:quality(80)/business-review.eu/wp-content/uploads/2019/12/foto-articol-macro-aurel.jpg)

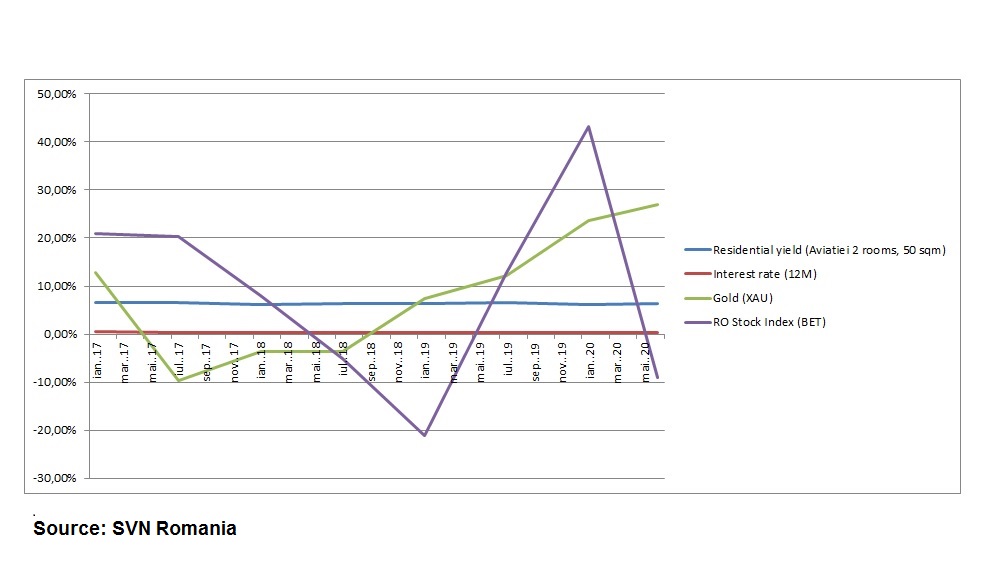

The financial investment with the highest returns between 2018 and 2020 was represented by shares listed on the Bucharest Stock Exchange (BVB), followed by residential investments for annual yields from renting, according to a report released by real estate consultant SVN Romania.

Thus, the best financial investment in euro during the last three and a half years was represented by shares included in BET index, which registered a total gain of 50.94 percent between 2017 and 15th June 2020, according to SVN calculations. The best annual evolution was registered in 2019 while in the first semester of 2020 was registered an annual decrease.

The next financial investments taking into account the potential yield in the last three and a half years was represented by residential investments. Thus, those who acquired homes for further renting obtained a medium annual yield of 6 percent in Euros during 2017 and June 2020, the total wining reaching thus approximately 25.4 percent.

SVN Romania calculations show that purchasing a one – bedroom new flat in Aviatiei (50 square meter net surface) had an annual yield from rents between 6.2 percent and 6.6 percent, depending on the project and the acquisition period. If we add also the price increases registered during the last three and a half years, of approximately 21 percent, the total financial gain reached 46.4 percent.

Gold was another profitable financial investment between 2017 and 2020, with a medium total yield of 40.32 percent, according to SVN Romania calculations. The highest increase, almost 27 percent, was registered in the last 12 months, while the first semester of 2020, marked by the COVID-19 pandemic, brought the highest increase in the last three and a half years.

”Diversification is the best method for maximizing financial gains, regardless of the financial and historical context. Stock exchange and gold registered the highest yields but their evolutions are also extremely volatiles, sharp decrease being also possible – like the Stock this year or gold in 2018. The residential segments remains also a profitable investments, regardless of the price evolution, taking into consideration the steady annual yield from rents – and if the acquisition is made during construction phases, the yield could also be much higher due to low prices,” explained Andrei Sarbu, CEO of real estate consultant SVN Romania.

Deposits, guaranteed within the EUR 100,000 limit, represent the most secured method of keeping financial resources but offer the lowest gain – only 1.55 percent in total, in Euro, in the last three and a half years.

In the analysis were taken into account the BET index evolution, the gold quotation evolution (XAU) and the residential yields were calculated for a one-bedroom new apartment in Aviatiei, delivered after 2016 and purchased completely finished – furniture costs were included. The associated costs represented by broker’s fees, administration costs for gold, the costs of withdrawing bank deposits and taxes related to each financial investment were not included.

SVN Romania is one of the biggest real estate consultants active on the local market. The company has also two regional offices, in Brasov and Cluj – Napoca and is also one of the main players on the property management segment (SVN Romania | Property Management & REO Services) and on the financing segment (SVN Romania | Credit & Financial Solutions). SVN International Corp. has over 200 offices worldwide, in 8 countries and regions, with over 1,600 brokers, consultants and administrative staff.

:quality(80)/business-review.eu/wp-content/uploads/2023/08/One-Floreasca-City-2-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/08/dreamstime_xl_134583360-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/08/grafice-evolutie-preturi-apartamente-noi-vs-vechi-bucuresti.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Schneider-Electric-anunta-castigatorii-Sustainability-Impact-Awards-2023-in-Romania-scaled.jpg)