:quality(80)/business-review.eu/wp-content/uploads/2018/06/dreamstime_m_92071559.jpg)

Romania’s compulsory private pension funds (Pillar II) have made 21,588 payments between 2008 and May 2018, mostly because of the death of contributors, according to Financial Supervisory Authority (ASF) data transmitted following a Business Review’s request.

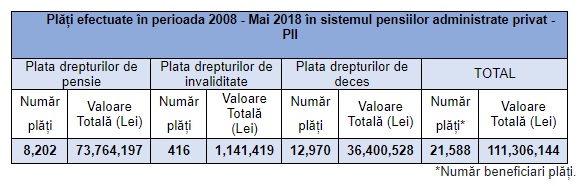

ASF data transmitted to Business Review show that Pillar II funds have made 8,202 payments of pension rights of contributors totaling RON 73.76 million until May 2018, 416 payments of invalidity rights amounting RON 1.14 million and 12,970 payments of rights due to death of contributors with a total amount of RON 34.4 million.

Pillar II contributions are inherited by the legal heirs in case of death of contributors, according to Romanian law.

Contributions to compulsory private pension funds started on May 20, 2008.

At the end of May 2018, the Pillar II pension funds had total assets of RON 42.7 billion (EUR 9.2 billion) under administration, out of which RON 7 billion were net yields from investment, according to Romania’s private pensions funds association (APAPR).

ASF official data shared with Business Review come in a period of noisy debate about the future of private pensions in Romania.

Private pensions under threat

Romania’s government has partially reversed the past systemic pension reform by lowering the proportion of social contributions transferred to the second pension pillar from 5.1 percent of gross wages in 2017 to 3.75 percent from January 2018.

A recent draft of the government proposes to apply a 0 percent contribution transfer for Pillar II during the second half of this year, in order to increase budget revenue.

Earlier this month, Labour minister Lia Olguta Vasilescu said that Pillar II private pension will become optional, and that she will present the advantages and disadvantages of contributing to Pillar II later this summer.

“We’ve decided what we want to do with pension Pillar II, and it’s what we’ve been saying since last year: it should be optional. This option is set in stone,” the minister said.

According to private pension association, the average value of the individual private pension account reaches RON 6,000, and over 1.2 million participants have already accumulated over RON 10,000 in their account.

In ten years, Pillar II funds generated an average annual yield of 8.15 percent, APAPR said.

The European Commission said recently, in the specific recommendation to Romania, that the cut of social contributions transferred to the second pension pillar (Pillar II) from January 2018 is set to have a positive short-term effect on government revenues, but could affect capital markets and generate the obligation to pay old-age pensions in the future.

According to European Commission data, the total net assets of the Pillar II pension funds increased from 0.2 percent of GDP in 2008 to roughly 4.6 percent of GDP in 2017.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/02/Daniela-Casapu-Membru-al-Directoratului-SIGNAL-IDUNA15632.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Schneider-Electric-anunta-castigatorii-Sustainability-Impact-Awards-2023-in-Romania-scaled.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Premier-Energy-Group-1.jpg)