:quality(80)/business-review.eu/wp-content/uploads/2018/09/PwC-Media-and-Marketing-in-Romania.jpg)

According to the PwC ‘Global Entertainment & Media Outlook 2018-2022’ over the next five years, the digital segments will be the most dynamic components of the Romanian media and entertainment market and the whole media and entertainement market will register an annual growth rate of 7.4 percent.

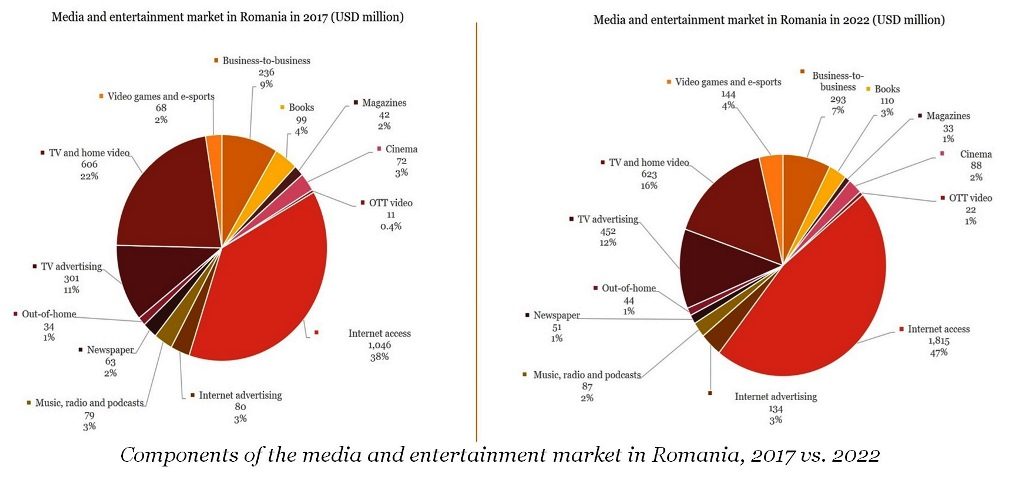

The whole media and entertainment market in Romania will register a compound annual growth rate (CAGR) of 7.4 percent reaching total revenues of USD 3.7 billion by 2022. Out of this, approximately half is represented by spendings for internet access who will register a CAGR of 11.6 percent and will report revenues of over USD 1.8 billion, by the same target year.

By comparison, Central and Eastern European (CEE) media and entertainment market will have a CAGR of about 7.1 percent and will reach total revenues of approximately USD 83 billion. The internet access segment will generate revenues of about USD 30.5 billion and will have a CAGR of 10.3 percent, compared to 6.6 percent global level. The internet access segment is generating, in Romania, CEE and at global level, the biggest revenues of all segments that comprise the media and entertainment market. In Romania, the share of this segment in the total media and entertainment market, will increase from 38 percent, in 2017, to 47 percent, in 2022. In CEE, the share of the internet access segment will rise from 31 percent to 36 percent (global level, from 26 percent to 29 percent).

A slight increase is estimated for the TV and home video segment, that will generate, in Romania, revenues of USD 623 million by 2022, an increase from the USD 606 million in 2017, with a compound annual growth rate of 0.5 percent. This is the second largest segment in terms of generated revenues, after internet access, both in Romania, CEE and at global level. The development of the local TV market is in line with the regional one that will have an increase of 0.6 precent by 2022.

In Romania, the growth on the TV segment with result also in substantial advertising revenues. In 2017, TV advertising reached USD 301 million, and has the potential of reaching USD 452 million by 2022, with a CAGR of 8.5 percent. This segment is the third in terms of revenue, following the internet access and TV and home video segments. As for the three segments, the 2017 classification on the podium remains unchanged in 2022 as well.

At local level, the video games segment will register a 16.3 percent compound annual growth rate by 2022, while over-the-top (OTT) segment will register a 14.8 percent annual growth rate. Over the course of time, these two segments have reported low revenues in Romania, but, by 2022, will reach a maximum of USD 144 million and USD 22 million respectively. Together with the internet access segment, who is closing the podium of the industries with the highest CAGR, the video games and OTT segments, in this order, are top of the class in the media and entertainment industry.

At regional level, the virtual reality industry will have the highest growth potential with a CAGR of 51.3 percent, even though the revenues will reach, by 2022, only USD 178 million. In terms of CAGR, the second place is reserved for video games industry with a CAGR of 15.5 percent and revenues of over USD 7.5 billion. The third place is reserved for the OTT segment with a compound annual growth rate of 13 percent and revenues of about USD 1.2 billion, by 2022.

At the local level, online advertising will generate revenues of about USD 134 million by 2022 with a CAGR of 11 percent. The two subcategories of the online advertising will have different trajectories in the next five years. While mobile advertising is forecasted to have the highest CAGR, 25.6 percent, and reach USD 51 million by 2022, advertising delivered over fixed connections will continue to generate higher revenues and will reach USD 84 million by 2022, with a CAGR of 5.5 percent.

Despite this, the revenues generated by the Romanian Internet advertising market, no matter the infrastructure, are still the smallest in Central and Eastern Europe where this segment will generate over USD 10.7 billion by 2022, with a CAGR of 12.4 percent (8.7 percent at global level). In 2022 the online advertising segment will become the second largest segment in terms of generated revenues, after internet access, both at CEE and global levels.

“The recovery of the Romanian media and entertainment sector has strongly picked-up in the past years. It was fueled by increased revenues from internet access and TV and mobile advertising. Publishers must have in sight the opportunities offered by new technologies such as Artificial Intelligence (AI) or augmented reality that will continue to redefine industries, segments, subsegments, consumers preferences and will force companies to rethink their business models. The speed with which things change, on all segments, forces companies to invest in technologies that allow content delivery to be made at lower costs while the content should be easier to personalise. It is still to be seen if the Romanian players in the media and entertainment industry have the financial capacity to sustain these necessary investments in order to keep up with the dynamics of the market and with consumers expectations,” said Florin Deaconescu, partner, Assurance Services, leader of the Technology, Media and Telecom services, PwC Romania.

The print industry will see a decrease in revenues, in line with the regional and global tendencies. The newspapers and magazines segments in Romania will register negative CAGRs of -3.9 percent, respectively -4.5 percent. The magazine industry will see a decrease in revenues from USD 42 million in 2017 to only USD 33 million in 2022. While the newspaper segments will decrease from USD 63 million to USD 51 million, in 2022.

In CEE, the magazines segment will have a positive CAGR, 0.8 percent, while in terms of revenues, will reach USD 1.97 billion by 2022, up from USD 1.89 billion in 2017. Newspapers, on the other hand, will have a negative CAGR -3 percent by 2022 and will reach revenues of over USD 2.16 billion, down from USD 2.52 billion in 2017.

The books segment in Romania will grow with a CAGR of 2.1 percent over the next five years. By 2022, the total revenues of this industry will reach USD 110 million, from USD 99 million in 2017. The main source of revenues in the cinema industry has been and will be the box office. This segment will generate revenues of, approximately USD 82 million by 2022 with a CAGR of 4.1 percent.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/coffeeast-3.jpeg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/06/Office-launch-Cluj-117285.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)