:quality(80)/business-review.eu/wp-content/uploads/2014/11/CEE-growth.jpg)

Investments made in high-priority areas such as infrastructure, energy and defense security and energy efficiency alongside overhauling public institutions and tackling corruption are some of the keys to the growth of the Central and Eastern European region, according to the “25 years after communism – does Central and Eastern Europe still hold the key to growth?” report by the Erste Group. Other measures that could support the region’s development are the growth of the IT&C sector, improving the education for employment and addressing the issue of the shrinking working age population.

The report found that CEE countries are significantly more prosperous today than 25 years ago, with the GDP per capita having jumped to 65 percent of EU 15 average from 49 percent.

“Although at times the region’s development pace may have seemed more of the ‘one step forward, two steps back’ kind, we need to remember how far these countries have come. Former Soviet satellites have become fully-fledged EU members. Institutional and legal frameworks were rebuilt from scratch. The free flow of goods, services and human capital helped to completely turn these economies around. EU funds – on top of massive foreign investments from Germany all the way to China – were poured in to great effect. And very importantly, reforms – among which privatisation was key – increased the share of the private sector in GDP from extremely low levels of even 10 percent to close to 80 percent, meaning that most of the economic value is nowadays created by the private sector,” said Juraj Kotian, Head of CEE Macro/Fixed Income Research at Erste Group and co-author of the report.

At the same time, the Erste Group Research report finds that, in the current context of European stagnation, CEE countries are faced with the challenge of finding new keys to growth, or else they risk being stuck at mediocre levels that will not allow them to catch up with the West.

“After the crisis, resources have become scarcer and competition is tougher. Old growth models based on low-cost advantages are fast becoming obsolete and threats such as the shrinking working age population are looming on the horizon. Our roadmap for CEE challenges the conventional wisdom of an exclusively manufacturing-based convergence. We argue that governments should focus on creating a better business environment for dynamic sectors with higher added value. CEE countries have a real chance to sharpen their competitive edge in sectors such as services and IT&C. Finally, improving the quality of institutions and governance is central to most of these issues because the institutional framework forms the basis of social stability, prevents corruption and fosters prosperity,”explains Kotian.

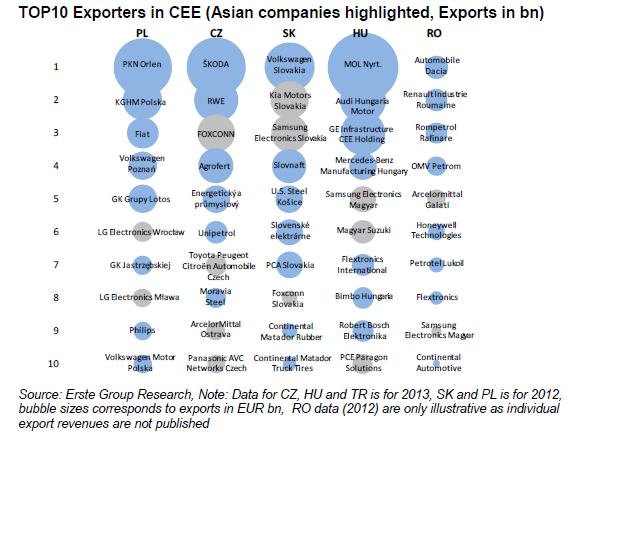

The report also notes that in the first decade after the fall of Communism, it was mainly German and Austrian companies which took the lead in expanding to the region and helped to improve the competitiveness of its industry. However, CEE countries are no longer just a German manufacturing hub. Nowadays, up to three Asian companies are ranked among the TOP10 exporters in CEE countries. During the last decade, Asian manufacturers have substantially increased their footprint in CEE, as their presence in the region provided them with direct access to the EU consumer market for relatively low production costs.

Top 10 Exporters in CEE

:quality(80)/business-review.eu/wp-content/uploads/2024/02/e-Commerce-in-Romania-2024.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2020/07/Radu-Dumitrescu-Deloitte-Romania.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2022/08/Anca-Merdescu_Colliers.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/08/One-Floreasca-City-2-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/ROMTEXTIL-2.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/WhatsApp-Image-2024-04-25-at-3.30.13-PM.jpeg)