:quality(80)/business-review.eu/wp-content/uploads/2019/08/card-payment-shopping-DT.jpg)

The study conducted by GfK on purchasing power in Romania in 2018 shows that while the average net income increased, it has also made the disparities between regions bigger. For example, Bucharest, which is at the high end of the purchasing power spectrum, is surrounded by counties with some of the lowest incomes.

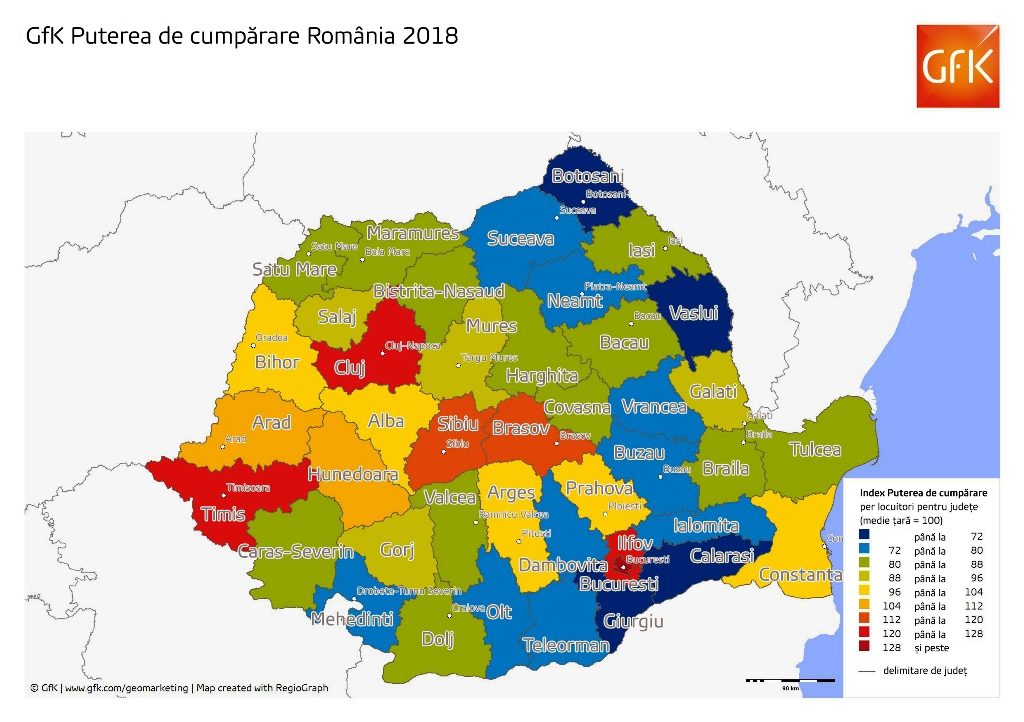

The results of the study are presented graphically in the form of a “heat map”, where blue and dark blue represent the areas with the lowest purchasing power at the national level, while regions in orange and red have the highest purchasing power.

Across our country, annual net income per capita increased by 18 percent in 2018, reaching EUR 5,083 from EUR 4,556 in 2017 and EUR 4,181 in 2016.

Botosani, Vaslui, Calarasi and Giurgiu counties have the lowest purchasing power, followed by Suceava, Neamt, Vrancea, Buzau, Ialomița, Teleorman, Olt and Mehedinti. The group of counties with purchasing power below the national average is completed by Satu-Mare, Maramures, Bistrita-Nasaud, Harghita, Covasna, Bacau, Iasi, Braila, Tulcea, Valcea, Dolj, Caras-Severin, Gorj, Salaj, Mures.

The counties located near the average purchasing power level in the country are those that include cities engaged in a competition for development: Prahova, Arges, Constanta, Alba and Arad. Here, significant economic growth is forecast and the counties serve as satellites of the big economic centers and benefit from the investments of players who relocate their activities in the proximity of the cities (Cluj, Timisoara, Brasov). All these cities take up top spots for absorption of European funds and in the development of infrastructure. Arad has provided a large number of transport connections with the European road network, while Alba Iulia is the absolute national leader among smart cities in the country, with the most smart city projects implemented.

The group of counties with a higher than average purchasing power includes Brasov and Sibiu, the “stars” on the economic development map and the engines of the country’s central area. In recent years, a new industrial area has been set up here, attracting massive investments.

Brasov has developed on several market segments, mainly on real estate and business services, due to the number of people with technical and language skills, the central geographical position, the lower costs compared to other locations and the very good living conditions. At the same time, the county has the most industrial parks in the country (10), after Prahova (15) and Cluj (11), and the development of the automotive and retail industry has also generated a boom in residential construction. In 2017, the largest number of homes were built in residential complexes in the post-communist history of Brasov.

Sibiu, in turn, has become a magnet for investors coming to Romania, being attractive to the automotive and IT industries. The largest industrial employer in the county and the giant in the automotive industry – Continental – expanded its investment in 2018, followed by other big players (Kika Automation) who are transferring their activities in this region.

Bucharest, Cluj, Timis and Ilfov, the poles of Romania’s development

Cluj, Timis and Ilfov, with Bucharest in the lead, are the traditional poles of development in the country where the purchasing power is at least 20 percent above the national average. These areas maintain stable development rates and act as “diffusers” of investments towards the neighboring areas.

In general, the reasons for the development of cities other than Bucharest are related to the cheap and highly educated workforce. The industries that have found the best opportunities in such cities are the automotive, IT and business service industries. Another important factor is the transport infrastructure.

It is estimated that Sibiu, Brasov, Arad, Constanta and Alba Iulia are the cities that will soon see a greater development rate than Bucharest, precisely because they have good infrastructure, but also university centers that will shape the labor market. Last but not least, another factor that changes the map of local development are cost dynamics – the classic areas of development become expensive for new investors (e.g. Cluj, which in 2019 has the most expensive industrial land in the country), and this causes them to look to the less explored areas of the country.

The regional competition also intensifies with the availability of European funds. In this regard, some counties have adopted strategies and alliances to boost the accessing of these funds in order to develop their infrastructure, as is the case of the “Western Alliance” – an alliance between four counties – Cluj, Timis, Arad and Oradea – meant to boost European financing for regional development.

About the study

The purchasing power index measured by GfK represents the net annual income available per capita, from salaries, pensions, unemployment aid and child allowances, after deduction of taxes and social contributions. The population uses its purchasing power to cover expenses for food, maintenance, services, vacations, insurance, private pensions and retail purchases. The figures communicated by GfK for purchasing power were made in euros based on the average exchange rate for 2018 for the national currencies in question (as reported by the European Commission).

Photo: dreamstime.com

:quality(80)/business-review.eu/wp-content/uploads/2024/04/BeFunky-collage-46-scaled.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Catalina-Burca-Andonie-Associate-si-Ionelia-Anton-Associate.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/03/business-review-buy-google-reviews.webp)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Rafaela-Nebreda-fondator-Imoteca.jpg)