:quality(80)/business-review.eu/wp-content/uploads/2016/03/premium-residential-market-e1458823157344.jpg)

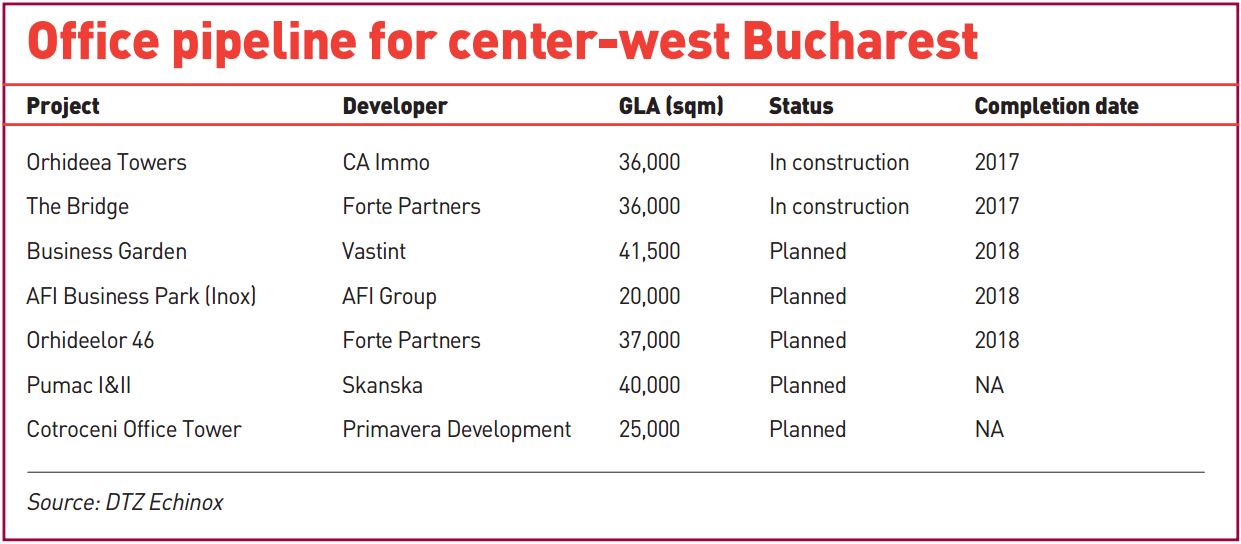

Several office projects are now in the pipeline in the center-west part of Bucharest, confirming real estate consultants’ previous forecasts that the area will turn into a new office pole for the capital. All in all, between 200,000 and 300,000 sqm of office space are scheduled to be completed in the area by the end of 2018, BR found out.

Simona Bazavan

Forte Partners, a consortium of real estate investors that begun works on the first phase of a EUR 100 million office scheme in the Grozavesti area of Bucharest this February, is the latest developer to start a project in this part of the capital. After real estate consultants have been talking for several years now of center-west Bucharest becoming a new “office pole” on the city’s map, now projects are finally in the pipeline.

“Indeed, the center-west part of Bucharest or more precisely the Grozavesti-Politehnica area, is in full development. High demand for office space coming from IT&C companies for whom the proximity to the university campus is very advantageous, has boosted this development,” Mihai Paduroiu, head of office agency with CBRE Romania told BR.

The proximity with the Polytechnic University and its nearby campus is one important selling point for the area, especially when considering that IT companies and BPO players are the main potential future tenants. “What shapes up to be a new a new office pole in Bucharest could reach up to 20,000 employees. The nearby university will definitely make the area interesting for IT&C but we also expect to attract companies active in financial services,” Ramona Marusac, associate director office agency with Colliers International told BR. As such companies find themselves competing against one another to attract and retain employees, the easy access the area offers to public transportation such as the subway is another advantage central-west Bucharest boasts.

Thirdly, there is the area’s good track record. The investors’ increased interest in the area can also be explained by the fact that Afi Park, the office project developed by Afi Europe, one of the first office developers in this part of Bucharest, has been a successful one, Maria Florea, head of office agency-contractor JLL, told BR. The vacancy rate in the area is below the average, standing at 4.5 percent at the end of 2015 according to CBRE data and headline rents are in the area vary between EUR 12 – EUR 15/sqm/month, in line with levels elsewhere in Bucharest.

