:quality(80)/business-review.eu/wp-content/uploads/2019/01/isarescu.jpg)

The National Bank of Romania released an impact assessment study on Emergency Ordinance 114/2018, specifically on the asset tax or “greed tax” the government wants to introduce for banks in the country. According to hotnews.ro, the study concludes that the bank asset tax would lead to an economic decline and have several other negative effects, including more expensive loans for the state, depreciation pressures on the national currency, fewer loans to the population and to companies, and a lower BET index for the Bucharest Stock Exchange.

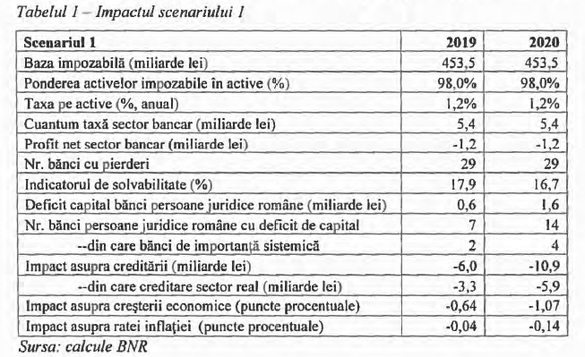

According to the central bank, the estimated impact based on the base scenario of a 1.2 percent tax on all financial assets of banks:

- 2019: the banking sector’s net financial result would record a loss of RON 1.2 billion; solvency indicator would lose about 2 percentage points (to 17.9 percent); 7 banks, of which two are systemic importance institutions, would record capital deficits, requiring increases of RON 0.6 billion; crediting cuts of RON 6 billion; economic growth would decline by 0.64 percent.

- 2020: the banking sector’s net financial result would record a loss of RON 1.2 billion; solvency indicator would lose about 1.2 percent (to 16.7 percent); 14 banks, of which 4 with major systemic importance, would record capital deficits, requiring increases of RON 1.6 billion; crediting cuts of RON 10.9 billion; economic growth would decline by 1.07 percent.

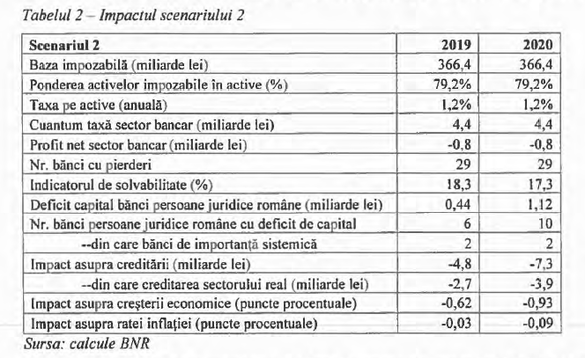

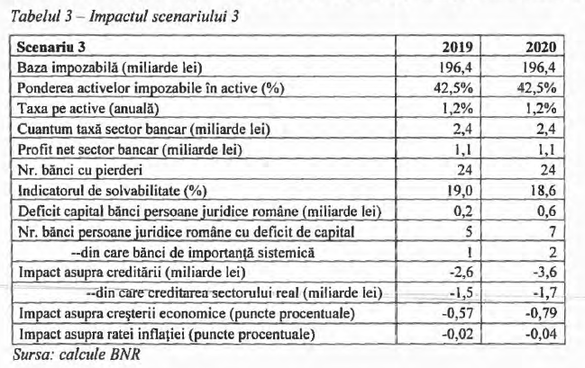

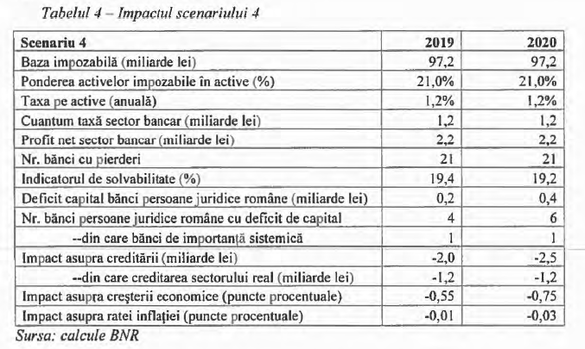

The BNR took into account four scenarios for the way the bank asset tax would be applied, estimating the following indicators for 2019 and 2020 (illustrated below): taxable basis; share of taxable assets in total assets; annual asset tax; total banking sector tax; net profit of banking sector; the number of banks with losses; solvency indicator; capital deficit for banks; number of banks with capital deficit + banks of systemic importance; impact on crediting + real sector crediting; impact on economic growth; impact on inflation.

- Scenario 1: The taxation of all financial assets of banks

- Scenario 2:A 25 percent decrease of the taxable asset basis for banks with foreign majority shareholders

- Scenario 3: Scenario 2 + excluding public administration exposure and exposure to central bank through minimum mandatory reserves

- Scenario 4: Scenario 3 + excluding assets representing performing loans to non-financial organisations

:quality(80)/business-review.eu/wp-content/uploads/2023/08/kiwi.com_-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Premier-Energy-Group-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2016/12/european-investments-bank.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2015/07/personal-loans-ts-1360x860-e1462282551895.jpg)