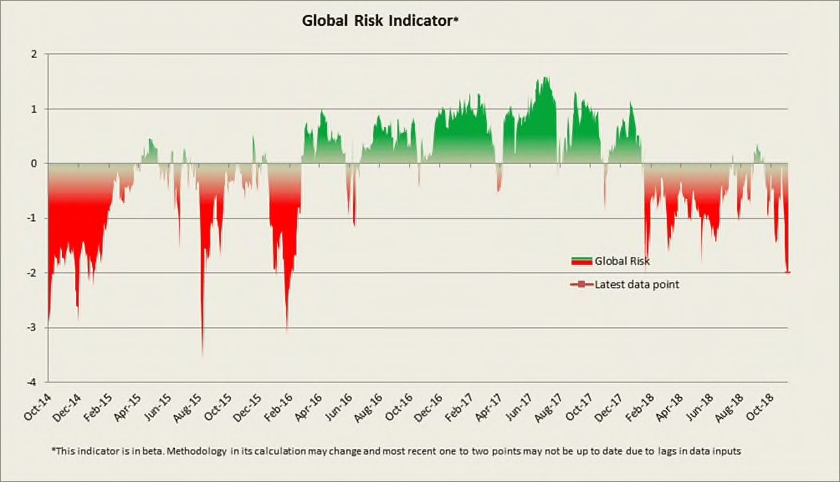

We remain committed to our reallocation from the US stock market to emerging markets and China, but as far as general risk is concerned, Saxo Bank forex strategy monitor John Hardy screams “Alert! Alert! “, so this market will decrease even more.

From a tactical point of view, we believe that the recent minimum of SPX and NASDAQ, less 5-10 percent, is the inflection point to stop the Fed.

This minimum from the beginning of the year to the Nasdaq is 6,317, so a 5 percent drop would lead to 6,000 and a 10 percent drop would lead to 5,685; 6,059 is also about 61.8 percent of the Fibonacci withdrawal, and 5,544 is 50 percent.

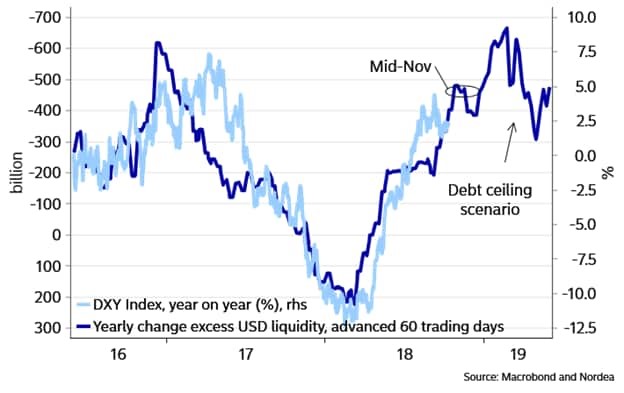

The key to this timing is the dollar. Here we borrow an excellent chart from the Nordea Economics Department describing the correlation between excess US and DXY liquidity.

(Note: the end of the year in the Nordea model coincides with the end of the calendar year.)

Finally, in the last few days, our “primitive” model has come close to buying USZ8 – US Treasury futures with 10-year yield.

I will write a more “deep” article about China in the next few days, just as Saxo Bank’s macro strategy manager, Christopher Dembik, has made an update on our work on the credit impulse. However, I now see things as follows: December will still be volatile, but China is overperforming despite the worst feeling I’ve ever seen in action on the ground. The market is developing a sense of great change that we mentioned at the beginning of this article.

Meanwhile, look at a different approach: Bradley Siderograph … fits our perspective.”

:quality(80)/business-review.eu/wp-content/uploads/2024/04/BeFunky-collage-40-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Rafaela-Nebreda-fondator-Imoteca.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)