Last but not least, other parts of the capital which have been highly sought-after by office developers are now getting crowded, thus favoring a shift to new spots, added Florea. Of the 325,000 sqm of office space which are scheduled to be delivered this year in the capital, about 60 percent are part of office projects located in the Barbu Vacarescu and Dimitrie Pompeiu areas, Mihaela Galatanu, head of research with DTZ Echinox told BR. This will change next year when CBRE estimates that 46 percent of new deliveries will be in the western part of the city. Forte Partners, CA Immo, Vastint and Skanska are the developers who have announced projects in the area and the first two have already begun works. Vastint secured a building permit for its office project at the end of last year while Swedish developer Skanska bought 2.1 hectares part of the former Pumac industrial platform. The availability in the area of former industrial platforms like Pumac is another factor that is making real estate investors consider the area, added Marusac.

All in all, real estate consultants expect this increase interest in the area to take the form of between 200,000 and 300,000 sqm of office space to be delivered until the end of 2018. “If all the projects that have been announced for western Bucharest will be delivered over the next three years, then the modern office stock for this area (e.n. for the entire western Bucharest, not only center-west) could reach 583,000 sqm, up by 115 percent compared to the present level of 272,000 sqm,” said Galatanu.

Further on, growth could be toned down by what could become a crowded area. “There is still land left that could be used for office development, but given the high number of projects that are scheduled for the next years and which in turn will lead to an abrubt increase of the office offer, developers have somehow become more reserved in considering center-west as possible location,” concluded Florea.

Who’s started works

EUR 60 million will go into the first building of The Bridge, the office project Forte Partners has started in the area earlier this year. It will have a gross leasable area (GLA) of over 36,000 sqm and is scheduled for delivery in September 2017. Some 30 percent of this is covered by private equity and the developer says it is in advanced negotiations to secure a bank loan for the rest of the sum.

So far, Forte Partners hasn’t signed any pre-lease but says it is negotiating with several potential tenants from industries such as IT or financial services and shared service centers, said Geo Margescu, the CEO and founder of Forte Partners. After the first building will reach a pre-lease of about 50 percent, the company plans to start construction of the second building which will increase the project’s total GLA to over 56,000 sqm.

The Bridge is developed on a 12,700 sqm plot of land which Forte Partners bought in 2014 from Spanish developer Hercesa and which is located close to the Carrefour Orhideea commercial center. Forte Partners shareholders include Ionut Dumitrescu (founder of Eurisko, a Romanian real estate agency sold to CBRE,) Geo Margescu (whose name is linked to projects such as Europolis Logistic Park, the headquarters of Millennium Bank and the Louis Blanc office building) and Jabra family (founders of Nova Brasilia business sold to Kraft Foods.)

In the immediate vicinity, Austrian developer CA Immo is building another office project, Orhideea Towers. Asked about the competition, Margescu said there is room for both projects given the high interest potential tenants have in the area due to its good connectivity to the public transport network. The Austrian CA Immo started construction of the 37,000 sqm (GLA) Orhideea Towers in October last year and the developer says it is ready to move into the next phase in March this year. Investment will reach EUR 75 million and the two office buildings are set to be delivered in 2017. CA Immo already owns five office buildings in Romania with a gross leasable area of 106,000 square meters.

When it comes to developers who are already present in the area, Afi Europe, the first to start an office scheme in this part of Bucharest, has reported positive results for its project. The AFI Park 4&5 office building has reached a 60 percent occupancy rate after signing a leasing agreement for 1,800 sqm with FotoNation, Afi Europe announced earlier this year. Over the next months the developer expects to fully lease the building, according to company representatives.

AFI Park 4&5 (32,000 sqm GLA) is the last phase of AFI Park, a 70,000 sqm (GLA) office project located near the AFI Palace Cotroceni shopping mall (82,000 sqm GLA), AFI Europe’s flagship project in Romania. Among the new tenants in AFI Park 4&5 are companies such as Cameron, SII Romania and ORTEC Central & Eastern Europe.

The developer boasts with the office park attracting mainly IT players. Other tenants in the project include Electronic Arts, Conglomerate TELUS International, UK-held Endava Romania, Microchip Technology, Sparkware Technologies and Cameron Romania, part of US Cameron Group.

:quality(80)/business-review.eu/wp-content/uploads/2024/03/ileana-mitrache.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/02/SkyTower_Bucharest_picture_-4-Copy.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/02/Small_NEAN4613-e1708447666236.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/02/Small_NEAN4600.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/BeFunky-collage-46-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Catalina-Burca-Andonie-Associate-si-Ionelia-Anton-Associate.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/03/business-review-buy-google-reviews.webp)